10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on August 4, 2022

EXHIBIT 3.1

CERTIFICATE OF DESIGNATIONS

OF

SERIES A CONVERTIBLE PARTICIPATING PREFERRED STOCK

OF

AMC ENTERTAINMENT HOLDINGS, INC.

Pursuant to Section 151 of the

General Corporation Law of the State of Delaware

AMC Entertainment Holdings, Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify:

That, pursuant to the authority granted to and vested in the Board of Directors of the Corporation (the “Board”) in accordance with the provisions of the Corporation’s Amended and Restated Certificate of Incorporation and applicable law, the Board by resolution adopted on July 28, 2022: (i) authorized and established, pursuant to Section 151 of the DGCL, a series of preferred stock of the Corporation classified as “Series A Convertible Participating Preferred Stock” and approved the form of Certificate of Designations thereof and (ii) established and designated a pricing committee of the Board (the “Pricing Committee”), pursuant to Section 141(c)(2) of the DGCL, and conferred upon the Pricing Committee the power and authority of the Board, to the fullest extent permitted by law, to, among other things, determine the final terms of the Certificate of Designations of the Series A Convertible Participating Preferred Stock.

That the Pricing Committee, through action by written consent on August 4, 2022, pursuant to the authority conferred upon the Pricing Committee by the Board, adopted the following resolution approving the final terms of the Certificate of Designations in accordance with its delegation by the Board:

“NOW, THEREFORE, BE IT RESOLVED, the Certificate of Designations, setting forth the designations, rights, preferences, powers, restrictions and limitations of the Series A Convertible Participating Preferred Stock is hereby authorized and approved and an Authorized Officer (as defined therein) of the Company, any one of whom may act without the joinder of any of the others, be, and each of them hereby is, authorized, empowered and directed to execute and file with the office of the Secretary of State of the State of Delaware the Certificate of Designations, in the form attached hereto as Exhibit A.”

IN WITNESS WHEREOF, this Certificate of Designations is executed on behalf of the Corporation by its duly authorized officer this 4th day of August, 2022.

WEIL:\98572002\19\13910.0030

AMC ENTERTAINMENT HOLDINGS, INC.

/s/ Kevin M. Connor

Name: Kevin M. Connor

Title: Senior Vice President, General Counsel and Secretary

2

RLF1 27623822v.1

RLF1 27623822v.1

RLF1 27623822v.1

WEIL:\98572002\19\13910.0030

Exhibit A

CERTIFICATE OF DESIGNATIONS

OF

SERIES A CONVERTIBLE PARTICIPATING PREFERRED STOCK

OF

AMC ENTERTAINMENT HOLDINGS, INC.

Pursuant to the authority vested in the Board of Directors (the “Board”) by the Amended and Restated Certificate of Incorporation (as amended and/or restated from time to time, the “Certificate of Incorporation”) of AMC Entertainment Holdings, Inc. (the “Corporation”), the Board does hereby designate, create, authorize and provide for the issue of a series of preferred stock, $0.01 par value per share, which shall be designated as Series A Convertible Participating Preferred Stock (the “Preferred Stock”) consisting of 10,000,000 shares having the following voting powers, preferences and relative, participating, optional and other special rights, and qualifications, limitations and restrictions thereof as follows:

SERIES A CONVERTIBLE PARTICIPATING PREFERRED STOCK

“Additional Shares of Common Stock” has the meaning specified in Section VI(c).

“Adjustment Event” has the meaning specified in Section VII(d).

“Amendment” means the Amendment to the Certificate of Incorporation increasing the number of shares of Common Stock that the Corporation is authorized to issue from 524,173,073 to such higher number of authorized shares of Common Stock as the Board may at any time determine in its sole discretion, which amount shall be not less than an amount sufficient to effect the conversion of the then-outstanding shares of Preferred Stock into Common stock.

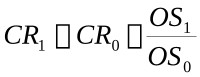

“Applicable Conversion Rate” means the Initial Conversion Rate, subject to adjustment pursuant to Sections VI and VII for any such event occurring subsequent to the initial determination of such rate.

“Board” has the meaning specified in the preamble.

“Certificate of Incorporation” has the meaning specified in the preamble.

“Closing Date” means the date that the Preferred Stock is first issued.

“Common Equivalent Dividend Amount” has the meaning specified in Section III(a).

“Common Stock” means the Class A common stock, $0.01 par value per share, of the Corporation.

WEIL:\98572002\19\13910.0030

“Conversion Date” means the first business day following the receipt of Stockholder Approval and the filing, acceptance and effectiveness of the Amendment with the Office of the Secretary of State of the State of Delaware.

“Corporation” has the meaning specified in the preamble.

“Exchange Property” has the meaning specified in Section VII(a).

“Holder” means the Person in whose name the shares of Preferred Stock are registered, which may be treated by the Corporation as the absolute owner of the shares of Preferred Stock for the purpose of making payment and settling conversion and for all other purposes.

“Initial Conversion Rate” means, one-hundred (100) shares of Common Stock for each share of Preferred Stock.

“Junior Securities” shall have the meaning specified in Section V(a).

“Liquidation Preference” means, for each share of Preferred Stock, an amount equal to $0.01.

“Parity Securities” shall have the meaning specified in Section V(a).

“Person” means a legal person, including any individual, corporation, estate, partnership, joint venture, association, joint-stock company, limited liability company or trust.

“Preferred Stock” has the meaning specified in the preamble.

“Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of the Common Stock (or other applicable security) have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of holders of the Common Stock (or other applicable security) entitled to receive such cash, securities or other property (whether such date is fixed by the Board or a duly authorized committee of the Board or by statute, contract or otherwise).

“Reorganization Event” has the meaning specified in Section VII(a).

“Senior Securities” shall have the meaning specified in Section V(a).

“Stockholder Approval” means the requisite approval by the requisite stockholders of the Corporation of the Amendment.

2

WEIL:\98572002\19\13910.0030

3

WEIL:\98572002\19\13910.0030

4

WEIL:\98572002\19\13910.0030

Notwithstanding any provision in this Certificate of Designations to the contrary, Holders shall not be entitled to receive any dividends for any calendar quarter in which the Conversion Date occurs, except to the extent that any such dividends have been declared by the Board or any duly authorized committee of the Board and the Record Date for such dividend occurs prior to the Conversion Date.

(a)Prior to the Conversion Date, Holders are entitled to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of Preferred Stock held by such holder are then convertible based on the Applicable Conversion Rate as of the record date for determining stockholders entitled to vote (i) on all matters presented to the holders of Common Stock for approval, voting together with the holders of Common Stock as one class, or (ii) whenever the approval or other action of Holders is required by applicable law or by the Certificate of Incorporation; provided, however that Holders shall not be entitled to vote together with the Common Stock with respect to any matter at a meeting of the stockholders of the Corporation, which under applicable law or the Certificate of Incorporation requires a separate class vote.

5

WEIL:\98572002\19\13910.0030

6

WEIL:\98572002\19\13910.0030

7

WEIL:\98572002\19\13910.0030

Whenever the number of shares of Common Stock into which the shares of the Preferred Stock are convertible is adjusted as provided in Section VI or Section VII, the Corporation shall promptly compute such adjustment and furnish to the Holders a certificate, signed by the principal financial officer or treasurer of the Corporation, setting forth the number of shares of Common Stock into which each share of the Preferred Stock is convertible as a result of such adjustment, a brief statement of the facts requiring such adjustment and the computation thereof and when such adjustment will become effective. Amounts resulting from any calculation hereunder will be rounded to the nearest 1/10,000th.

Except as may otherwise be required by law, the shares of Preferred Stock shall not have any voting powers, preferences or relative, participating, optional or other special rights, other than those specifically set forth herein (as this Certificate of Designations may be amended from time to time) and in the Certificate of Incorporation. The shares of Preferred Stock shall have no preemptive or subscription rights.

If any voting powers, preferences or relative, participating, optional or other special rights of the Preferred Stock and qualifications, limitations and restrictions thereof set forth in this

8

WEIL:\98572002\19\13910.0030

Certificate of Designations (as this Certificate of Designations may be amended from time to time) is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, all other voting powers, preferences and relative, participating, optional and other special rights of Preferred Stock and qualifications, limitations and restrictions thereof set forth in this Certificate of Designations (as so amended) which can be given effect without the invalid, unlawful or unenforceable voting powers, preferences or relative, participating, optional or other special rights of Preferred Stock and qualifications, limitations and restrictions thereof shall, nevertheless, remain in full force and effect, and no voting powers, preferences or relative, participating, optional or other special rights of Preferred Stock or qualifications, limitations and restrictions thereof herein set forth shall be deemed dependent upon any other such voting powers, preferences or relative, participating, optional or other special rights of Preferred Stock or qualifications, limitations and restrictions thereof unless so expressed herein.

Consistent with Section 243 of the DGCL, shares of Preferred Stock that have been issued and reacquired in any manner, including shares purchased by the Corporation or exchanged or converted, may not be reissued and shall (upon compliance with any applicable provisions of the laws of the State of Delaware) be retired and cancelled promptly after acquisition thereof. All such shares shall upon their cancellation have the status of authorized but unissued shares of preferred stock of the Corporation undesignated as to series and may be designated or redesignated and issued or reissued, as the case may be, as part of any series of preferred stock of the Corporation. The Corporation may from time to time take such appropriate action as may be necessary to reduce the authorized number of shares of Preferred Stock.

Notwithstanding anything set forth in the Certificate of Incorporation or this Certificate of Designations to the contrary, the Board or any authorized committee of the Board, without the vote of the Holders, may increase or decrease the number of authorized shares of Preferred Stock or other stock ranking junior or senior to, or on parity with, the Preferred Stock as to dividends and the distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

The Corporation shall be solely responsible for making all calculations called for hereunder. Absent manifest error, such calculations shall be final and binding on all Holders. The Corporation shall have the power to resolve any ambiguity and its action in so doing, as evidenced by a resolution of the Board, shall be final and conclusive unless clearly inconsistent with the intent hereof. Amounts resulting from any calculation will be rounded, if necessary, to the nearest one ten-thousandth, with five one-hundred thousandths being rounded upwards.

The Corporation may not, at any time, redeem the outstanding shares of the Preferred Stock.

9

WEIL:\98572002\19\13910.0030

Subject to the limitations imposed herein, the Corporation may purchase and sell shares of Preferred Stock from time to time to such extent, in such manner, and upon such terms as the Board or any duly authorized committee of the Board may determine.

Shares of Preferred Stock are not subject to the operation of a sinking fund.

All notices, requests and other communications to each Holder shall be in writing (including facsimile transmission) and shall be given at the address of such Holder as shown on the books of the Corporation. A Holder may waive any notice required hereunder by a writing signed before or after the time required for notice or the action in question.

Notwithstanding anything to the contrary contained in this Certificate of Designations, no shares of Preferred Stock shall be issued in physical, certificated form. All shares of Preferred Stock shall be evidenced by book-entry on the books and records of the Computershare Trust Company, N.A. or such other Person as determined by the Corporation.

Notwithstanding anything to the contrary contained herein, while any Preferred Stock is issued and outstanding, the Certificate of Incorporation shall not be amended in any manner, including in a merger or consolidation, which would alter, change or repeal the powers, preferences or special rights of the Preferred Stock so as to affect them materially and adversely without the affirmative vote of the Holders of at least two-thirds of the outstanding shares of Preferred Stock, voting together as a single class.

10

WEIL:\98572002\19\13910.0030