10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 28, 2023

Exhibit 4.5

DESCRIPTION OF THE REGISTRANT’S SECURITIES

REGISTERED PURSUANT TO SECTION 12 OF THE

SECURITIES EXCHANGE ACT OF 1934

As of December 31, 2022, AMC Entertainment Holdings, Inc., a Delaware corporation (“AMC,” the “Company,” or “us”) had two classes of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):(i) Class A common stock and (ii) AMC Preferred Equity Units, each constituting a depositary share representing a 1/100th interest in a share of Series A Convertible Participating Preferred Stock.

The following description summarizes important terms of our capital stock. This summary does not purport to be complete and is qualified in its entirety, by reference to our third amended and restated certificate of incorporation (the “certificate of incorporation”), our third amended and restated bylaws (the “bylaws”), the Deposit Agreement, by and among the Company, Computershare Inc. and Computershare Trust Company, N.A., collectively acting as depositary and conversion agent (the “Depositary”) dated as of August 4, 2022 (the “Deposit Agreement”) and the Certificate of Designations (the “Certificate of Designations”) for the Series A Convertible Participating Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), as filed with the Delaware Secretary of State on August 4, 2022, each of which is incorporated by reference as an exhibit to the Annual Report on Form 10-K for the year ended December 31, 2022 of which this Exhibit 4.5 is a part, and the applicable provisions of Delaware law.

Our authorized capital stock consists of 524,173,073 shares of Class A common stock, par value $0.01 per share (“Class A common stock”) and 50,000,000 shares of preferred stock, par value $0.01 per share, of which 10,000,000 have been designated as Series A Preferred Stock. As of December 31, 2022, there were 516,778,945 shares of Class A common stock outstanding and 7,245,871 shares of Series A Convertible Participating Preferred Stock outstanding, represented by 724,587,058 AMC Preferred Equity Units.

Our Class A common stock and AMC Preferred Equity Units are listed on the New York Stock Exchange (“NYSE”) under the symbols “AMC” and “APE”, respectively. The transfer agent and registrar for our Class A common stock, Series A Preferred Stock and AMC Preferred Equity Units is Computershare Trust Company, N.A.

Common Stock

Voting Rights:

Holders of Class A common stock are entitled to one vote per share.

Our directors are elected by all of the common stockholders voting together as a single class.

Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of our outstanding voting power. Except as otherwise required by the Delaware General Corporation Law (the “DGCL”), the certificate of incorporation or voting rights granted to any subsequently issued preferred stock, the holders of outstanding shares of our common stock and our preferred stock entitled to vote thereon, if any, vote as one class with respect to all matters to be voted on by our stockholders. Under the DGCL, amendments to the certificate of incorporation that would alter or change the powers, preferences or special rights of the common stock so as to affect them adversely also must be approved by a majority of the votes entitled to be cast by the holders of the shares affected by the amendment, voting as a separate class.

Conversion:

The Class A common stock is not convertible into any other shares of our capital stock.

Dividends:

Holders of Class A common stock share ratably (based on the number of shares of common stock held) in any dividend declared by the AMC board of directors (the “AMC Board”), subject to any preferential rights of any outstanding preferred stock.

Other Rights:

Upon liquidation, dissolution or winding up, after payment in full of the amounts required to be paid to holders of preferred stock, if any, all holders of common stock, regardless of class, will be entitled to share ratably in any assets available for distribution to holders of shares of common stock. No shares of any class of common stock are subject to redemption or have preemptive rights to purchase additional shares of common stock.

Preferred Stock:

The certificate of incorporation authorizes the AMC Board to issue from time to time up to an aggregate of 50,000,000 shares of preferred stock in one or more series without further stockholder approval. The AMC Board is authorized, without further stockholder approval, to fix or alter the designations, preferences, rights and any qualifications, limitations or restrictions of the shares of each such series thereof, including the dividend rights, dividend rates, conversion rights, voting rights, terms of redemption (including sinking fund provisions), redemption price or prices, liquidation preferences and the number of shares constituting any series or designations of such series.

Anti-Takeover Effects of Certain Provisions of the Certificate of Incorporation, the Bylaws, and Delaware Law:

Certain provisions of the certificate of incorporation and bylaws may be considered to have an anti-takeover effect and may delay or prevent a tender offer or other corporate transaction that a stockholder might consider to be in its best interest, including those transactions that might result in payment of a premium over the market price for our shares. These provisions are designed to discourage certain types of transactions that may involve an actual or threatened change of control of AMC without prior approval of the AMC Board. These provisions are meant to encourage persons interested in acquiring control of AMC to first consult with the AMC Board to negotiate terms of a potential business combination or offer. For example, the certificate of incorporation and bylaws:

| ● | provide for a classified board of directors, pursuant to which the AMC Board is divided into three classes whose members serve three-year staggered terms; |

| ● | provide that the size of the AMC Board will be set by members of the AMC Board, and any vacancy on the AMC Board, including a vacancy resulting from an enlargement of the AMC Board, may be filled only by vote of a majority of the directors then in office; |

| ● | do not permit stockholders to take action by written consent; |

| ● | provide that, except as otherwise required by law, special meetings of stockholders can only be called by the AMC Board; |

| ● | establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders, including proposed nominations of candidates for election to the AMC Board; |

| ● | limit consideration by stockholders at annual meetings to only those proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the AMC Board or by a stockholder of record on the record date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our secretary of the stockholder’s intention to bring such business before the meeting; |

| ● | authorize the issuance of “blank check” preferred stock that could be issued by the AMC Board to increase the number of outstanding shares or establish a stockholders rights plan making a takeover more difficult and expensive; and |

| ● | do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates. |

The certificate of incorporation expressly states that we have elected not to be governed by Section 203 of the DGCL, which prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the time the stockholder became an interested stockholder, subject to certain exceptions, including if, prior to such time, the board of such corporation approved the business combination or the transaction which resulted in the stockholder becoming an interested stockholder. “Business combinations” include mergers, asset sales and other transactions resulting in a financial benefit to the “interested stockholder.” Subject to various exceptions, an “interested stockholder” is a person who, together with his or her affiliates and associates, owns, or within three years did own, 15% or more of the corporation’s outstanding voting stock. These

restrictions generally prohibit or delay the accomplishment of mergers or other takeover or change-in-control attempts that are not approved by a company’s board. Although we have elected to opt out of the statute’s provisions, we could elect to be subject to Section 203 in the future.

Special Meeting of Stockholders:

Special meetings of our stockholders may be called only by a majority of our directors.

Actions by Written Consent:

Stockholder action may not be taken by written consent in lieu of a meeting. Stockholder action can be taken only at an annual or special meeting of stockholders.

Advance Notice Requirements for Stockholder Proposals and Director Nominations:

The bylaws provide that stockholders seeking to bring business before an annual meeting of stockholders, or to nominate candidates for election as directors at an annual meeting of stockholders, must provide timely notice thereof in writing. To be timely, a stockholder’s notice generally must be delivered to and received at our principal executive offices, not less than 30 days nor more than 60 days prior to the first anniversary of the preceding year’s annual meeting; provided, that in the event that the date of such meeting is advanced more than 30 days prior to, or delayed by more than 30 days after, the anniversary of the preceding year’s annual meeting of our stockholders, a stockholder’s notice to be timely must be so delivered not earlier than the close of business on the 60th day prior to such meeting and not later than the close of business on the later of the 30th day prior to such meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. The bylaws also specify certain requirements as to the form and content of a stockholder’s notice. These provisions may preclude stockholders from bringing matters before an annual meeting of stockholders or from making nominations for directors at an annual meeting of stockholders.

Authorized But Unissued Shares:

The authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval. These additional shares may be used for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of AMC by means of a proxy contest, tender offer, merger or otherwise.

Amendments to Certificate of Incorporation or Bylaws:

The certificate of incorporation provides that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend the certificate of incorporation. In addition, under the DGCL, an amendment to the certificate of incorporation that would alter or change the powers, preferences or special rights of the common stock so as to affect them adversely also must be approved by a majority of the votes entitled to be cast by the holders of the shares affected by the amendment, voting as a separate class. Subject to the bylaws, the AMC Board may from time to time make, amend, supplement or repeal the bylaws by vote of a majority of the AMC Board.

Registration Rights:

Pursuant to the management stockholders agreement, dated as of August 30, 2012, as amended on December 17, 2013, by and among us and the stockholders party thereto, certain members of management have the right subject to various conditions and limitations, to include shares of our Class A common stock in registration statements relating to our Class A common stock.

Limitation of Liability and Indemnification of Directors and Officers:

As permitted by the DGCL, we have adopted provisions in the certificate of incorporation that limit or eliminate the personal liability of our directors for monetary damages for a breach of their fiduciary duty of care as a director. The

duty of care generally requires that, when acting on behalf of the corporation, directors and officers exercise an informed business judgment based on all material information reasonably available to them. Consequently, a director will not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except for liability for:

| ● | any breach of the person’s duty of loyalty to us or our stockholders; |

| ● | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| ● | any act related to unlawful stock repurchases, redemptions or other distributions or payment of dividends; or |

| ● | any transaction from which the person derived an improper personal benefit. |

These limitations of liability do not generally affect the availability of equitable remedies such as injunctive relief or rescission.

As permitted by the DGCL, the certificate of incorporation and bylaws provide that:

| ● | we will indemnify our current and former directors and officers and anyone who is or was serving at our request as the director or officer of, or legal representative in, another entity, and may indemnify our current or former employees and other agents, to the fullest extent permitted by the DGCL, subject to limited exceptions; and |

| ● | we may purchase and maintain insurance on behalf of our current or former directors, officers, employees or agents against any liability asserted against them and incurred by them in any such capacity, or arising out of their status as such. |

We currently maintain liability insurance for our directors and officers.

The certificate of incorporation requires us to advance expenses to our directors and officers in connection with a legal proceeding, subject to receiving an undertaking from such director or officer to repay advanced amounts if it is determined he or she is not entitled to indemnification. The bylaws provide that we may advance expenses to our employees and other agents, upon such terms and conditions, if any, as we deem appropriate.

AMC Preferred Equity Units

General

Each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of the Series A Preferred Stock and is evidenced by a depositary receipt. The underlying shares of the Series A Preferred Stock are deposited with the Depositary (as defined below) pursuant to the Deposit Agreement. Subject to the terms of the Deposit Agreement, the depositary shares are entitled to all the rights and preferences of the Series A Preferred Stock, as applicable, in proportion to the fraction of a share of Series A Preferred Stock those depositary shares represent.

Listing

The AMC Preferred Equity Units are listed on the NYSE under the symbol “APE”. The underlying Series A Preferred Stock is not listed on any exchange.

Automatic Conversion

To provide for the authorization of a sufficient number of authorized and unissued and unreserved shares of the Class A common stock into which the Series A Preferred Stock (and, by virtue of such conversion, AMC Preferred Equity Units) can convert in full, the Company may seek to obtain the requisite stockholder approval, at such time or times as the AMC Board in its sole discretion shall determine, of an amendment to its certificate of incorporation to increase the number of authorized shares of Class A common stock to a number at least sufficient to permit the full conversion of the then-outstanding shares of Series A Preferred Stock into Class A common stock, or to such

higher number of authorized shares of Class A common stock (which may be issued for any purpose) as the AMC Board may determine in its sole discretion (the “Common Stock Amendment”).

Under Delaware law, the affirmative vote of holders of at least a majority in voting power of the Company’s outstanding capital stock will be required for stockholder approval of the Common Stock Amendment. The holders of the AMC Preferred Equity Units will be entitled to vote on the Common Stock Amendment.

Upon the terms and in the manner described below under “Series A Preferred Stock – Conversion Procedures,” at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment, all of the issued and outstanding shares of Series A Preferred Stock will automatically convert in full with no action on the part of holders into Class A common stock at the then-applicable conversion rate and the Series A Preferred Stock will cease to exist.

Because each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of Series A Preferred Stock, and upon conversion one (1) share of Series A Preferred Stock is convertible into one-hundred (100) shares of Class A common stock, each AMC Preferred Equity Unit would represent an interest in one (1) share of Class A common stock upon conversion and such Class A common stock will be deliverable upon conversion in respect of each AMC Preferred Equity Unit, in each case subject to adjustments as described herein. After delivery of Class A common stock by the transfer agent to the Depositary following conversion of the Series A Preferred Stock, the Depositary will transfer the proportional number of shares of Class A common stock to the holders of AMC Preferred Equity Units by book-entry transfer through the Depository Trust Company (“DTC”) or, if such holders’ interests are in certificated depositary receipts or held through the book-entry settlement system of the Depositary, by delivery of common stock certificates or book-entry transfer through the Depositary, as applicable, for such number of shares of Class A common stock. In the event that the holders of AMC Preferred Equity Units would be entitled to receive fractional shares of Class A common stock, the Depositary will pay such holders cash in lieu of such fractional shares, as described under “Series A Preferred Stock – Fractional Shares” below.

Dividends and Other Distributions

Holders of AMC Preferred Equity Units will receive dividends only to the extent such dividends are declared on the Series A Preferred Stock. Each dividend on an AMC Preferred Equity Unit will be in an amount equal to the dividend on one share of Class A common stock, or one one-hundredth (1/100th) of any dividend declared on the related share of the Preferred Stock, subject to adjustment.

The Depositary will distribute all cash dividends and other cash distributions received on the Series A Preferred Stock to the holders of record of the depositary receipts in proportion, as nearly as practicable, to the number of AMC Preferred Equity Units held by each holder. In the event of a distribution other than in cash, rights, preferences or privileges upon the Series A Preferred Stock, the Depositary will, at the direction of the Company, distribute such amounts of securities or property received by it to the holders of record of the depositary receipts in proportion to the number of AMC Preferred Equity Units held by each holder, unless the Depositary determines that this distribution is not feasible, in which case the Depositary may, with the Company’s approval, adopt a method of distribution that it deems practicable, including the sale of the property and distribution of the net proceeds of that sale to the holders of the depositary receipts.

Record dates for the payment of dividends and other matters relating to the AMC Preferred Equity Units will be the same as the corresponding record dates for the Series A Preferred Stock.

The amount paid as dividends or otherwise distributable by the Depositary with respect to the AMC Preferred Equity Units or the underlying Series A Preferred Stock will be reduced by any amounts required to be withheld by the Company or the Depositary on account of taxes or other governmental charges. The Depositary may refuse to make any payment or distribution, or any transfer, exchange, or withdrawal of any AMC Preferred Equity Units or the shares of the Series A Preferred Stock until such taxes or other governmental charges are paid.

Voting Rights

Because each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of the Series A Preferred Stock, and holders of the Series A Preferred Stock will initially be entitled to one hundred (100) votes per share and will vote together with the holders of common stock on an as-converted basis, each AMC Preferred Equity Unit represents the equivalent of one vote under those circumstances in which holders of the Series A Preferred Stock are entitled to a vote, as described under “Series A Preferred Stock – Voting Rights” below.

When the Depositary receives notice of any meeting at which the holders of the Series A Preferred Stock are entitled to vote, the Depositary will, if requested in writing, as soon as practicable thereafter, mail or transmit a notice prepared by the Company which will contain (i) the information contained in the notice to the record holders of the AMC Preferred Equity Units relating to the Series A Preferred Stock, (ii) a statement that such holders may, subject to any applicable restrictions, instruct the Depositary as to the exercise of the voting rights pertaining to the shares of the Series A Preferred Stock represented by their respective AMC Preferred Equity Units, and (iii) a brief statement as to the manner in which such instructions may be given. Each record holder of the AMC Preferred Equity Units on the record date, which will be the same date as the record date for the Series A Preferred Stock, may instruct the Depositary to vote the amount of the Series A Preferred Stock represented by the holder’s AMC Preferred Equity Units. Insofar as practicable, the Depositary will vote the amount of the Series A Preferred Stock represented by AMC Preferred Equity Units in accordance with the instructions it receives. The Company will agree to take all reasonable actions that the Depositary determines are necessary to enable the Depositary to vote as instructed. In the absence of specific instructions from holders of AMC Preferred Equity Units, the Depositary will vote the Series A Preferred Stock represented by the AMC Preferred Equity Units evidenced by the receipts of such holders proportionately with votes cast pursuant to instructions received from the other holders of AMC Preferred Equity Units.

Additional AMC Preferred Equity Units

The Company without the consent of holders of AMC Preferred Equity Units may issue from time to time additional AMC Preferred Equity Units that will form part of the same series of security.

Redemption

The AMC Preferred Equity Units is not redeemable or subject to any sinking fund or similar provision.

Preemptive Rights

The AMC Preferred Equity Units do not provide any preemptive rights.

Withdrawal

Any holder of an AMC Preferred Equity Unit may withdraw the number of whole shares of the Series A Preferred Stock and all money and other property, if any, represented thereby by surrendering the receipts evidencing the AMC Preferred Equity Units at the Depositary’s principal office or at such other offices as the Depositary may designate. Only whole shares of Series A Preferred Stock may be withdrawn. If the AMC Preferred Equity Units surrendered by the holder in connection with withdrawal exceed the number of AMC Preferred Equity Units that represent the number of whole shares of Series A Preferred Stock to be withdrawn, the Depositary will deliver to that holder at the same time a new depositary receipt evidencing the excess number of AMC Preferred Equity Units.

Amendment and Termination of the Deposit Agreement

The Company may amend the form of depositary receipt evidencing the AMC Preferred Equity Units and any provision of the Deposit Agreement at any time and from time to time by agreement with the Depositary without the consent of the holders of depositary receipts. However, any amendment that will materially and adversely alter the rights of the holders of depositary receipts will not be effective unless the holders of at a majority of the affected AMC Preferred Equity Units then outstanding approve the amendment. Every holder of an outstanding depositary

receipt at the time any such amendment becomes effective shall be deemed, by continuing to hold such depositary receipts, to consent and agree to such amendment and to be bound by the Deposit Agreement as amended thereby.

The Company will make no amendment that impairs the right of any holder of AMC Preferred Equity Units to receive shares of the Series A Preferred Stock and any money or other property represented by those AMC Preferred Equity Units, except in order to comply with mandatory provisions of applicable law or the rules and regulations of any governmental body, agency, or commission, or applicable securities exchange.

The Deposit Agreement may be terminated:

| ● | if all outstanding AMC Preferred Equity Units issued under the Deposit Agreement have been cancelled, upon conversion of the Series A Preferred Stock or otherwise; |

| ● | if there shall have been a final distribution made in respect of the Series A Preferred Stock in connection with any liquidation, dissolution or winding up of the Company and such distribution shall have been distributed to the holders of depositary receipts representing AMC Preferred Equity Units pursuant to the terms of the Deposit Agreement; or |

| ● | upon the consent of holders of depositary receipts representing in the aggregate not less than two-thirds of the AMC Preferred Equity Units outstanding. |

Resignation and Removal of Depositary

The Depositary may resign at any time by delivering to the Company written notice of its election to do so at least forty-five (45) days prior to such resignation. The Company also may, at any time, remove the Depositary by providing at least forty-five (45) days prior written notice. The Company will use its reasonable best efforts to appoint the successor depositary within forty-five (45) days after delivery of the notice of resignation or removal. The successor depositary must be a bank or trust company having its principal office in the United States and having a combined capital and surplus of at least $50 million.

Form and Notices

The Series A Preferred Stock have been and will be issued in registered form to the Depositary, and the AMC Preferred Equity Units have been and will be issued in book-entry only form through DTC, as described under “Registration and Settlement – Book Entry System” below. The Depositary shall forward to the holders of AMC Preferred Equity Units all reports, notices, and communications from the Company that are delivered to the Depositary and that the Company is required to furnish to the holders of the Series A Preferred Stock.

Series A Preferred Stock

Effect of Stockholder Approval

If we obtain the requisite stockholder approval of the Common Stock Amendment, then upon the terms and in the manner described below under “– Conversion Procedures,” at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment, all of the issued and outstanding shares of Series A Preferred Stock will automatically convert in full with no action on the part of holders into Class A common stock at the then-applicable conversion rate and the Series A Preferred Stock will cease to exist.

Automatic Conversion of Series A Preferred Stock

Upon the terms and in the manner described below under “– Conversion Procedures,” each issued and outstanding share of Series A Preferred Stock will automatically convert in full into shares of Class A common stock at the conversion rate, with no action on the part of holders, at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment (the “Conversion Date”). The initial conversion rate is one hundred (100) shares of Class A common stock for each share of Series A Preferred Stock (or one (1) share of Class A common stock for each AMC Preferred Equity Unit). Such conversion rate is subject to adjustment as described below under “– Anti-Dilution Adjustments.” Cash will be paid in lieu of any fractional shares of Class A common stock that would be issued on conversion as described below under “– Fractional Shares.”

General

The Series A Preferred Stock is a series (Series A) of the Company’s authorized preferred stock. The Depositary is the sole holder of shares of the Series A Preferred Stock. Holders of AMC Preferred Equity Units are required to exercise their proportional rights in the Series A Preferred Stock through the Depositary.

Conversion Procedures

As promptly as practicable after the Conversion Date, the Company shall provide written notice of the conversion to each holder of Series A Preferred Stock stating the Conversion Date and the number of shares of Class A common stock issued upon conversion of each share of Series A Preferred Stock held of record by such holder and subject to conversion. Immediately upon conversion, the rights of the holder of Series A Preferred Stock with respect to the shares of Series A Preferred Stock so converted shall cease and the persons entitled to receive the shares of Class A common stock upon the conversion of such shares of Series A Preferred Stock shall be treated for all purposes as having become the record and beneficial owners of such shares of Class A common stock. In the event that a holder of Series A Preferred Stock shall not by written notice designate the name in which shares of Class A common stock and/or cash, securities or other property (including payments of cash in lieu of fractional shares) to be issued or paid upon conversion of shares of Series A Preferred Stock should be registered or paid or the manner in which such shares should be delivered, the Company shall be entitled to register and deliver such shares, and make such payment, in the name of such holder and in the manner shown on the records of the Company.

The Company shall not be required to reserve or keep available, out of its authorized but unissued shares of Class A common stock, or to have sufficient authorized shares of Class A common stock to cover, the number of shares of Class A common stock that would be required to effect the conversion of all of the then-outstanding shares of Series A Preferred Stock prior to the approval of the common stock amendment.

All shares of Class A common stock which may be issued upon conversion of the shares of Series A Preferred Stock will, upon issuance by the Company, be validly issued, fully paid and non-assessable.

Effective immediately prior to the Conversion Date, dividends shall no longer be declared on the shares of Series A Preferred Stock and such shares of Series A Preferred Stock shall cease to be outstanding, in each case, subject to the rights of holders of Series A Preferred Stock to receive any declared and unpaid dividends on such shares and any other payments to which they are otherwise entitled to as further described herein and in the Certificate of Designations.

Fractional Shares

No fractional shares of Class A common stock shall be issued upon conversion of shares of Series A Preferred Stock. If more than one share of Series A Preferred Stock shall be surrendered for conversion at any one time by the same holder of Series A Preferred Stock, the number of full shares of Class A common stock issuable upon conversion thereof shall be computed on the basis of the aggregate number of shares of Series A Preferred Stock so surrendered. Instead of any fractional shares of Class A common stock which would otherwise be issuable upon conversion of any shares of Series A Preferred Stock, the Company shall pay an amount in cash (rounded to the nearest cent) equal to the interest in the net proceeds from the sale in the open market by the applicable conversion agent of the aggregate fractional shares of Class A common stock that otherwise would have been issuable upon conversion of the Series A Preferred Stock.

Dividends

Dividends on the Series A Preferred Stock shall not mandatory. Holders of the Series A Preferred Stock shall be entitled to receive, when, as, and if declared by the AMC Board or any duly authorized committee of the AMC Board, but only out of assets legally available therefor, all cash dividends or distributions (including, but not limited to, regular quarterly dividends) declared and paid or made in respect of the shares of Class A common stock, at the same time and on the same terms as holders of Class A common stock, in an amount per share of Series A Preferred Stock equal

to the product of (x) the then-applicable conversion rate then in effect and (y) any per share dividend or distribution, as applicable, declared and paid or made in respect of each share of Class A common stock (the “Common Equivalent Dividend Amount”), and the AMC Board or any duly authorized committee thereof may not declare and pay any such cash dividend or make any such cash distribution in respect of Class A common stock unless the AMC Board or any duly authorized committee of the AMC Board declares and pays to the holders of Series A Preferred Stock, at the same time and on the same terms as holders of Class A common stock, the Common Equivalent Dividend Amount per share of Series A Preferred Stock. Notwithstanding any provision to the contrary in the Certificate of Designations with respect to dividends, the holders of Series A Preferred Stock shall not be entitled to receive any cash dividend or distribution made with respect to the Class A common stock after the issuance of the Series A Preferred Stock where the record date for determination of holders of Class A common stock entitled to receive such dividend or distribution occurs prior to the issuance of the Series A Preferred Stock.

Each dividend or distribution declared and paid as described hereunder will be payable to holders of record of Series A Preferred Stock as they appear in the records of the Company at the close of business on the same day as the record date for the corresponding dividend or distribution to the holders of shares of Class A common stock.

Except as set forth in the Certificate of Designations, the Company shall have no obligation to pay, and the holders of Series A Preferred Stock shall have no right to receive, dividends at any time, including with respect to dividends with respect to Parity Securities (as defined herein) or any other class or series of authorized preferred stock of the Company. To the extent the Company declares dividends on the Series A Preferred Stock and on any Parity Securities but does not make full payment of such declared dividends, the Company will allocate the dividend payments on a pro rata basis among the holders of the shares of Series A Preferred Stock and the holders of any Parity Securities then outstanding. For purposes of calculating the allocation of partial dividend payments, the Company will allocate dividend payments on a pro rata basis among the holders of Series A Preferred Stock and the holders of any Parity Securities so that the amount of dividends paid per share on the Series A Preferred Stock and such Parity Securities shall in all cases bear to each other the same ratio that payable dividends per share on the shares of the Series A Preferred Stock and such Parity Securities (but without, in the case of any noncumulative preferred stock, accumulation of dividends for prior dividend periods) bear to each other. The foregoing right shall not be cumulative and shall not in any way create any claim or right in favor of holders of Series A Preferred Stock in the event that dividends have not been declared or paid in respect of any prior calendar quarter.

No interest or sum of money in lieu of interest will be payable in respect of any dividend payment or payments on Series A Preferred Stock or on such Parity Securities that may be in arrears.

Holders of Series A Preferred Stock shall not be entitled to any dividends, whether payable in cash, securities or other property, other than dividends (if any) declared and payable on Series A Preferred Stock as specified hereunder.

Notwithstanding any provision in the Certificate of Designations to the contrary, holders of Series A Preferred Stock shall not be entitled to receive any dividends for any calendar quarter in which the Conversion Date occurs, except to the extent that any such dividends have been declared by the AMC Board or any duly authorized committee of the AMC Board and the record date for such dividend occurs prior to the Conversion Date.

A holder of an AMC Preferred Equity Unit, which is a depositary share in the Series A Preferred Stock, will not be entitled to receive dividends on the Series A Preferred Stock declared by the AMC Board unless such holder is a holder of record of the depositary share as of the close of business on the record date for such dividend.

Voting Rights

The holders of the Series A Preferred Stock shall vote together with the holders of the Class A common stock (and any other securities that vote together or that may in the future vote together with the holders of the Class A common stock) on all matters upon which the holders of Class A common stock are entitled to vote, including the Common Stock Amendment, except for those matters which under the Certificate of Incorporation or Delaware law would require the vote of the Series A Preferred Stock or the Class A common stock voting as a separate voting group. Holders of the Series A Preferred Stock shall be entitled to one hundred (100) votes per share (or one (1) vote per AMC Preferred Equity Unit), or such other number of votes per share equal to the number of shares of Class A common stock into which a share of Series A Preferred Stock (and AMC Preferred Equity Units) would convert at the

then-applicable conversion rate, subject to adjustments as described herein. The Series A Preferred Stock will not otherwise have voting rights except as specifically required by Delaware law.

Holders of Series A Preferred Stock shall not be entitled to vote together with the Class A common stock with respect to any matter at a meeting of the stockholders of the Company, which under applicable law or the Certificate of Incorporation requires a separate class vote.

Ranking and Liquidation Rights

With respect to any dividends or distributions (including, but not limited to, regular quarterly dividends) declared by the AMC Board, the Series A Preferred Stock shall rank (i) senior to any class or series of capital stock of the Company hereafter created specifically ranking by its terms junior to any Series A Preferred Stock (“Junior Securities”); (ii) on parity with the Class A common stock and any class or series of capital stock of the Company created specifically ranking by its terms on parity with the Series A Preferred Stock (“Parity Securities”); and (iii) junior to any class or series of capital stock of the Company hereafter created specifically ranking by its terms senior to any Series A Preferred Stock (“Senior Securities”). With respect to distributions of assets upon liquidation, dissolution or winding up of the Company, whether voluntarily or involuntarily, except as set forth in (b) below, the Series A Preferred Stock shall rank (i) senior to all of the Class A common stock; (ii) senior to any class or series of Junior Securities; (iii) on parity with any class or series of Parity Securities; and (iv) junior to any class or series of Senior Securities.

Subject to any superior liquidation rights of the holders of any Senior Securities of the Company and the rights of the Company’s existing and future creditors, upon any voluntary or involuntary liquidation, dissolution or winding up of the Company, each holder of the Series A Preferred Stock shall be entitled to be paid out of the assets of the Company legally available for distribution to stockholders, prior and in preference to any distribution of any of the assets or surplus funds of the Company to the holders of the Class A common stock and Junior Securities and pari passu with any distribution to the holders of Parity Securities: (i) an amount equal to the sum of the Liquidation Preference for each share of Series A Preferred Stock held by such holder and an amount equal to any dividends declared but unpaid thereon plus (ii) the amount the holders of Series A Preferred Stock would have received if, immediately prior to such voluntary or involuntary liquidation, dissolution or winding up of the Company, the Series A Preferred Stock had converted into Class A common stock (based on the then-applicable conversion rate and without giving effect to any limitations on conversion set forth herein) and if such amount exceeds the amount set forth in (i) above, minus the amount set forth in (i) above, which shall be paid out pari passu with any distribution to holders of the Class A common stock and Parity Securities. Holders shall not be entitled to any further payments in the event of any such voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company other than what is expressly provided for in the Certification of Designations and will have no right or claim to any of the Company’s remaining assets.

The sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all of the property and assets of the Company shall not be deemed a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company, nor shall the merger, consolidation or any other business combination transaction of the Company into or with any other corporation or person or the merger, consolidation or any other business combination of any other corporation or person into or with the Company be deemed to be a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company.

Anti-Dilution Adjustments

Initially, each share of Series A Preferred Stock shall be convertible into Class A common stock at a rate of one hundred (100) shares of Class A common stock for each share of Series A Preferred Stock (or one (1) share of Class A common stock for one (1) AMC Preferred Equity Unit), subject to adjustment as set forth herein.

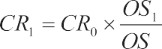

If the Company issues solely shares of Class A common stock as a dividend or distribution on all or substantially all shares of the Class A common stock, or if the Company effects a stock split, stock combination or other similar recapitalization of the Class A common stock (in each case excluding an issuance solely pursuant to a reorganization event), then the conversion rate will be adjusted based on the following formula:

where:

CR0 = the conversion rate in effect immediately before the close of business on the record date or effective date, as applicable, for such dividend, distribution, stock split, stock combination or other similar recapitalization, as applicable;

CR1=the conversion rate in effect immediately after the close of business on such record date or effective date, as applicable of such dividend, distribution, stock split, stock combination or other similar recapitalization event;

OS0=the number of shares of Class A common stock outstanding immediately prior to such dividend, distribution, stock split, stock combination or other similar recapitalization; and

OS1=the number of shares of Class A common stock outstanding immediately after giving effect to such dividend, distribution, stock split, stock combination or other similar recapitalization.

If any distribution, dividend, stock split, stock combination or other similar recapitalization of the Class A common stock is declared or announced, but not so paid or made, then the conversion rate will be readjusted, effective as of the date the AMC Board, or any officer acting pursuant to authority conferred by the AMC Board, determines not to pay such distribution or dividend or to effect such stock split, stock combination or other similar recapitalization, to the conversion rate that would then be in effect had such dividend, distribution, stock split, stock combination or similar recapitalization not been declared or announced.

Adjustments

In the event of:

| • | the consolidation, merger or conversion of the Company with or into another person in each case pursuant to which the Class A common stock will be converted into cash, securities, or other property of the Company or another person; |

| • | any sale, transfer, lease, or conveyance to another person of all or substantially all of the consolidated assets of the Company and its subsidiaries, taken as a whole, in each case pursuant to which Class A common stock will be converted into cash, securities, or other property; or |

| • | any reclassification of Class A common stock into securities other than Class A common stock, |

each of which is referred to as a “reorganization event,” each share of the Series A Preferred Stock outstanding immediately prior to such reorganization event will, without the consent of the holders of the Series A Preferred Stock, automatically convert into the kind of securities, cash, and other property receivable in such reorganization event by a holder of the shares of Class A common stock into which such share of Series A Preferred Stock was convertible immediately prior to such reorganization event in exchange for such shares of Class A common stock. In the event that holders of the shares of Class A common stock have the opportunity to elect the form of consideration to be received in such reorganization event, the consideration that the holders of the Series A Preferred Stock are entitled to receive will be deemed to be the weighted average of the types and amounts of consideration actually received, per share of Class A common stock, by the holders of the Company’s Class A common stock, unless holders of Series A Preferred Stock have the opportunity to elect the form of consideration to be received in such reorganization event.

The Company (or any successor) shall, within 20 days of the occurrence of any reorganization event, provide written notice to the holders of Series A Preferred Stock of such occurrence of such event and of the type and amount of the cash, securities or other property that such holders are entitled to.

Other than with respect to an adjustment as described herein, if at any time prior to the Conversion Date, the Company issues to all holders of the Class A common stock shares of securities or assets of the Company (other than shares of Class A common stock or cash) as a dividend on the Class A common stock, or the Company issues to all holders of

the Class A common stock certain rights or warrants entitling them for a period of 60 days or less to purchase shares of Class A common stock at less than the current market value of the Class A common stock at that time, or the Company purchases shares of Class A common stock pursuant to a tender offer or exchange offer generally available to holders of Class A common stock (subject to customary securities laws limitations) at above the current market value of the Class A common stock at that time, and in each such case the record date with respect to such event (or the date such event is effective, as the case may be) occurs on or after the date of issuance of the Series A Preferred Stock and prior to the Conversion Date (each, an “Adjustment Event”), then the Company will make such provision (i) to extend such tender offer or exchange offer on equivalent terms to holders of Series A Preferred Stock or (ii) as is necessary so that the holder of Series A Preferred Stock receives (upon cancellation of such shares of Series A Preferred Stock in the event of a tender offer or exchange offer) the same dividend or other asset or property, if any, as it would have received in connection with such Adjustment Event if it had been the holder on the record date (or the date such event is effective, as the case may be) of the number of shares of Class A common stock into which the shares of Series A Preferred Stock held by such holder are then convertible, or, to the extent that it is not reasonably practicable for the Company to make such provision, the then-applicable conversion rate or other terms of the Series A Preferred Stock shall be adjusted to provide such holder with an economic benefit comparable to that which it would have received had such provision been made. The foregoing shall not apply to the extent that any holder of Series A Preferred Stock participates, or is permitted to participate, on a pro rata as-converted basis with the holders of Class A common stock. Amounts resulting from any calculation as described under “— Anti-Dilution Adjustments” or this “— Conversion Procedures” will be rounded to the nearest 1/10,000th.

Redemption

The Series A Preferred Stock are not redeemable or subject to any sinking fund or similar provision.

Preemptive Rights

The Series A Preferred Stock do not provide any preemptive rights.

Miscellaneous

The Company is required to reserve or keep available, out of the authorized but unissued Class A common stock, or have sufficient authorized Class A common stock to cover, the shares of Class A common stock issuable upon the conversion of the Series A Preferred Stock prior to the applicable conversion date. Any shares of the Series A Preferred Stock converted into shares of Class A common stock or otherwise reacquired by the Company shall resume the status of authorized and unissued preferred shares, undesignated as to series, and shall be available for subsequent issuance.

Additional Shares of Series A Preferred Stock and Classes or Series of Stock

Notwithstanding anything to the contrary set forth in our certificate of incorporation or the Certificate of Designations, the AMC Board or any authorized committee of the AMC Board, without the vote of the holders of Series A Preferred Stock (including the holders of the related AMC Preferred Equity Units), may increase or decrease the number of authorized shares of Series A Preferred Stock or other stock ranking junior or senior to, or on parity with, the Series A Preferred Stock as to dividends and the distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company.