10-K/A: Annual report pursuant to Section 13 and 15(d)

Published on April 28, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

| (Mark One) | |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For

the fiscal year ended |

|

| OR | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to | |

Commission file number

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| interest in a share of Series A Convertible Participating Preferred Stock |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and emerging growth company in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer ¨ | Non-accelerated filer ¨ |

|

Smaller reporting company |

Emerging

Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm

that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to§240.10D-1(b). ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value

of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2022, computed by reference to the

price at which the registrant’s Class A common stock was last sold on the New York Stock Exchange on such date was $

Shares of Class A common stock outstanding — shares at April 26, 2023

Shares of AMC Preferred Equity Units outstanding, each representing participating voting and economic rights in the equivalent of one (1) share of Class A common stock — shares at April 26, 2023

| Auditor Name | Auditor Location | Auditor Firm ID | ||

DOCUMENTS INCORPORATED BY REFERENCE

None.

Explanatory Note

The purpose of this Amendment No. 1 to the Annual Report on Form 10-K of AMC Entertainment Holdings, Inc. for the fiscal year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2023 (the “Original Report” and together with this Amendment No. 1, this “Report”), is to amend Part III, Items 10 through 14 of the Original Report to include information previously omitted from the Original Report in reliance on General Instructions G(3) to Form 10-K (“Instruction G”), which provides that registrants may incorporate by reference certain information from a definitive proxy statement filed with the SEC within 120 days after the end of the fiscal year.

We are also amending Part IV, Item 15 of the Original Report to include certain exhibits to be filed with this Amendment No. 1 to the Original Report.

Except as described above, this Amendment No. 1 to the Original Report does not amend, update or change any other items or disclosures in the Original Report and does not purport to reflect information or events subsequent to the filing thereof. Among other things, forward-looking statements made in the Original Report have not been revised to reflect events, results or developments that have occurred or facts that have become known to us after the date of the Original Report (other than as discussed above), and such forward-looking statements should be read in their historical context. Accordingly, this Amendment No. 1 to the Original Report should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Report.

The Board of Directors has not set a date for the 2023 Annual Meeting of Stockholders (“Annual Meeting”), but it is expected to be held in the third quarter of 2023. The Company will announce the date and time of the Annual Meeting and the deadlines for the submission of stockholder proposals in the proxy materials or otherwise to be considered at the Annual Meeting in a quarterly report on Form 10-Q or in a current report on Form 8-K.

Unless the context otherwise indicates, references to “AMC,” “our company,” “the Company,” “us,” “we” and “our” refer to AMC Entertainment Holdings, Inc. and its consolidated subsidiaries.

1

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Directors of the Company

Each of the biographies of our directors below contains information regarding the person’s service as a director, business experience, director positions held currently or at any time during the past five years, and the experience, qualifications, attributes and skills that caused the Board to determine that the person should be nominated for election as a director at the Annual Meeting. The following information is as of April 28, 2023.

Mr. Adam M. Aron

Mr. Aron, 68, has served as Chief Executive Officer, President and a director of the Company since January 2016, and as Chairman of the Board since July 2021. From February 2015 to December 2015, Mr. Aron was Chief Executive Officer of Starwood Hotels and Resorts Worldwide, Inc. and served on the board from 2006 to 2015. Since 2006, Mr. Aron has served as Chairperson and Chief Executive Officer of World Leisure Partners, Inc., a personal consultancy for matters related to travel and tourism, high-end real estate development, and professional sports, that he founded. Mr. Aron served as Chief Executive Officer and Co-Owner of the Philadelphia 76ers from 2011 to 2013, and remained an investor through 2022. From 2006 to 2015, Mr. Aron served as Senior Operating Partner of Apollo Management L.P. Mr. Aron currently serves on the board of directors of Norwegian Cruise Line Holdings, Ltd. Mr. Aron served on the board of directors of Centricus Acquisitions Corp. in 2021, the board of directors of Prestige Cruise Holdings, Inc. from 2007 to 2014, as well as HBSE, a private company that owns the NHL’s New Jersey Devils and the NBA’s Philadelphia 76ers. Mr. Aron received a Master’s of Business Administration degree with distinction from the Harvard Business School and a Bachelor of Arts degree cum laude from Harvard College. Mr. Aron brings to the Board significant business and executive leadership experience, including valuable insight into consumer services. He has almost 30 years of experience as a Chief Executive Officer, almost 35 years of experience as a corporate director, and more than 40 years of consumer-engagement experience.

Ms. Denise M. Clark

Ms. Clark, 65, has served as a director of the Company since January 2023. Ms. Clark is a global information technology executive with experience leading technical groups for multiple companies. Ms. Clark served as Senior Vice President and Global Chief Information Officer for The Estée Lauder Companies Inc. from November 2012 until her retirement in March 2017. Prior to that role, Ms. Clark served as Senior Vice President and Chief Information Officer for Hasbro Inc. from October 2007 to November 2012. Ms. Clark also served at Mattel, Inc., where she was Global Chief Technology Officer and later Chief Information Officer for the Fisher Price brand between January 2000 and February 2007. Ms. Clark’s previous experience also includes positions at Warner Music Group and Apple Inc. Ms. Clark has been a member of the board of directors of United Natural Foods, Inc. (UNFI) since 2013, where she is currently the chair of the nominating and governance committee. She previously served as a director of Six Flags Entertainment Corporation from March 2021 to August 2022 and Caesars Entertainment Corporation, including as chair of its compensation committee from October 2018 to May 2020. Ms. Clark also serves on the board of directors of Best Friends Animal Society, a national non-profit organization. Ms. Clark holds a B.S. in Sociology from the University of Missouri and an MBA from San Jose State University. Ms. Clark is a veteran of the United States Navy. Ms. Clark brings extensive public company executive experience to the Board, with particular expertise in information technology, strategic planning, and transformative business initiatives.

Mr. Howard W. “Hawk” Koch

Mr. Koch, 77, has served as a director of the Company since October 2014. Mr. Koch is a veteran movie producer and principal at The Koch Company, the former president of the Academy of Motion Picture Arts and Sciences (“AMPAS”), and Recording Secretary and former President of the Producers Guild of America. Mr. Koch serves on the Board of Directors of the Motion Picture & Television Fund from 2005 continuing through 2022 and the National Film Preservation Foundation. Mr. Koch previously served on the Board of Governors of AMPAS from 2004 to 2013 and the Board of Directors of the Producers Guild of America from 1999 to 2020. Mr. Koch has been intimately involved with the making of over 60 major motion pictures, among them such films as “Source Code”, “Fracture”, “Primal Fear”, “Marathon Man,” “Chinatown,” “Wayne’s World,” “Peggy Sue Got Married,” “The Idolmaker,” “Heaven Can Wait,” “The Way We Were” and “Rosemary’s Baby.” Mr. Koch continues to develop and produce movies. Mr. Koch has over 50 years of experience in the motion picture industry and provides our Board with a unique insight into the production of movies that are exhibited on our screens.

2

Mr. Philip Lader

Mr. Lader, 77, has served as a director of the Company since June 2019 and as Lead Independent Director since July 2021. Mr. Lader is a Senior Advisor to Morgan Stanley Institutional Securities as well as a partner emeritus with the law firm of Nelson Mullins Riley & Scarborough LLP. He is also the former U.S. Ambassador to the Court of St. James’s and Chairperson of WPP plc. Mr. Lader served in President Clinton’s Cabinet as Administrator of the US Small Business Administration, White House Deputy Chief of Staff, Assistant to the President, and Deputy Director of the Office of Management & Budget. Previously, he was Executive Vice President of Sir James Goldsmith’s US holdings and President of Sea Pines Company, universities in South Carolina and Australia, and Business Executives for National Security. Also, he is currently a trustee and Investment Committee Chairperson of RAND Corporation and several foundations, as well as a member of the boards of several privately-held companies, the investment committees of Morgan Stanley’s Global Infrastructure and Real Estate Funds, and the Council on Foreign Relations. He currently or has previously served on the boards of Lloyds of London, Marathon Oil, AES, WPP plc, Songbird (Canary Wharf), Rusal Corporations, the British Museum, American Red Cross, Smithsonian Museum of American History, St. Paul’s Cathedral Foundation, Atlantic Council, and several banks and universities. He is the founder and co-host of Renaissance Weekends. Mr. Lader’s education includes Duke, Michigan, Oxford and Harvard Law School, and he has been awarded honorary doctorates by 14 universities. He is an Honorary Fellow of Oxford University’s Pembroke College and London Business School and Honorary Bencher of Middle Temple (British Inns of Court), he was awarded the Benjamin Franklin Medal by The Royal Society for Arts, Manufactures & Commerce for his contributions to trans-Atlantic relations. Mr. Lader brings vast experience in business, government and law to the Board.

Mr. Gary F. Locke

Mr. Locke, 73, has served as a director of the Company since February 2016. Mr. Locke is currently a trade consultant and owner of Locke Global Strategies, LLC since 2014. Mr. Locke has also served as the interim President of Bellevue College since June of 2020. Mr. Locke was the first Chinese American to be elected as a U.S. Governor when the voters of Washington elected him in 1996 and re-elected him in 2000. During his administration, he strengthened economic ties between China and Washington State. Mr. Locke then served as U.S. Commerce Secretary from 2009-2011, where he led the effort to implement President Obama’s National Export Initiative to double American exports in five years. He then became America’s 10th Ambassador to China, serving from 2011-2014, and during his service he opened markets for made-in-USA goods and services and reduced wait times for visa interviews of Chinese applicants from 100 days to three days. Mr. Locke has served as a member of the board of directors of nLight, Inc. since August 2017. Mr. Locke previously served on the boards of directors of Fortinet, Inc. from September 2015 until June 2020 and Port Blakely Tree Farms from August 2019 until June 2022. He attended Yale University, graduating with a bachelor’s degree in political science and received his law degree from Boston University. Mr. Locke brings to the Board a global and valuable business perspective due to his extensive role in politics and experience as an Ambassador to China.

Ms. Kathleen M. Pawlus

Ms. Pawlus, 63, has served as a director of the Company since December 2014. Ms. Pawlus, a retired partner of Ernst and Young, LLP (“EY”), served as the Global Assurance Chief Financial Officer and Chief Operating Officer from 2012 to 2014. EY’s Assurance practice is the largest of EY’s four service lines and includes its Audit Practice, Fraud, Investigation and Dispute Services Practice, Climate Change and Sustainability Services Practice and its Financial Accounting Advisory Services Practice. Prior to this, from 2006 to 2012, Ms. Pawlus served as EY’s Americas Vice Chairperson and Chief Financial Officer, Global PBFA Function Leader and US Firm Vice Chairperson and Chief Financial Officer responsible for finance, IT operations, treasury, purchasing and facilities. Ms. Pawlus served on EY’s U.S. Executive Board from 2006 to 2012. Ms. Pawlus earned her Bachelor of Science degree from Indiana University and was a Certified Public Accountant from 1982 through 2021. Ms. Pawlus brings to the Board extensive financial, accounting, operational and management experience in various capacities with more than 30 years of experience.

Ms. Keri S. Putnam

Ms. Putnam, 57, has served as a director of the Company since January 2023. Ms. Putnam is a creative producer, strategic advisor, and senior media executive who has supported, developed and produced bold original content throughout her career. In 2022, Ms. Putnam founded Putnam Pictures to produce film and television content from creators with distinct and adventurous vision. Ms. Putnam served as CEO of the Sundance Institute from April 2010 until September 2021. Ms. Putnam’s previous experience includes serving as President of Production at Miramax Films, a division of the Walt Disney Company, and Executive Vice President at HBO, where she helped launch the Picturehouse theatrical label in partnership with Fine Line Features. Ms. Putnam serves as a non-voting independent director of the privately held independent production company PICTURESTART and German media company Leonine. She is also on the advisory board of Topic Media and Brooklyn College’s Feirstein School. Ms. Putnam co-founded and serves on the leadership council of ReFrame, a leading organization advocating for diversity in media. Ms. Putnam is a member of the Academy of Motion Pictures Arts and Sciences, an A.D. White Professor-at-Large at Cornell University, and a mentor at USC’s Stark Producing Program. Ms. Putnam holds a B.A. in Theatre History and Literature from Harvard College. Ms. Putnam brings extensive media company executive experience to the Board, with particular expertise in leadership, independent film production, and content creation.

3

Dr. Anthony J. Saich

Dr. Saich, 70, has served as a director of the Company since August 2012. Since July 2008, Dr. Saich has served as the Director of the Ash Center for Democratic Governance and Innovation and Daewoo Professor of International Affairs at Harvard University. In his capacity as Ash Center Director, Dr. Saich also serves as the director of the Rajawali Foundation Institute for Asia and the faculty chairperson of the China Public Policy Program, the Asia Energy Leaders Program and the Leadership Transformation in Indonesia Program. He oversees the School’s work in Vietnam as well as Myanmar, and the Ash Center’s programs on democratic governance and local government innovation. Dr. Saich also serves as a member of International Bridges to Justice and as the U.S. Secretary-General of the China United States Strategic Philanthropy Network. Dr. Saich sits on the executive committees of the John King Fairbank Center for Chinese Studies and the Asia Center, both at Harvard University, and serves as the Harvard representative of the Kennedy Memorial Trust. Dr. Saich holds a bachelor’s degree in politics and geography from the University of Newcastle, United Kingdom, a master’s degree in politics with special reference to China from the School of Oriental and African Studies, London University, and has a Ph.D. from the Faculty of Letters, University of Leiden, the Netherlands. Dr. Saich has over 40 years of experience in international affairs and will provide valuable international insights to the Company.

Mr. Adam J. Sussman

Mr. Sussman, 51, has served as a director of the Company since May 2019. Mr. Sussman has served as President of Epic Games, Inc. since January 2020. Prior to that, from 2017 until 2020, Mr. Sussman was appointed as Nike, Inc.’s first-ever Chief Digital Officer, was previously head of Nike’s Global Strategy and Corporate Development and served as the VP/GM Direct Digital and Geographies. He was responsible for building Nike’s portfolio of world-class digital consumer experiences and innovations and transforming retail for the world’s leading sports brand. He managed Nike’s digital teams globally and Nike’s direct-to-consumer GMs across the four key operating geographies of the company. Prior to Nike, Mr. Sussman was Senior Vice President of Global Publishing at Zynga responsible for marketing, sales, growth and digital products. He also served as Senior Vice President of Publishing at Disney, building the global team that managed gaming properties across all media platforms around the world. At Electronic Arts, he was Vice President of Worldwide Publishing, leading the team that established EA Mobile as the #1 publisher on the Apple App store. Mr. Sussman started his career as a creative executive at Hearst Entertainment, a division of the Hearst Corporation. Mr. Sussman holds a BA from Harvard College and an MBA from Harvard University Graduate School of Business Administration. Mr. Sussman brings valuable experience as president of large company and in marketing, information technology and digital platforms to the Board.

Board Committees

Our Board has established three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each of our standing committees operates under a charter, which is available on our website at www.amctheatres.com under “Investor Relations”—“Governance”—“Governance Documents”. The membership of and functions performed by each of the standing committees of the Board are briefly described below.

Audit Committee

Our Audit Committee consists of Ms. Clark, Mr. Lader, Ms. Pawlus, Ms. Putnam, and Dr. Saich. Ms. Pawlus serves as chairperson of the Audit Committee. The Board has determined that Ms. Pawlus qualifies as an Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K and that each member of our Audit Committee is financially literate as defined in the NYSE rules and is independent within the meaning of Rule 10A-3 of the Exchange Act and the NYSE rules. Mr. Lee Wittlinger served on the Audit Committee until his resignation from the Board in December 2022. Ms. Clark, Mr. Lader and Ms. Putnam were appointed to the Audit Committee in January 2023.

The principal duties and responsibilities of our Audit Committee are as follows:

| · | to oversee our financial reporting process and internal control system; |

| · | to appoint and replace our independent registered public accounting firm from time to time, determine their compensation and other terms of engagement, oversee their work and perform an annual evaluation; |

| · | to oversee the performance of our internal audit function; and |

| · | to oversee our compliance with legal, ethical and regulatory matters. |

4

Compensation Committee

Our Compensation Committee consists of Mr. Koch, Mr. Lader, Mr. Locke, Ms. Pawlus, Dr. Saich, and Mr. Sussman, all of whom are independent in accordance with the NSYE rules. Dr. Saich serves as chairperson of the Compensation Committee. Mr. Lee Wittlinger served as a member and the chairperson of the Compensation Committee until his resignation from the Board in December 2022. Mr. Koch, Mr. Locke, Ms. Pawlus, and Dr. Saich were appointed to the Compensation Committee in January 2023.

The principal duties and responsibilities of our Compensation Committee are as follows:

| · | to provide oversight on the development and implementation of the compensation policies, strategies, plans and programs for our key employees and non-employee directors and disclosure relating to these matters; |

| · | to review and approve the compensation of our CEO and our other executive officers; and |

| · | to provide oversight concerning the compensation of our CEO, succession planning, performance of our CEO and compensation related matters. |

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Ms. Clark, Mr. Koch, Mr. Locke, Ms. Putnam, and Mr. Sussman, all of whom are independent in accordance with the NSYE rules. Mr. Locke serves as chairperson of the Nominating and Corporate Governance Committee. Mr. Wittlinger served on the Nominating and Corporate Governance Committee until his resignation from the Board in December 2022. Mr. Lader and Dr. Saich (including as chairperson) also served on the Nominating and Corporate Governance Committee until January 2023. Ms. Clark, Mr. Koch, Mr. Locke, Ms. Putnam, and Mr. Sussman were appointed to the Audit Committee in January 2023.

The principal duties and responsibilities of the Nominating and Corporate Governance Committee are as follows:

| · | to establish criteria for board and committee membership and recommend to our Board proposed nominees for election to the Board and for membership on committees of the Board; and |

| · | to make recommendations to our Board regarding board governance matters and practices. |

Executive Officers of the Company

For information with respect to the executive officers of the Company, see “Information about our Executive Officers” included as a separate item at the end of Part I, Item 1 of the Original Report.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock and other equity securities. Officers, directors and holders of greater than 10% of our Common Stock are required by regulations of the SEC to furnish us with copies of all Section 16(a) reports they file.

To our knowledge, based solely upon a review of the copies of such reports filed electronically with the SEC and/or written representations that no other reports were required to be filed during 2022, all filing requirements under Section 16(a) applicable to our officers, directors and 10% stockholders were satisfied timely, except for one late Form 4 for Mr. Sean D. Goodman, Executive Vice President, Chief Financial Officer and Treasurer, with respect to one transaction due to an administrative error.

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to all of our associates, including our principal executive officer, principal financial officer and principal accounting officer, or persons performing similar functions. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. The Code of Business Conduct and Ethics, which addresses the subject areas covered by the SEC’s rules, may be obtained free of charge through our website: www.amctheatres.com under “Investor Relations”—“Governance”—“Governance Documents”. Any amendment to, or waiver from, any provision of the Code of Business Conduct and Ethics required to be disclosed with respect to any senior executive or financial officer shall be posted on this website.

5

Item 11. Executive Compensation.

Compensation Committee Interlocks and Insider Participation

During 2022, our Compensation Committee consisted of Mr. Lader, Mr. Sussman and Mr. Lee Wittlinger, who served on the Compensation Committee until his resignation from the Board in December 2022. During the period January 1, 2022, through December 31, 2022, no member of the Compensation Committee had a relationship required to be described under the SEC rules relating to disclosure of related person transactions and none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee of the Company.

Compensation Policies and Practices as They Relate to Risk Management

The Compensation Committee has reviewed and discussed the concept of risk as it relates to the Company’s compensation policies and it does not believe the Company’s compensation policies or practices create or encourage the taking of excessive risks that are reasonably likely to have a material adverse effect on the Company. Below are some of the highlights of the Company’s compensation programs that mitigate risks associated with compensation:

| · | Compensation is comprised of a combination of base salary, annual cash incentive, and long-term equity incentive awards; |

| · | While annual cash incentives are available for all full-time employees, only senior officers receive equity awards; |

| · | Equity compensation vesting is multi-year service based and performance based with overlapping performance periods; and |

| · | Maximum payout for cash and equity incentives is 200% of the value at target. |

The Compensation Committee has identified no material risks in the compensation programs for 2022.

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the disclosures contained in the following section entitled “Compensation Discussion and Analysis.” Based on this review and discussion, the Compensation Committee recommended to the Board that the section entitled “Compensation Discussion and Analysis” be included in this Report.

Compensation Committee of the Board of Directors:

Anthony J. Saich (Chairperson)

Howard W. “Hawk” Koch, Jr.

Philip Lader

Gary F. Locke

Kathleen M. Pawlus

Adam J. Sussman

6

Compensation Discussion and Analysis

The following Compensation Discussion & Analysis (“CD&A”) describes the philosophy, objectives and structure of our fiscal year 2022 executive compensation program. This CD&A is intended to be read in conjunction with the tables below, which provide further detail and historical compensation information for our NEOs as identified below.

| Name | Position | |

| Adam M. Aron | Chairman, Chief Executive Officer, President and Director | |

| Sean D. Goodman | Executive Vice President, Chief Financial Officer and Treasurer | |

| Daniel E. Ellis | Executive Vice President, Chief Operations and Development Officer | |

| Elizabeth F. Frank | Executive Vice President, Worldwide Programming and Chief Content Officer | |

| Kevin M. Connor | Senior Vice President, General Counsel and Secretary |

Consideration of Say-on-Pay Results

The Board and the Compensation Committee continually evaluate our compensation policies and practices. As part of that process, the Board and the Compensation Committee consider the results of our annual advisory vote on executive compensation, commonly known as the “say-on-pay” vote. At our 2022 Annual Meeting, we were disappointed that only approximately 36% of the votes were cast in support of the say-on-pay proposal. We were further frustrated that stockholders representing less than 30% of the eligible votes on the say-on-pay proposal participated in the vote, regardless of their support or opposition.

The Company continues to maintain that the compensation decisions on which the 2022 say-on-pay vote was based were necessary to retain our talented executive team and reward them for their outstanding efforts in ensuring the Company’s survival of the COVID-19 pandemic and its significant continuing impacts on our industry. However, we have also undertaken efforts to engage with stockholders to understand and address their concerns with our compensation programs. During the last year the Company, including participation by independent members of the Board, initiated stockholder outreach dialogue with our largest stockholders to solicit feedback on corporate governance and executive compensation. We would note that through these discussions, we learned that our largest institutional stockholder had voted in favor of our say-on-pay proposal in 2022. Further, we have continued to emphasize the AMC Investor Connect initiative focused on our large base of retail investors.

Our compensation policies and decisions continue to be focused on financial performance and aligning the interests of executives with the interests of stockholders. However, we have considered last year’s say-on-pay voting result and the feedback received through our stockholder engagement in compensation decisions, including:

| · | Freezing CEO base salary and bonus opportunity in 2022 and all components of CEO compensation in 2023; |

| · | Freezing the base salary and bonus opportunity of all NEOs in 2023; |

| · | Shifting the executive compensation pay mix back toward equity components to align with stockholders; |

| · | Returning to historical methodology for calculating equity grants; and |

| · | Adjusting compensation peer group for 2023 to include additional and peers utilized by proxy advisory firms. |

Executive Summary

2022 Business Review; Industry Headwinds

As 2022 began, the Company was optimistic about prospects for significant continuing industry recovery. However, that optimism waned as the year progressed and movie release schedules were delayed. Further, consumers were slow to return to our theatres without a full and compelling slate of movies to draw them. Ultimately, 2022 industry performance still remained at only about 65% of pre-pandemic levels. With depressed attendance, we continued to bear the weight of a high fixed cost structure, which was exacerbated by inflationary pressures on both labor and supply costs.

As an illustration of the ongoing impacts to our industry, the North American industry box office in 2022 was $7.45 billion compared to AMC internal projections of $9.0 billion at the beginning of the year and a 2019 pre-pandemic level of $11.4 billion.

Despite challenging industry and economic conditions, as has been the case since the onset of the COVID-19 pandemic, the Company remained vigilant, flexible, and focused on maximizing results. The extraordinary efforts and creativity of our management team has allowed AMC to weather the storm while some of our competitors were forced to permanently close or seek bankruptcy protection. While there is still much work to be done, industry trends were improving as 2022 ended with an attractive movie slate for 2023. Our initiatives to conserve resources, manage costs, and raise capital have preserved AMC’s ability to fully participate in the industry recovery.

7

Despite the formidable headwinds facing the Company in 2022, the management team secured some impressive accomplishments:

| · | Total revenues grew by approximately $1.4 billion to $3.9 billion and we returned to generating positive Adjusted EBITDA. |

| · | In the fourth quarter of 2022, revenue per patron reached $19.98, exceeding pre-pandemic levels, driven by strategic ticket pricing initiatives and strong food and beverage sales. |

| · | We raised nearly $229 million in gross proceeds through “at-the-market” offerings of our newly created APE securities to further bolster our balance sheet. |

| · | At December 31, 2022, we had available liquidity of $842.7 million, including $211.2 million of undrawn capacity under the Company’s revolving credit facility. |

| · | Our total aggregate principal amount of debt was reduced by approximately $220 million. |

| · | We began the upgrade of 3,500 auditoriums in the U.S. to laser projection technology in partnership with Cinionic. |

| · | In collaboration with Zoom Video Communications, Inc., we announced Zoom Rooms at AMC to enable dispersed groups to conduct cohesive virtual and in-person events and meeting experiences at our theatres. |

| · | We acquired 15 theatres with 157 screens and built and opened 7 new theatres with 51 screens. |

| · | We developed a line of pre-packaged and ready-to-pop microwaveable AMC Theatres Perfectly Popcorn products for sale at retail outlets outside of our theatres with a launch in Wal-Mart stores in early 2023. |

| · | As of December 31, 2022, we had approximately 28 million member households enrolled in our AMC Stubs loyalty program. |

| · | In partnership with Deserve, Inc., we announced the launch of an AMC co-branded credit card that will allow our loyal guests to earn AMC Stubs rewards on their everyday spending. |

Compensation Decisions

Our compensation program is grounded in a pay-for-performance philosophy and designed with equity as a significant component of compensation. Performance goals in both our short- and long-term incentive plans are set at challenging levels, with the ultimate goal that the achievement of operating, financial and other goals will drive long-term, sustainable stockholder value growth. In addition, a key goal of executive compensation is to attract, retain, motivate, and reward talented executives. However, the severe and continuing effects of the COVID-19 pandemic on our industry have dramatically impacted the Company’s financial performance and the price of the Company’s equity securities for reasons unrelated to the performance by our officers and employees in managing the Company’s business and preserving stockholder value during the pandemic. While our response to, and ongoing recovery from, the COVID-19 pandemic warranted uncommon actions with respect to compensation programs, our underlying philosophy has not been permanently altered or abandoned.

In the view of the Compensation Committee, management successfully undertook major initiatives to reduce and control costs, raise additional capital, restructure a substantial portion of the Company’s debt, renegotiate arrangements with studios and landlords, operate theatres safely, promote attendance, and lay the groundwork to seek opportunities to diversify the business. These initiatives were essential to preserving the Company’s business and stockholder value at a critical time for the Company. The unprecedented challenges facing our industry and the recognition that retention of the Company’s leadership was one of the most critical issues facing the Company required that the Compensation Committee remain flexible in its approach to executive compensation. Consequently, the Compensation Committee made a number of strategic decisions during 2022 that it believes were reasonable and necessary in light the circumstances. Further, the Compensation Committee believes that its actions will enable the Company to return to a normalized compensation structure and approach as the industry stabilizes. Each of the decisions outlined below is more fully described in the subsequent sections of this CD&A and the tables following.

8

2022 Key Compensation Determinations

| · | Generally, base salary increases were consistent with market conditions at approximately 3.5%. However, CEO and CFO base salaries (and by extension annual incentive plan bonuses) remained at the same level as in 2021 due to the significant increases granted in the prior year and in order to shift the pay mix for these officers toward equity incentives. A larger increase was also awarded to the Executive Vice President, Chief Operations and Development Officer in recognition of the expanded responsibilities for that position. |

| · | In continued recognition of the high level of uncertainty regarding the industry recovery and in order to maintain an incentive in the event of industry underperformance and to limit compensation expense exposure in the event of industry overperformance, 2022 performance goals for the annual incentive plan remained indexed to industry results. However, to more accurately reflect the diversity of the markets in which the Company operates, the North American box office factor was supplemented with an international market attendance factor for purposes of indexing targets to industry performance. |

| · | The incentive at target as a percentage of base salary for the NEOs under the annual incentive plan remained the same as prior years. |

| · | To improve transparency for stockholders, the Adjusted EBITDA definition used for compensation purposes was changed to align with the definition used in the Company’s public financial reporting. |

| · | For purposes of calculating 2022 equity grants, the Company returned to its historical practice of using the five-day average closing price of the Company’s Common Stock at the time of grant instead of the longer-term volume weighted average for a significantly longer period used in 2021 to smooth the impact of the COVID-19 pandemic. |

| · | Following termination in 2021, accounts in the Company’s non-qualified deferred compensation plan were liquidated and distributed to participants in May 2022. |

| · | To more closely align with the peer groups used by proxy advisory firms, Roku, Inc. and Formula One Group were added to the compensation peer group for 2023. |

| · | In conjunction with the special APE dividend to stockholders, an equitable adjustment of outstanding equity awards was approved and a reserve of APEs was established for future equity grants. |

| · | Despite significant industry underperformance compared to both pre-pandemic levels and forecasts for 2022, Company performance achieved levels permitting for annual incentive plan pay out at 200% of the industry-adjusted target, the maximum permitted under the compensation programs. |

| · | Due to industry underperformance and lack of an industry adjustment mechanism, equity grants based upon fiscal year 2022 Adjusted EBITDA and Free Cash Flow vested at only 0% and 79%, respectively. |

2023 Actions

| · | No compensation components were increased for the CEO. |

| · | For NEOs other than the CEO, base salaries and annual bonus opportunities also remain at 2022 levels, but modest increases to annual equity grants were made to shift pay mix toward equity-based components. |

| · | Performance goals for the annual incentive plan continue to be indexed to North American industry box office and international industry attendance results. |

| · | For 2023 annual equity grants, aggregate award values were allocated between the Company’s Common Stock and APEs based upon the relative market capitalization of each security in order to align management incentives with the interests of our overall equity ownership base. |

| · | As disclosed in Item 9B of the Original Report, the Compensation Committee determined that the failure to attain the 2022 performance goals applicable to equity grants was primarily due to changes in studio movie release schedules, which was outside the control of the Company and was not known at the time the performance targets were established. In recognition of the ongoing extraordinary efforts of the Company’s management team as the theatrical exhibition industry continues to lag its pre-pandemic performance, encourage continued engagement, and incentivize executives during continued difficult business conditions, the Compensation Committee, in consultation with the Company’s independent compensation consultant, approved one-time immediately vested awards of the Company’s Common Stock and APEs. The awards were calculated based upon the difference between the vesting level of the equity grants allocated to the 2022 tranche year and the maximum vesting level of such grants, which the Compensation Committee believed would have been achieved had the performance goals been set based upon the ultimate industry box office level. For accounting purposes, the special awards were treated as modifications of outstanding equity grants and the value will be reflected in the Company's 2023 compensation tables. |

9

How Our Compensation Program Works

The Compensation Committee regularly reviews best practices in executive compensation and uses the following guidelines to design our compensation programs during ordinary business cycles, with exceptions made only under extraordinary circumstances:

| What We Do |

ü Pay-for-performance philosophy and culture ü Strong emphasis on performance-based incentive awards ü Comprehensive clawback policy ü Responsible use of shares under our long-term incentive program ü Stock ownership requirements for all senior officers ü Engage an independent compensation consultant ü Perform an annual risk assessment of our compensation program ü “Double-trigger” change-in-control provisions |

| What We Don’t Do |

ü No hedging or pledging of Company stock ü No excise tax gross-ups ü No backdating or repricing of stock option awards ü No ongoing supplemental executive retirement plans ü No excessive perquisites |

Components of Our Pay

Our Compensation Committee oversees our executive compensation program, which includes three primary compensation elements: base salary, annual cash incentives, and long-term equity awards. The Compensation Committee has tailored our program to incentivize and reward specific aspects of Company performance that it believes are central to delivering long-term stockholder value.

| Base Salary | ||

| · Fixed pay, set with regard to responsibilities, market norms, and individual performance |

| Annual Cash Incentives | ||

| · Annual incentives intended to reward short-term performance | ||

| · For executives other than the CEO and CFO, based on: | ||

| · 80% corporate goals (Adjusted EBITDA) and 20% individual performance | ||

| · For the CEO and CFO, 100% based on corporate performance |

| Long-Term Equity Incentives | ||

| · Focused on incentivizing executives for long-term performance, as well as providing a retention vehicle for our top executive talent | ||

| · Annual equity grants are delivered as: | ||

| · 50% time-vesting RSUs, vesting ratably over 3-years | ||

| · 50% PSUs with vesting based on annual Adjusted EBITDA and free cash flow performance goals, vesting ratably over 3-years | ||

10

Pay Mix

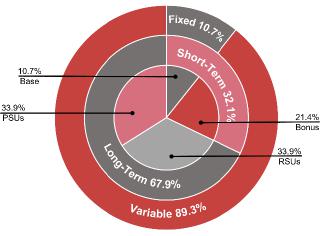

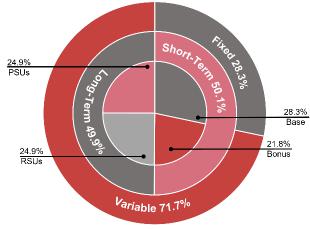

The Compensation Committee utilizes the above mentioned compensation elements to promote a performance-based culture that aligns the interests of management and stockholders. The Compensation Committee chooses an appropriate balance of fixed and variable pay as well as long-term versus short-term incentives and opportunities. In 2022, our target pay mix was as follows:

| CEO Target Pay Mix | Average Other NEO Target Pay Mix |

|

|

Executive Compensation Philosophy and Program Objectives

The goals of the Compensation Committee with respect to executive compensation are:

| · | to attract, retain, motivate and reward talented executives; |

| · | to tie annual compensation incentives to the achievement of specified performance objectives; and |

| · | to achieve long-term creation of value for our stockholders by aligning the interests of these executives with those of our stockholders. |

To achieve these goals, we endeavor to maintain compensation plans that tie a substantial portion of executives’ overall compensation to key strategic, operational and financial goals and other non-financial goals that the Compensation Committee deems important. The Compensation Committee evaluates our compensation programs to ensure they are supportive of these goals and our business strategy and align the interests of our executives with those of our stockholders.

Executive Compensation Program Elements

Our executive compensation program primarily consists of a combination of base salary, annual cash incentives, and long-term equity incentives. Our Compensation Committee believes that a combination of these elements offers the best approach to achieving our compensation goals, including attracting and retaining talented and capable executives and motivating our executives and other officers to expend maximum effort to improve the business results and earnings and create long-term, sustainable growth of stockholder value.

11

Base Salaries

Base salaries for our NEOs are reviewed from time to time by the Compensation Committee and may be increased pursuant to such review and in accordance with guidelines contained in the various employment agreements in order to realign salaries with market levels after taking into account individual responsibilities, performance and experience. Base salaries for our NEOs are established based on several considerations, including:

| · | the scope of their responsibilities |

| · | current competitive practices of peer group companies |

| · | individual performance and achievements |

| · | current compensation |

| · | recommendations from the CEO for executives (other than the CEO) |

The table below shows the annual base salaries for our NEOs for 2022, compared to 2021:

| Executive | 2022 Base Salary |

2021 Base Salary |

% Increase / (Decrease) |

|||||||||

| Adam M. Aron | $ | 1,500,000 | $ | 1,500,000 | 0 | % | ||||||

| Sean D. Goodman | 800,000 | 800,000 | 0 | % | ||||||||

| Daniel E. Ellis (1) | 595,000 | 545,000 | 9.2 | % | ||||||||

| Elizabeth F. Frank | 595,000 | 575,000 | 3.5 | % | ||||||||

| Kevin M. Connor (1) | 561,350 | 545,000 | 3.0 | % | ||||||||

| (1) | Mr. Ellis and Mr. Connor were not NEOs in 2021, but were officers of the Company so their 2021 salaries are provided for context. |

Mr. Aron’s and Mr. Goodman’s base salaries remained unchanged for 2022 in light of the significant salary increases provided in the prior year and to shift their pay mix toward equity-based compensation. Mr. Ellis’ salary increase reflects his additional responsibilities assigned upon the retirement of a former executive officer.

Annual Incentive Program

The Compensation Committee has the authority to award annual incentive bonuses to our NEOs pursuant to our annual incentive compensation program (“AIP”), which historically have been paid in cash and traditionally have been paid in a single installment in the first quarter of the subsequent year upon certification of performance by the Compensation Committee.

Under employment agreements with our NEOs, each NEO is eligible for an annual bonus, as it may be determined by the Compensation Committee from time to time. We believe that annual bonuses based on performance serve to align the interests of management and stockholders. Individual bonuses are performance-based and, as such, can be highly variable from year to year. The annual incentive bonus opportunities for our NEOs are determined by our Compensation Committee, taking into account the recommendation of our CEO (except with respect to his own bonus).

Payout Opportunities

Consistent with the prior year, the aggregate bonus for each NEO was set as a percentage of base salary ranging from 65% to 200% and, except for Mr. Aron and Mr. Goodman, was apportioned to a Company component (80%) and an individual component (20%). In the case of Mr. Aron and Mr. Goodman, their aggregate bonus is entirely based on Company performance with no individual component.

12

2022 Performance Goals

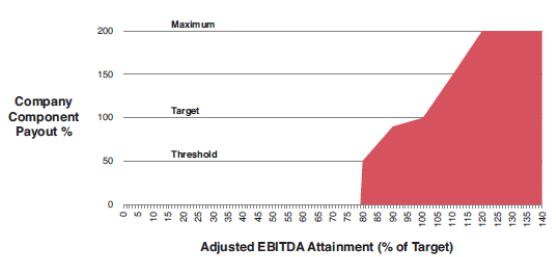

Company Performance: Consistent with past years, for 2022, the Company component was based on attainment of an Adjusted EBITDA goal. For purposes of the AIP, Adjusted EBITDA is determined in the same manner as described and defined in the Original Report (see Item 11 – Reconciliation of Adjusted EBITDA and Free Cash Flow for the calculation of Adjusted EBITDA). Payouts under the AIP can range from 0% to 200% of target depending upon actual performance measured against the Adjusted EBITDA goal. There is no payout for attainment below 80% of the goal, at the 80% threshold payout is 50% of target, at 100% attainment payout is 100% of target, and at the maximum attainment of 120% payout is 200% of target. The following chart represents the AIP payout scale for the Company component:

Company performance is highly dependent upon the timing and popularity of the films released by distributors in the markets in which we operate, leading to the potential for volatility and requiring a significant number of assumptions and projections involved in setting performance goals. Box office volatility and the difficulty of making assumptions continued to be amplified for 2022 because of the continuing uncertainty surrounding the recovery from the COVID-19 pandemic and shifting studio release schedules. Based on an estimated domestic industry box office of $9.0 billion and international market industry attendance of 438.8 million for 2022 at the beginning of the year, the projected Adjusted EBITDA performance levels narrowly ranged from a threshold of $150.6 million (50% payout) to a target of $188.2 million (100% payout) to a maximum of $225.8 million (200% payout). In recognition of the box office volatility, the narrow range of outcomes, and the high level of uncertainty around planning assumptions, the Compensation Committee determined that, in order to maintain an incentive for management in the event of industry underperformance and to limit compensation expense exposure in the event of industry overperformance, that the AIP performance goal should be indexed to domestic industry box office and international market industry attendance levels (due to lack of visibility into industry box office in certain international markets where we operate). Therefore, the Adjusted EBITDA goal was made adjustable dependent upon actual North American industry box office results and industry attendance in the international markets in which the Company operates using the following scale:

| 2022 AIP Industry Indexed Consolidated Adjusted EBITDA Target | |||

| Domestic Component | |||

| Industry Box Office* | $7.0 billion | $9.0 billion | $11.0 billion |

| Adj EBITDA Component | ($186.8 million) | $129.6 million | $419.6 million |

| International Component | |||

| Industry Attendance* | 341.3 million | 438.8 million | 536.3 million |

| Adj EBITDA Component | ($93.9 million) | $58.6 million | $211.0 million |

| Consolidated Adjusted EBITDA Target | ($280.8 million) | $188.2 million | $630.6 million |

* If actual industry domestic box office and/or international attendance performance falls between two stated levels, the target components shall be determined by linear interpolation

Individual Performance: The individual component of the bonus is based on overall individual performance and contribution to our strategic and financial goals. Our Compensation Committee and, except with respect to his own bonus, our CEO, retain certain discretion to decrease or increase individual component bonuses relative to the targets based on qualitative or other subjective factors deemed relevant by the Compensation Committee.

13

2022 Payouts

The following table summarizes the AIP bonus for our NEOs for 2022:

| Opportunity | Actual | |||||||||||||||||||||||||||||||

| 2022 Base |

Target (as % of |

Target | Allocation | Achievement | 2022 | |||||||||||||||||||||||||||

| Executive | Salary | base salary) | ($) | Company | Individual | Company | Individual | Earned AIP | ||||||||||||||||||||||||

| Adam M. Aron | $ | 1,500,000 | 200 | % | $ | 3,000,000 | 100 | % | — | % | 200 | % | — | % | $ | 6,000,000 | ||||||||||||||||

| Sean D. Goodman | 800,000 | 100 | % | 800,000 | 100 | % | — | % | 200 | % | — | % | 1,600,000 | |||||||||||||||||||

| Daniel E. Ellis | 595,000 | 65 | % | 386,750 | 80 | % | 20 | % | 200 | % | 100 | % | 696,150 | |||||||||||||||||||

| Elizabeth F. Frank | 595,000 | 65 | % | 386,750 | 80 | % | 20 | % | 200 | % | 100 | % | 696,150 | |||||||||||||||||||

| Kevin M. Connor | 561,350 | 65 | % | 364,900 | 80 | % | 20 | % | 200 | % | 100 | % | 656,800 | |||||||||||||||||||

Our Compensation Committee approved bonus amounts to be paid for the performance during 2022. The Company attained Adjusted EBITDA of $46.6 million (calculated as set forth in Item 11 – Reconciliation of Adjusted EBITDA and Free Cash Flow) for the year ended December 31, 2022. Actual North American industry box office was $7.45 billion for 2022 and industry attendance in the international markets in which the Company operates was 348.7 million in 2022, which resulted in an industry-adjusted Adjusted EBITDA goal of ($185.8 million). As a result, the Compensation Committee determined performance attainment to be 225% of target, equating to a 200% payout of the Company component, the maximum permitted under the AIP. Payouts would have been significantly higher without the caps established by the Compensation Committee.

For the NEOs other than the CEO and CFO, the individual component was approved at 100% of target by the Compensation Committee following a review of each such NEO’s individual performance.

Retention Bonus for Mr. Goodman

In order to secure retention of his services as the Company’s CFO and to preempt recruitment attempts, in March 2021, the Compensation Committee approved a special cash retention bonus for Mr. Goodman. The committee determined that it was essential to provide stability in the role of CFO during the Company’s recovery from the COVID-19 pandemic. The retention bonus is payable as set forth below, subject to Mr. Goodman’s continued employment as of each date. The right to receive the retention bonus payments will be forfeited if Mr. Goodman’s employment is terminated for any reason prior to an applicable payment date.

| Vesting Date | Retention Bonus Payable | |||

| March 17, 2022 | $ | 450,000 | ||

| March 17, 2023 | 450,000 | |||

| March 17, 2024 | 900,000 | |||

Equity-Based Incentive Compensation Program

Our Compensation Committee believes that the equity-based incentive compensation program furthers our goal to attract, retain and motivate talented executives by enabling such executives to participate in the Company’s long-term growth and financial success and aligns the interests of management and stockholders.

Our annual grants are equally split between:

| · | Time-vesting Restricted Stock Units (“RSUs”); and |

| · | Performance-vesting Performance Stock Units (“PSUs”). |

Each RSU and PSU represents the right to receive one share of Common Stock or one APE, as applicable, on a future settlement date. To determine the size of grants, our Compensation Committee considers prior executive performance, level of responsibility, the executive’s ability to influence the Company’s long-term growth and business performance, among other factors. The Compensation Committee does not apply a strict methodology to these factors, and does not benchmark executive pay to a particular reference point of the peer group. Company performance is highly dependent upon the timing and popularity of the films released by distributors in the markets in which we operate leading to the potential for volatility and requiring a significant number of assumptions and projections involved in setting performance goals.

14

In making grants of RSUs and PSUs, the Compensation Committee approves a target award value for each participant. That award value is then divided by a stock price measurement to determine the number of RSUs and PSUs granted. The default stock price measurement used in the calculation is the average closing price for the underlying security over the five days preceding the date of grant. Because the APEs had not yet been created at the time equity grants were made in 2022, only the price of our Common Stock was utilized to determine the number of RSUs and PSUs granted to each participant. Equity-based compensation components reflected in the executive compensation tables represent the aggregate grant date fair value of the award and are based upon the closing price for our Common Stock on the date of grant. Since the stock prices used to calculate the grants and determine the compensation value are different, in times of high volatility, the reflected compensation may ultimately be higher or lower than that targeted by the Compensation Committee. For the 2022 equity grants, this difference was significant given the $17.65 price used to calculate the grant amount and the $19.67 price used to calculate the compensation included in the tables.

2022 Annual Equity Grants

On February 16, 2022, the Compensation Committee approved grants of RSUs, and PSUs (the “2022 RSUs” and “2022 PSUs”), to certain of the Company’s employees under the EIP. Our NEOs received the following grants (in units):

| Executive | 2022 RSUs | 2022 PSUs | Total | |||||||||

| Adam M. Aron | 269,122 | 269,122 | 538,244 | |||||||||

| Sean D. Goodman | 56,658 | 56,658 | 113,316 | |||||||||

| Daniel E. Ellis | 25,496 | 25,496 | 50,992 | |||||||||

| Elizabeth F. Frank | 25,496 | 25,496 | 50,992 | |||||||||

| Kevin M. Connor | 19,831 | 19,831 | 39,662 | |||||||||

Restricted Stock Units: The 2022 RSUs vest ratably over a three-year period, with the first tranche vesting on the first business day of the fiscal year starting after the grant date. The executive must remain employed by the Company through the last day of the fiscal year immediately prior to the vesting date. A dividend equivalent equal to the amount paid, if any, in respect of one share of the securities underlying the RSUs begins accruing with respect to the RSUs on the date of grant. Such accrued dividend equivalents are paid to the holder upon vesting of the RSUs.

Performance Stock Units: The 2022 PSUs are subject to Adjusted EBITDA and free cash flow (“FCF”) performance goal conditions and service conditions over a three-year performance period. For purposes of the EIP, Adjusted EBITDA is determined in the same manner as described and defined in the Original Report. For purposes of the EIP, FCF is defined as cash flow from operations less gross capital expenditures and changes in construction payables. Of the 2022 PSUs, 60% were allocated to Adjusted EBITDA targets with the remaining 40% allocated to FCF targets. See Item 11 – Reconciliation of Adjusted EBITDA and Free Cash Flow for the calculation of these numbers. Adjusted EBITDA and FCF are Non-GAAP financial measures and should not be construed as an alternative to net earnings and cash flow from operations (each as determined in accordance with U.S. GAAP) as indicators of operating performance.

The 2022 PSUs are divided into three tranches, with each tranche allocated to a fiscal year within the three-year performance period covered by the grant (each a “Tranche Year”). Each tranche is subject to a separate performance goal applicable to its corresponding Tranche Year. At the time of grant, the Compensation Committee established the performance goals for the first Tranche Year covered by the 2022 PSUs. The subsequent tranches remain subject to substantive performance goals established and approved by the Compensation Committee in conjunction with the budgeting process for their applicable Tranche Year. Tranches are not valued and included in the compensation tables until the year in which the performance goals for their applicable Tranche Year are established. The PSUs will be forfeited upon termination of the holder’s employment for any reason prior to the end of the applicable Tranche Year. PSUs will vest based upon certification of performance for the applicable Tranche Year by the Compensation Committee. A dividend equivalent equal to the amount paid, if any, in respect of one share of the securities underlying the PSUs begins accruing with respect to the PSUs on the date of grant. Such accrued dividend equivalents are paid to the holder upon, and only to the extent of, vesting of the PSUs.

2022 Tranche Year Performance Goals

For purposes of reporting executive compensation and accounting for stock compensation expense, PSU tranches are not considered granted until such time as the performance goals are established. As a result, only the PSU tranches allocated to the 2022 Tranche Year are included in the summary compensation tables. Subsequent tranches will be included in the summary compensation tables for the years in which performance goals for such tranches are established. The 2022 Tranche Year was applicable to the following PSU awards: (i) tranche I of the 2022 PSUs, (ii) tranche II of the 2021 PSUs, and (iii) tranche III of the 2020 PSUs. The table below summarizes the number of PSUs at target allocated to the 2022 Tranche Year for each NEO:

| 2022 PSUs Tranche I | 2021 PSUs Tranche II | 2020 PSUs Tranche III | ||||||||||||||||||||||

| Adj EBITDA | FCF | Adj EBITDA | FCF | Adj EBITDA | FCF | |||||||||||||||||||

| Adam M. Aron | 53,824 | 35,882 | 189,873 | 126,582 | 88,802 | 59,202 | ||||||||||||||||||

| Sean D. Goodman | 11,331 | 7,554 | 40,506 | 27,003 | 18,140 | 12,094 | ||||||||||||||||||

| Daniel E. Ellis | 5,099 | 3,399 | 16,455 | 10,970 | 8,580 | 5,719 | ||||||||||||||||||

| Elizabeth F. Frank | 5,099 | 3,399 | 20,886 | 13,923 | 11,085 | 7,390 | ||||||||||||||||||

| Kevin M. Connor | 3,966 | 2,643 | 16,455 | 10,970 | 8,517 | 5,678 | ||||||||||||||||||

15

Company performance is highly dependent upon the timing and popularity of the films released by distributors in the markets in which we operate, leading to the potential for volatility and requiring a significant number of assumptions and projections involved in setting performance goals. Box office volatility and the difficulty of making assumptions were amplified for 2022 as a result of continuing uncertainty surrounding the recovery from the COVID-19 pandemic and shifting studio release schedules. Due to expectations that box office performance would continue to be depressed in 2021, the Company projected modestly positive Adjusted EBITDA and significantly negative FCF for 2022. On February 16, 2022, the Compensation Committee established the following performance goals for vesting of the PSU tranches allocated to the 2022 Tranche Year:

| 2022 Tranche Year Performance Goals | ||||||||||||

| Metric | Threshold | Target | Maximum | |||||||||

| Adjusted EBITDA(1) | $ | 150,560,000 | $ | 188,200,000 | $ | 225,840,000 | ||||||

| FCF(1) | (884,640,000 | ) | (737,200,000 | ) | (589,760,000 | ) | ||||||

| Potential Vesting Level | 50 | % | 100 | % | 200 | % | ||||||

| (1) | Adjusted EBITDA and FCF are non-GAAP financial measures and should not be construed as an alternative to net earnings and cash flow from operations (each as determined in accordance with U.S. GAAP) as indicators of operating performance. |

The Compensation Committee reviewed the Company’s financial results and certified achievement of $46.6 million Adjusted EBITDA and ($830.5 million) FCF (each calculated as set forth in Item 11 – Reconciliation of Adjusted EBITDA and Free Cash Flow) for the year ended December 31, 2022. As a result, all outstanding PSU tranches allocated to the 2022 Tranche Year with an Adjusted EBITDA target did not vest and those with an FCF target vested at the 79% level.

Award Modification for APE Dividend

On August 19, 2022, the Company paid a special dividend of one APE for each share of Common Stock outstanding as of August 15, 2022. In connection with the special dividend, the Compensation Committee approved an equitable adjustment of awards outstanding under the EIP. In accordance with the terms of the Plan and effective upon payment of the dividend, each RSU/PSU outstanding under the EIP was equitably adjusted to consist of an RSU/PSU convertible into one share of Common Stock and one APE upon vesting. All other terms and conditions of outstanding RSUs and PSUs (including vesting, forfeiture and acceleration provisions, and with respect to PSUs, performance goals) that were applicable to the awards prior to the equitable adjustment continued to apply. Because the special dividend was paid on all outstanding Common Stock with treatment similar to a stock split, the modification did not change the performance goals applicable to the outstanding awards, and due to the lack of impact on the probability of vesting, no additional stock-based compensation was recognized in accordance with ASC 718, Compensation—Stock Compensation.

16

COMPENSATION SETTING PROCESS

Independent Compensation Consultant

For compensation related decisions effective for 2022, the Compensation Committee retained the services of Aon as independent executive compensation consultant to advise the Compensation Committee on compensation matters related to the executive and director compensation programs. In 2022, Aon assisted the Compensation Committee with, among other things:

| ● | executive and director market pay analysis; |

| ● | reviewing and making changes to the compensation peer group; |

| ● | development of executive and director pay programs; |

| ● | CEO pay recommendations; |

| ● | decisions in response to the industry’s recovery from the COVID-19 pandemic; and |

| ● | Assisting with the Compensation, Discussion and Analysis disclosures. |

Aon reported to the Compensation Committee and had direct access to the chairperson and the other members of the Compensation Committee.

The Compensation Committee conducted a specific review of its relationship with Aon in 2022, and determined that Aon’s work for the Compensation Committee did not raise any conflicts of interest. Aon’s work has conformed to the independence factors and guidance provided by the Dodd-Frank Act, the SEC and the NYSE.

2022 Peer Group

The Company has adopted a peer group of companies as a reference group to provide a broad perspective on competitive pay levels and practices. Peer companies were selected based on industry classification, company size in terms of revenue and market capitalization, and similarity in business operations. The Compensation Committee periodically reviews and updates the peer group, as necessary, upon recommendation of its independent executive compensation consultant.

For 2022, the Company’s peer group consisted of the following 18 companies:

| AMC Networks, Inc. | Discovery, Inc. | Marriott International, Inc. |

| Bloomin’ Brands, Inc. | Hilton Worldwide Holdings, Inc. | Norwegian Cruise Line Holdings, Ltd. |

| Brinker International, Inc. | Hyatt Hotels Corporation | Royal Caribbean Cruises, Ltd. |

| Carnival Corporation | IMAX Corporation | Sinclair Broadcast Group, Inc. |

| Cinemark Holdings, Inc. | Lions Gate Entertainment Corp. | TEGNA, Inc. |

| Darden Restaurants, Inc. | Live Nation Entertainment, Inc. | Wyndham Hotels & Resorts, Inc. |

Based on the selection factors mentioned above, the Compensation Committee reviewed the 2021 peer group composition and made no changes for 2022.

17

OTHER Compensation PRACTICES

Compensation Clawback Policy

Pursuant to the terms of the EIP, for a period of one year following the date on which the value of an award under the EIP is realized, such value must be repaid in the event (i) the NEO is terminated for “Cause” (as defined in the NEO’s respective employment agreement), or (ii) after termination for any other reason it is determined that such NEO (a) engaged in an act during his or her employment that would have warranted termination for “Cause”, or (b) engaged in conduct that violated a continuing obligation to the Company. Mr. Aron’s, Mr. Goodman’s, Mr. Ellis’, and Ms. Frank’s employment agreements require repayment of any bonus compensation based on materially inaccurate financial statements or performance metrics.

The Company is monitoring the adoption of new listing standards by the New York Stock Exchange (“NYSE”) requiring the development and implementation of policies providing for the recovery of incentive compensation in the event of a required accounting restatement. When the listing standard becomes effective, the Company plans to adopt a policy compliant with such standard.

Executive Stock Ownership Guidelines

On November 2, 2021, the Compensation Committee adopted stock ownership guidelines for our executives, as follows:

| Position | Ownership Guideline | |

| CEO | 8x base salary | |

| CFO | 6x base salary | |

| Executive Vice Presidents | 4x base salary | |

| Senior Vice Presidents | 2x base salary | |

Each covered officer is required to achieve the applicable ownership guideline within five years after adoption of the guidelines, becoming a covered officer, or being promoted into a position with a higher ownership guideline. Outstanding Common Stock and APEs, unvested RSUs and unvested PSUs at target count for measurement of ownership using a 30-day volume weighted average price for the Company’s Common Stock and APEs. Covered officers who fall below their applicable ownership guideline have a five-year cure period, after which the Compensation Committee may require that compensation otherwise payable in cash be paid in Common Stock or APEs to achieve the applicable ownership guideline. As of December 31, 2022, all NEOs were still within the five-year grace period for initial compliance.

Anti-Hedging Policy

Under our Insider Trading Policy, directors and officers (Vice President and above) are prohibited from engaging in short sales or investing in other kinds of hedging transactions or financial instruments (including puts, calls, prepaid variable forward contracts, equity swaps, collars and exchange funds) that are designed to offset any decrease in the market value of the Company’s securities.

Anti-Pledging Policy

Under our Insider Trading Policy, directors and officers (Vice President and above) are prohibited from utilizing the Company’s securities in a margin account or pledging the Company’s securities as collateral for a loan or other obligation.

Retirement Benefits

We provide retirement benefits to the NEOs under both qualified and non-qualified defined benefit and defined contribution retirement plans. The Defined Benefit Retirement Income Plan for Certain Employees of American Multi-Cinema, Inc. (“AMC Defined Benefit Retirement Income Plan”) and the AMC 401(k) Savings Plan are both tax-qualified retirement plans in which the NEOs participate on substantially the same terms as our other participating employees. Due to limitations on benefits imposed by the Employee Retirement Income Security Act of 1974 (“ERISA”), we established a non-qualified supplemental defined benefit plan (the “AMC Supplemental Executive Retirement Plan”). On November 7, 2006, our Board approved a proposal to freeze the AMC Defined Benefit Retirement Income Plan and the AMC Supplemental Executive Retirement Plan, effective as of December 31, 2006. Benefits no longer accrue under the AMC Defined Benefit Retirement Income Plan or the AMC Supplemental Executive Retirement Plan for our NEOs or for other participants.

18

The “Pension Benefits” table and related narrative section “Pension and Other Retirement Plans” below describes our qualified and non-qualified defined benefit plans in which our NEOs participate.

Non-Qualified Deferred Compensation Program

The Company sponsored the AMC Non-Qualified Deferred Compensation Plan (the “NQDC Plan”), pursuant to which NEOs were permitted to elect to defer base salaries and their cash bonuses. Amounts deferred under the NQDC Plan were credited with an investment return determined as if the participant’s account was invested in one or more investment funds made available by the Company and selected by the participant. The Company could, but need not, credit the deferred compensation account of any participant with a discretionary or profit sharing credit as determined by the Company. On May 3, 2021, the Company terminated the NQDC Plan and account balances were distributed to participants in May 2022.

The “Non-Qualified Deferred Compensation” table and related narrative section below describe the NQDC Plan and the benefits thereunder.

Severance and Other Benefits Upon Termination of Employment

We believe that the occurrence, or potential occurrence, of a change of control transaction will create uncertainty regarding the continued employment of our executive officers. This uncertainty results from the fact that many change of control transactions result in significant organizational changes, particularly at the senior executive level. In order to encourage certain of our executive officers to remain employed with us during an important time when their prospects for continued employment following the transaction are often uncertain, we provide the executives with severance benefits if they terminate their employment within a certain number of days following specified changes in their compensation, responsibilities or benefits following a change of control. Accordingly, we provide such protections for each of the NEOs and for other of our senior officers in their respective employment agreements. The Compensation Committee evaluates the level of severance benefits provided to our executive officers on a case-by-case basis. We consider these severance protections are set at a conservative level when compared with competitive practices.

As described in more detail below under “Compensation Discussion and Analysis—Potential Payments Upon Termination or Change of Control,” pursuant to their employment agreements, each of the NEOs is entitled to severance benefits in the event of termination of employment without cause and certain NEOs are entitled to severance benefits upon death or disability. In the case of Mr. Aron, Mr. Goodman, Mr. Ellis, and Ms. Frank, resignation for good reason (as defined in their respective employment agreements) also entitles them to severance benefits.

Tax and Accounting