8-A12B: Form for the registration / listing of a class of securities on a national securities exchange pursuant to Section 12(b)

Published on August 4, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR (g) OF

THE SECURITIES EXCHANGE ACT OF 1934

AMC ENTERTAINMENT HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 26-0303916 | |

| (State of incorporation or organization) | (IRS Employer Identification No.) | |

|

One AMC Way 11500 Ash Street, Leawood, KS |

66211 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Securities to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class to be so Registered | Name

of Each Exchange on Which Each Class is to be Registered |

|

| AMC Preferred Equity Units, each constituting a depositary share representing a 1/100th interest in a share of Series A Convertible Participating Preferred Stock | New York Stock Exchange |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check the following box. x

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. ¨

Securities Act registration statement file number to which this form relates: None

Securities to be registered pursuant to Section 12(g) of the Act: None

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Description of Registrant’s Securities to be Registered.

On August 4, 2022, AMC Entertainment Holdings, Inc., (the “Company”) declared a special dividend of one depositary share (an “AMC Preferred Equity Unit”) for each share of Class A common stock, par value $0.01 per share (the “Common Stock”) of the Company outstanding at the close of business on August 15, 2022. Each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of the Company’s Series A Convertible Participating Preferred Stock (the “Preferred Stock”). Each share of Preferred Stock is initially convertible into one-hundred (100) shares of the Company’s Common Stock upon the terms described below.

Description of the AMC Preferred Equity Units

General

Each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of the Preferred Stock and will be evidenced by a depositary receipt. The Company will deposit the underlying shares of the Preferred Stock with the Depositary (as defined below) pursuant to a Deposit Agreement among the Company, Computershare Inc. and Computershare Inc.’s wholly-owned subsidiary Computershare Trust Company, N.A., collectively acting as depositary and conversion agent (together, the “Depositary”), dated August 4, 2022 (the “Deposit Agreement”). Subject to the terms of the Deposit Agreement, the depositary shares will be entitled to all the rights and preferences of the Preferred Stock, as applicable, in proportion to the fraction of a share of Preferred Stock those depositary shares represent.

Listing

The Company has applied to list the AMC Preferred Equity Units on the New York Stock Exchange (“NYSE”) under the symbol “APE”. Once the application is approved, trading of the AMC Preferred Equity Units on the NYSE is expected to begin on or around August 22, 2022. The underlying Preferred Stock will not be listed.

Automatic Conversion

To provide for the authorization of a sufficient number of authorized and unissued and unreserved shares of the Common Stock into which the Preferred Stock (and, by virtue of such conversion, AMC Preferred Equity Units) can convert in full, the Company may seek to obtain the requisite stockholder approval, at such time or times as the board of directors in its sole discretion shall determine, of an amendment to its Third Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of Common Stock to a number at least sufficient to permit the full conversion of the then-outstanding shares of Preferred Stock into Common Stock, or to such higher number of authorized shares of Common Stock (which may be issued for any purpose) as the Company’s board of directors may determine in its sole discretion (the “Common Stock Amendment”).

Under Delaware law, the affirmative vote of holders of at least a majority in voting power of the Company’s outstanding capital stock will be required for stockholder approval of the Common Stock Amendment. The holders of the AMC Preferred Equity Units will be entitled to vote on the Common Stock Amendment.

Upon the terms and in the manner described below under “Description of the Preferred Stock – Conversion Procedures,” at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment, all of the issued and outstanding shares of Preferred Stock will automatically convert in full with no action on the part of holders into Common Stock at the then-applicable conversion rate and the Preferred Stock will cease to exist.

Because each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of Preferred Stock, and upon conversion one (1) share of Preferred Stock is convertible into one-hundred (100) shares of Common Stock, each AMC Preferred Equity Unit would represent an interest in one (1) share of Common Stock upon conversion and such Common Stock will be deliverable upon conversion in respect of each AMC Preferred Equity Unit, in each case subject to adjustments as described herein. After delivery of Common Stock by the transfer agent to the Depositary following conversion of the Preferred Stock, the Depositary will transfer the proportional number of shares of Common Stock to the holders of AMC Preferred Equity Units by book-entry transfer through the Depository Trust Company (“DTC”) or, if such holders’ interests are in certificated depositary receipts or held through the book-entry settlement system of the Depositary, by delivery of common stock certificates or book-entry transfer through the Depositary, as applicable, for such number of shares of Common Stock. In the event that the holders of AMC Preferred Equity Units would be entitled to receive fractional shares of Common Stock, the Depositary will pay such holders cash in lieu of such fractional shares, as described under “Description of the Preferred Stock – Fractional Shares” below.

Dividends and Other Distributions

Holders of AMC Preferred Equity Units will receive dividends only to the extent such dividends are declared on the Preferred Stock. Each dividend on a AMC Preferred Equity Unit will be in an amount equal to the dividend on one share of Common Stock, or one one-hundredth (1/100th) of any dividend declared on the related share of the Preferred Stock, subject to adjustment.

The Depositary will distribute all cash dividends and other cash distributions received on the Preferred Stock to the holders of record of the depositary receipts in proportion, as nearly as practicable, to the number of AMC Preferred Equity Units held by each holder. In the event of a distribution other than in cash, rights, preferences or privileges upon the Preferred Stock, the Depositary will, at the direction of the Company, distribute such amounts of securities or property received by it to the holders of record of the depositary receipts in proportion to the number of AMC Preferred Equity Units held by each holder, unless the Depositary determines that this distribution is not feasible, in which case the Depositary may, with the Company’s approval, adopt a method of distribution that it deems practicable, including the sale of the property and distribution of the net proceeds of that sale to the holders of the depositary receipts.

Record dates for the payment of dividends and other matters relating to the AMC Preferred Equity Units will be the same as the corresponding record dates for the Preferred Stock.

The amount paid as dividends or otherwise distributable by the Depositary with respect to the AMC Preferred Equity Units or the underlying Preferred Stock will be reduced by any amounts required to be withheld by the Company or the Depositary on account of taxes or other governmental charges. The Depositary may refuse to make any payment or distribution, or any transfer, exchange, or withdrawal of any AMC Preferred Equity Units or the shares of the Preferred Stock until such taxes or other governmental charges are paid.

Voting Rights

Because each AMC Preferred Equity Unit represents an interest in one one-hundredth (1/100th) of a share of the Preferred Stock, and holders of the Preferred Stock will initially be entitled to one hundred (100) votes per share and will vote together with the holders of common stock on an as-converted basis, each AMC Preferred Equity Unit represents the equivalent of one vote under those circumstances in which holders of the Preferred Stock are entitled to a vote, as described under “Description of the Preferred Stock – Voting Rights” below.

When the Depositary receives notice of any meeting at which the holders of the Preferred Stock are entitled to vote, the Depositary will, if requested in writing, as soon as practicable thereafter, mail or transmit a notice prepared by the Company which will contain (i) the information contained in the notice to the record holders of the AMC Preferred Equity Units relating to the Preferred Stock, (ii) a statement that such holders may, subject to any applicable restrictions, instruct the Depositary as to the exercise of the voting rights pertaining to the shares of the Preferred Stock represented by their respective AMC Preferred Equity Units, and (iii) a brief statement as to the manner in which such instructions may be given. Each record holder of the AMC Preferred Equity Units on the record date, which will be the same date as the record date for the Preferred Stock, may instruct the Depositary to vote the amount of the Preferred Stock represented by the holder’s AMC Preferred Equity Units. Insofar as practicable, the Depositary will vote the amount of the Preferred Stock represented by AMC Preferred Equity Units in accordance with the instructions it receives. The Company will agree to take all reasonable actions that the Depositary determines are necessary to enable the Depositary to vote as instructed. In the absence of specific instructions from holders of AMC Preferred Equity Units, the Depositary will vote the Preferred Stock represented by the AMC Preferred Equity Units evidenced by the receipts of such holders proportionately with votes cast pursuant to instructions received from the other holders of AMC Preferred Equity Units.

Additional AMC Preferred Equity Units

The Company without the consent of holders of AMC Preferred Equity Units may issue from time to time additional AMC Preferred Equity Units that will form part of the same series of security.

Redemption

The AMC Preferred Equity Units will not be redeemable or subject to any sinking fund or similar provision.

Preemptive Rights

The AMC Preferred Equity Units will not have any preemptive rights.

Withdrawal

Any holder of an AMC Preferred Equity Unit may withdraw the number of whole shares of the Preferred Stock and all money and other property, if any, represented thereby by surrendering the receipts evidencing the AMC Preferred Equity Units at the Depositary’s principal office or at such other offices as the Depositary may designate. Only whole shares of Preferred Stock may be withdrawn. If the AMC Preferred Equity Units surrendered by the holder in connection with withdrawal exceed the number of AMC Preferred Equity Units that represent the number of whole shares of Preferred Stock to be withdrawn, the Depositary will deliver to that holder at the same time a new depositary receipt evidencing the excess number of AMC Preferred Equity Units.

Amendment and Termination of the Deposit Agreement

The Company may amend the form of depositary receipt evidencing the AMC Preferred Equity Units and any provision of the Deposit Agreement at any time and from time to time by agreement with the Depositary without the consent of the holders of depositary receipts. However, any amendment that will materially and adversely alter the rights of the holders of depositary receipts will not be effective unless the holders of at a majority of the affected AMC Preferred Equity Units then outstanding approve the amendment. Every holder of an outstanding depositary receipt at the time any such amendment becomes effective shall be deemed, by continuing to hold such depositary receipts, to consent and agree to such amendment and to be bound by the Deposit Agreement as amended thereby.

The Company will make no amendment that impairs the right of any holder of AMC Preferred Equity Units to receive shares of the Preferred Stock and any money or other property represented by those AMC Preferred Equity Units, except in order to comply with mandatory provisions of applicable law or the rules and regulations of any governmental body, agency, or commission, or applicable securities exchange.

The Deposit Agreement may be terminated:

| · | if all outstanding AMC Preferred Equity Units issued under the Deposit Agreement have been cancelled, upon conversion of the Preferred Stock or otherwise; |

| · | if there shall have been a final distribution made in respect of the Preferred Stock in connection with any liquidation, dissolution or winding up of the Company and such distribution shall have been distributed to the holders of depositary receipts representing AMC Preferred Equity Units pursuant to the terms of the Deposit Agreement; or |

| · | upon the consent of holders of depositary receipts representing in the aggregate not less than two-thirds of the AMC Preferred Equity Units outstanding. |

Resignation and Removal of Depositary

The Depositary may resign at any time by delivering to the Company written notice of its election to do so at least forty-five (45) days prior to such resignation. The Company also may, at any time, remove the Depositary by providing at least forty-five (45) days prior written notice. The Company will use its reasonable best efforts to appoint the successor depositary within forty-five (45) days after delivery of the notice of resignation or removal. The successor depositary must be a bank or trust company having its principal office in the United States and having a combined capital and surplus of at least $50 million.

Form and Notices

The Preferred Stock will be issued in registered form to the Depositary, and the AMC Preferred Equity Units will be issued in book-entry only form through DTC, as described under “Registration and Settlement – Book Entry System” below. The Depositary will forward to the holders of AMC Preferred Equity Units all reports, notices, and communications from the Company that are delivered to the Depositary and that the Company is required to furnish to the holders of the Preferred Stock.

Miscellaneous

The descriptions of the terms of the Deposit Agreement and the AMC Preferred Equity Units set forth herein are qualified in their entirety by reference to the full text of the Deposit Agreement, which is included as Exhibit 4.1 to this Registration Statement on Form 8-A and are incorporated by reference herein.

Description of the Preferred Stock

Effect of Stockholder Approval

If we obtain the requisite stockholder approval of the Common Stock Amendment, then upon the terms and in the manner described below under “– Conversion Procedures,” at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment, all of the issued and outstanding shares of Preferred Stock will automatically convert in full with no action on the part of holders into Common Stock at the then-applicable conversion rate and the Preferred Stock will cease to exist.

Automatic Conversion of Preferred Stock

Upon the terms and in the manner described below under “– Conversion Procedures,” each issued and outstanding share of Preferred Stock will automatically convert in full into shares of Common Stock at the conversion rate, with no action on the part of holders, at 9:30 a.m., New York City time, on the first business day following the effectiveness of the Common Stock Amendment (the “Conversion Date”). The initial conversion rate is one hundred (100) shares of Common Stock for each share of Preferred Stock (or one (1) share of Common Stock for each AMC Preferred Equity Unit). Such conversion rate is subject to adjustment as described below under “– Anti-Dilution Adjustments.” Cash will be paid in lieu of any fractional shares of Common Stock that would be issued on conversion as described below under “– Fractional Shares.”

General

The Preferred Stock will be a series (Series A) of the Company’s authorized preferred stock. The Depositary will be the sole holder of shares of the Preferred Stock. The holders of AMC Preferred Equity Units will be required to exercise their proportional rights in the Preferred Stock through the Depositary.

Conversion Procedures

As promptly as practicable after the Conversion Date, the Company shall provide written notice of the conversion to each holder of Preferred Stock stating the Conversion Date and the number of shares of Common Stock issued upon conversion of each share of Preferred Stock held of record by such holder and subject to conversion. Immediately upon conversion, the rights of the holder of Preferred Stock with respect to the shares of Preferred Stock so converted shall cease and the persons entitled to receive the shares of Common Stock upon the conversion of such shares of Preferred Stock shall be treated for all purposes as having become the record and beneficial owners of such shares of Common Stock. In the event that a holder of Preferred Stock shall not by written notice designate the name in which shares of Common Stock and/or cash, securities or other property (including payments of cash in lieu of fractional shares) to be issued or paid upon conversion of shares of Preferred Stock should be registered or paid or the manner in which such shares should be delivered, the Company shall be entitled to register and deliver such shares, and make such payment, in the name of such holder and in the manner shown on the records of the Company.

The Company shall not be required to reserve or keep available, out of its authorized but unissued shares of Common Stock, or to have sufficient authorized shares of Common Stock to cover, the number of shares of Common Stock that would be required to effect the conversion of all of the then-outstanding shares of Preferred Stock prior to the approval of the Common Stock Amendment.

All shares of Common Stock which may be issued upon conversion of the shares of Preferred Stock will, upon issuance by the Company, be validly issued, fully paid and non-assessable.

Effective immediately prior to the Conversion Date, dividends shall no longer be declared on the shares of Preferred Stock and such shares of Preferred Stock shall cease to be outstanding, in each case, subject to the rights of holders of Preferred Stock to receive any declared and unpaid dividends on such shares and any other payments to which they are otherwise entitled to as further described herein and in the Certificate of Designations.

Fractional Shares

No fractional shares of Common Stock shall be issued upon conversion of shares of Preferred Stock. If more than one share of Preferred Stock shall be surrendered for conversion at any one time by the same holder of Preferred Stock, the number of full shares of Common Stock issuable upon conversion thereof shall be computed on the basis of the aggregate number of shares of Preferred Stock so surrendered. Instead of any fractional shares of Common Stock which would otherwise be issuable upon conversion of any shares of Preferred Stock, the Company shall pay an amount in cash (rounded to the nearest cent) equal to the interest in the net proceeds from the sale in the open market by the applicable conversion agent of the aggregate fractional shares of Common Stock that otherwise would have been issuable upon conversion of the Preferred Stock.

Dividends

Dividends on the Preferred Stock will not be mandatory. Holders of the Preferred Stock will be entitled to receive, when, as, and if declared by the Company’s board of directors or any duly authorized committee of the Company’s board of directors, but only out of assets legally available therefor, all cash dividends or distributions (including, but not limited to, regular quarterly dividends) declared and paid or made in respect of the shares of Common Stock, at the same time and on the same terms as holders of Common Stock, in an amount per share of Preferred Stock equal to the product of (x) the then-applicable conversion rate then in effect and (y) any per share dividend or distribution, as applicable, declared and paid or made in respect of each share of Common Stock (the “Common Equivalent Dividend Amount”), and (ii) the Board or any duly authorized committee thereof may not declare and pay any such cash dividend or make any such cash distribution in respect of Common Stock unless the Board or any duly authorized committee of the Board declares and pays to the holders of Preferred Stock, at the same time and on the same terms as holders of Common Stock, the Common Equivalent Dividend Amount per share of Preferred Stock. Notwithstanding any provision to the contrary in the Certificate of Designations with respect to dividends, the holders of Preferred Stock shall not be entitled to receive any cash dividend or distribution made with respect to the Common Stock after the issuance of the Preferred Stock where the record date for determination of holders of Common Stock entitled to receive such dividend or distribution occurs prior to the issuance of the Preferred Stock.

Each dividend or distribution declared and paid as described hereunder will be payable to holders of record of Preferred Stock as they appear in the records of the Company at the close of business on the same day as the record date for the corresponding dividend or distribution to the holders of shares of Common Stock.

Except as set forth in the Certificate of Designations, the Company shall have no obligation to pay, and the holders of Preferred Stock shall have no right to receive, dividends at any time, including with respect to dividends with respect to Parity Securities (as defined herein) or any other class or series of authorized preferred stock of the Company. To the extent the Company declares dividends on the Preferred Stock and on any Parity Securities but does not make full payment of such declared dividends, the Company will allocate the dividend payments on a pro rata basis among the holders of the shares of Preferred Stock and the holders of any Parity Securities then outstanding. For purposes of calculating the allocation of partial dividend payments, the Company will allocate dividend payments on a pro rata basis among the holders of Preferred Stock and the holders of any Parity Securities so that the amount of dividends paid per share on the Preferred Stock and such Parity Securities shall in all cases bear to each other the same ratio that payable dividends per share on the shares of the Preferred Stock and such Parity Securities (but without, in the case of any noncumulative preferred stock, accumulation of dividends for prior dividend periods) bear to each other. The foregoing right shall not be cumulative and shall not in any way create any claim or right in favor of holders of Preferred Stock in the event that dividends have not been declared or paid in respect of any prior calendar quarter.

No interest or sum of money in lieu of interest will be payable in respect of any dividend payment or payments on Preferred Stock or on such Parity Securities that may be in arrears.

Holders of Preferred Stock shall not be entitled to any dividends, whether payable in cash, securities or other property, other than dividends (if any) declared and payable on Preferred Stock as specified hereunder.

Notwithstanding any provision in the Certificate of Designations to the contrary, holders of Preferred Stock shall not be entitled to receive any dividends for any calendar quarter in which the Conversion Date occurs, except to the extent that any such dividends have been declared by the Company’s board of directors or any duly authorized committee of the Company’s board of directors and the record date for such dividend occurs prior to the Conversion Date.

A holder of an AMC Preferred Equity Unit, which is a depositary share in the Preferred Stock, will not be entitled to receive dividends on the Preferred Stock declared by the Company’s board of directors unless such holder is a holder of record of the depositary share as of the close of business on the record date for such dividend.

Voting Rights

The holders of the Preferred Stock will vote together with the holders of the Common Stock (and any other securities that vote together or that may in the future vote together with the holders of the Common Stock) on all matters upon which the holders of Common Stock are entitled to vote, including the Common Stock Amendment, except for those matters which under the Certificate of Incorporation or Delaware law would require the vote of the Preferred Stock or the Common Stock voting as a separate voting group. Holders of the Preferred Stock will be entitled to one hundred (100) votes per share (or one (1) vote per AMC Preferred Equity Unit), or such other number of votes per share equal to the number of shares of Common Stock into which a share of Preferred Stock (and AMC Preferred Equity Units) would convert at the then-applicable conversion rate, subject to adjustments as described herein. The Preferred Stock will not otherwise have voting rights except as specifically required by Delaware law.

Holders of Preferred Stock shall not be entitled to vote together with the Common Stock with respect to any matter at a meeting of the stockholders of the Company, which under applicable law or the Certificate of Incorporation requires a separate class vote.

Ranking and Liquidation Rights

With respect to any dividends or distributions (including, but not limited to, regular quarterly dividends) declared by the Company’s board of directors, the Preferred Stock shall rank (i) senior to any class or series of capital stock of the Company hereafter created specifically ranking by its terms junior to any Preferred Stock (“Junior Securities”); (ii) on parity with the Common Stock and any class or series of capital stock of the Company created specifically ranking by its terms on parity with the Preferred Stock (“Parity Securities”); and (iii) junior to any class or series of capital stock of the Company hereafter created specifically ranking by its terms senior to any Preferred Stock (“Senior Securities”). With respect to distributions of assets upon liquidation, dissolution or winding up of the Company, whether voluntarily or involuntarily, except as set forth in (b) below, the Preferred Stock shall rank (i) senior to all of the Common Stock; (ii) senior to any class or series of Junior Securities; (iii) on parity with any class or series of Parity Securities; and (iv) junior to any class or series of Senior Securities.

Subject to any superior liquidation rights of the holders of any Senior Securities of the Company and the rights of the Company’s existing and future creditors, upon any voluntary or involuntary liquidation, dissolution or winding up of the Company, each holder of the Preferred Stock shall be entitled to be paid out of the assets of the Company legally available for distribution to stockholders, prior and in preference to any distribution of any of the assets or surplus funds of the Company to the holders of the Common Stock and Junior Securities and pari passu with any distribution to the holders of Parity Securities: (i) an amount equal to the sum of the Liquidation Preference for each share of Preferred Stock held by such holder and an amount equal to any dividends declared but unpaid thereon plus (ii) the amount the holders of Preferred Stock would have received if, immediately prior to such voluntary or involuntary liquidation, dissolution or winding up of the Company, the Preferred Stock had converted into Common Stock (based on the then-applicable conversion rate and without giving effect to any limitations on conversion set forth herein) and if such amount exceeds the amount set forth in (i) above, minus the amount set forth in (i) above, which shall be paid out pari passu with any distribution to holders of the Common Stock and Parity Securities. Holders shall not be entitled to any further payments in the event of any such voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company other than what is expressly provided for in the Certification of Designations and will have no right or claim to any of the Company’s remaining assets.

The sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) or all or substantially all of the property and assets of the Company shall not be deemed a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company, nor shall the merger, consolidation or any other business combination transaction of the Company into or with any other corporation or person or the merger, consolidation or any other business combination of any other corporation or person into or with the Company be deemed to be a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Company.

Anti-Dilution Adjustments

Initially, each share of Preferred Stock will convert into Common Stock at a rate of one hundred (100) shares of Common Stock for each share of Preferred Stock (or one (1) share of Common Stock for one (1) AMC Preferred Equity Unit), subject to adjustment as set forth herein.

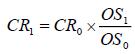

If the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split, stock combination or other similar recapitalization of the Common Stock (in each case excluding an issuance solely pursuant to a reorganization event), then the conversion rate will be adjusted based on the following formula:

where:

| CR0 | = | the conversion rate in effect immediately before the close of business on the record date or effective date, as applicable, for such dividend, distribution, stock split, stock combination or other similar recapitalization, as applicable; | |

| CR1 | = | the conversion rate in effect immediately after the close of business on such record date or effective date, as applicable; | |

| OS0 | = | the number of shares of Common Stock outstanding immediately before the close of business on such record date or effective date, as applicable, without giving effect to such dividend, distribution, stock split, stock combination or other similar recapitalization; and | |

| OS1 | = | the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split, stock combination or other similar recapitalization. |

If any distribution, dividend, stock split, stock combination or other similar recapitalization of the Common Stock is declared or announced, but not so paid or made, then the conversion rate will be readjusted, effective as of the date the Company’s board of directors, or any officer acting pursuant to authority conferred by the Company’s board of directors, determines not to pay such distribution or dividend or to effect such stock split, stock combination or other similar recapitalization, to the conversion rate that would then be in effect had such dividend, distribution, stock split, stock combination or similar recapitalization not been declared or announced.

Adjustments

In the event of:

| · | the consolidation, merger or conversion of the Company with or into another person in each case pursuant to which the Common Stock will be converted into cash, securities, or other property of the Company or another person; |

| · | any sale, transfer, lease, or conveyance to another person of all or substantially all of the consolidated assets of the Company and its subsidiaries, taken as a whole, in each case pursuant to which Common Stock will be converted into cash, securities, or other property; or |

| · | any reclassification of Common Stock into securities other than Common Stock, |

each of which is referred to as a “reorganization event,” each share of the Preferred Stock outstanding immediately prior to such reorganization event will, without the consent of the holders of the Preferred Stock, automatically convert into the kind of securities, cash, and other property receivable in such reorganization event by a holder of the shares of Common Stock into which such share of Preferred Stock was convertible immediately prior to such reorganization event in exchange for such shares of Common Stock. In the event that holders of the shares of Common Stock have the opportunity to elect the form of consideration to be received in such reorganization event, the consideration that the holders of the Preferred Stock are entitled to receive will be deemed to be the weighted average of the types and amounts of consideration actually received, per share of Common Stock, by the holders of the Company’s Common Stock, unless holders of Preferred Stock have the opportunity to elect the form of consideration to be received in such reorganization event.

The Company (or any successor) shall, within 20 days of the occurrence of any reorganization event, provide written notice to the holders of Preferred Stock of such occurrence of such event and of the type and amount of the cash, securities or other property that such holders are entitled to.

Other than with respect to an adjustment as described herein, if at any time prior to the Conversion Date, the Company issues to all holders of the Common Stock shares of securities or assets of the Company (other than shares of Common Stock or cash) as a dividend on the Common Stock, or the Company issues to all holders of the Common Stock certain rights or warrants entitling them for a period of 60 days or less to purchase shares of Common Stock at less than the current market value of the Common Stock at that time, or the Company purchases shares of Common Stock pursuant to a tender offer or exchange offer generally available to holders of Common Stock (subject to customary securities laws limitations) at above the current market value of the Common Stock at that time, and in each such case the record date with respect to such event (or the date such event is effective, as the case may be) occurs on or after the date of issuance of the Preferred Stock and prior to the Conversion Date (each, an “Adjustment Event”), then the Company will make such provision (i) to extend such tender offer or exchange offer on equivalent terms to holders of Preferred Stock or (ii) as is necessary so that the holder of Preferred Stock receives (upon cancellation of such shares of Preferred Stock in the event of a tender offer or exchange offer) the same dividend or other asset or property, if any, as it would have received in connection with such Adjustment Event if it had been the holder on the record date (or the date such event is effective, as the case may be) of the number of shares of Common Stock into which the shares of Preferred Stock held by such holder are then convertible, or, to the extent that it is not reasonably practicable for the Company to make such provision, the then-applicable conversion rate or other terms of the Preferred Stock shall be adjusted to provide such holder with an economic benefit comparable to that which it would have received had such provision been made. The foregoing shall not apply to the extent that any holder of Preferred Stock participates, or is permitted to participate, on a pro rata as-converted basis with the holders of Common Stock. Amounts resulting from any calculation as described under “– Anti-Dilution Adjustments” or this “– Conversion Procedures” will be rounded to the nearest 1/10,000th.

Redemption

The Preferred Stock will not be redeemable or subject to any sinking fund or similar provision.

Preemptive Rights

The Preferred Stock will not have any preemptive rights.

Anti-Takeover Effects of Certain Provisions of the Certificate of Incorporation, the Bylaws, and Delaware Law

Certain provisions of the Certificate of Incorporation and the Company’s Third Amended and Restated Bylaws (the “Bylaws”) may be considered to have an anti-takeover effect and may delay or prevent a tender offer or other corporate transaction that a stockholder might consider to be in its best interest, including those transactions that might result in payment of a premium over the market price for our shares. These provisions are designed to discourage certain types of transactions that may involve an actual or threatened change of control of the Company without prior approval of the Company’s board of directors. These provisions are meant to encourage persons interested in acquiring control of the Company to first consult with the Company’s board of directors to negotiate terms of a potential business combination or offer. For example, the Certificate of Incorporation and Bylaws:

| · | provide for a classified board of directors, pursuant to which the Company’s board of directors is divided into three classes whose members serve three-year staggered terms; |

| · | provide that the size of the Company’s board of directors will be set by members of the board of directors, and any vacancy on the board of directors, including a vacancy resulting from an enlargement of the board of directors, may be filled only by vote of a majority of the directors then in office; |

| · | do not permit stockholders to take action by written consent; |

| · | provide that, except as otherwise required by law, special meetings of stockholders can only be called by the Company’s board of directors; |

| · | establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders, including proposed nominations of candidates for election to the Company’s board of directors; |

| · | limit consideration by stockholders at annual meetings to only those proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the Company’s board of directors or by a stockholder of record on the record date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our secretary of the stockholder’s intention to bring such business before the meeting; |

| · | authorize the issuance of “blank check” preferred stock that could be issued by the Company’s board of directors to increase the number of outstanding shares or establish a stockholders rights plan making a takeover more difficult and expensive; and |

| · | do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates. |

The Certificate of Incorporation expressly states that the Company has elected not to be governed by Section 203 of the Delaware General Corporate Law, which prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the time the stockholder became an interested stockholder, subject to certain exceptions, including if, prior to such time, the board of such corporation approved the business combination or the transaction which resulted in the stockholder becoming an interested stockholder. “Business combinations” include mergers, asset sales and other transactions resulting in a financial benefit to the “interested stockholder.” Subject to various exceptions, an “interested stockholder” is a person who, together with his or her affiliates and associates, owns, or within three years did own, 15% or more of the corporation’s outstanding voting stock. These restrictions generally prohibit or delay the accomplishment of mergers or other takeover or change-in-control attempts that are not approved by a company’s board. Although the Company has elected to opt out of the statute’s provisions, the Company could elect to be subject to Section 203 in the future.

Common Stock Rights

For a description of the rights of holders of Common Stock to be delivered upon conversion of the Preferred Stock, see “Description of Capital Stock” included in the “Description of the registrant’s securities registered pursuant to Section 12 of the Securities Exchange Act of 1934” filed as Exhibit 4.5 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Miscellaneous

The Company shall not be required to reserve or keep available, out of the authorized but unissued Common Stock, or have sufficient authorized Common Stock to cover, the shares of Common Stock issuable upon the conversion of the Preferred Stock prior to the applicable conversion date. Any shares of the Preferred Stock converted into shares of Common Stock or otherwise reacquired by the Company shall resume the status of authorized and unissued preferred shares, undesignated as to series, and shall be available for subsequent issuance.

The descriptions of the terms of the Preferred Stock set forth herein are qualified in their entirety by reference to the full text of the Certificate of Designations, which is included as Exhibit 3.4 to this Registration Statement on Form 8-A and are incorporated by reference herein.

Additional Shares of Preferred Stock and Classes or Series of Stock

Notwithstanding anything to the contrary set forth in the Certificate of Incorporate or the Certificate of Designations, the Company’s board of directors or any authorized committee of the board of directors, without the vote of the holders of Preferred Stock (including the holders of the related AMC Preferred Equity Units), may increase or decrease the number of authorized shares of Preferred Stock or other stock ranking junior or senior to, or on parity with, the Preferred Stock as to dividends and the distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company.

Registration and Settlement

Book-Entry System

The Preferred Stock will be issued in book-entry only form to Computershare Trust Company, N.A., as depositary and sole holder of the Preferred Stock. Individual Preferred Stock certificates will not be issued to each holder of Preferred Stock.

Owners of beneficial interests in the AMC Preferred Equity Units will hold their AMC Preferred Equity Units through the book-entry settlement system of DTC, and if requested by the Company or DTC, such AMC Preferred Equity Units may be represented by a global depositary receipt, deposited with and held in the name of DTC, or its nominee. The AMC Preferred Equity Units of record holders will be deposited with and held in an account at Computershare Trust Company, N.A. In order to own a beneficial interest in the AMC Preferred Equity Units, a holder must be an organization that participates in DTC or have an account with an organization that so participates, including Euroclear Bank, SA/NV, as operator of the Euroclear System, and Clearstream Banking, société anonyme, Luxembourg.

Owners of beneficial interests in AMC Preferred Equity Units held through DTC, or its nominee, if applicable, will not be entitled to have AMC Preferred Equity Units registered in their names, nor will such owners receive or be entitled to receive physical delivery of the AMC Preferred Equity Units in definitive form, or be considered the owners or holders of AMC Preferred Equity Units under the Deposit Agreement including for purposes of receiving any reports or notices delivered by the Company unless DTC ceases to make its book-entry settlement system available as described below. Accordingly, each person owning a beneficial interest in such AMC Preferred Equity Units, must rely on the procedures of DTC and, if that person is not a participant, on the procedures of the participant through which that person owns its beneficial interest, in order to exercise or sell any rights of a holder of AMC Preferred Equity Units.

If DTC ceases to make its book-entry settlement system available, the Company will instruct the Depositary to make other arrangements for book-entry settlement. If the AMC Preferred Equity Units are not eligible for book-entry form, the Depositary shall provide AMC Preferred Equity Units in certificated form registered in the names of the beneficial owners. Once AMC Preferred Equity Units in certificated form are issued, the underlying Preferred Stock may be withdrawn from the depositary arrangement upon surrender of AMC Preferred Equity Units at the corporate trust office of the Depositary and upon payment of the taxes, charges, and fees provided for in the Deposit Agreement. Subject to the Deposit Agreement, the holders of such AMC Preferred Equity Units will receive the appropriate number of shares of Preferred Stock and any money or property represented by the AMC Preferred Equity Units.

Only whole shares of the Preferred Stock may be withdrawn. If a holder holds an amount other than a whole multiple of one-hundred (100) AMC Preferred Equity Units, the Depositary will deliver, along with the withdrawn shares of the Preferred Stock, a new depositary receipt evidencing the excess number of AMC Preferred Equity Units. Holders of withdrawn shares of the Preferred Stock will not be entitled to redeposit those shares or to receive a new depositary receipt evidencing AMC Preferred Equity Units therefor.

Same Day Settlement

As long as the AMC Preferred Equity Units are held through DTC, or its nominee, if applicable, the AMC Preferred Equity Units will trade in the DTC Same-Day Funds Settlement System. DTC requires secondary market trading activity in the AMC Preferred Equity Units to settle in immediately available funds. This requirement may affect trading activity in the AMC Preferred Equity Units.

Payment of Dividends

The Company will pay dividends, if any, on the Preferred Stock represented by AMC Preferred Equity Units in book-entry form to the Depositary. In turn, the Depositary will deliver the dividends to record holders, including DTC, or its nominee, in accordance with the arrangements then in place between the Depositary and DTC. Generally, DTC will be responsible for crediting the dividend payments it receives from the depositary to the accounts of DTC participants, and each participant will be responsible for disbursing the dividend payment for which it is credited to the holders that it represents. As long as the AMC Preferred Equity Units, are held through DTC, or its nominee, if applicable, the Company will make all dividend payments in immediately available funds. Computershare will pay record holders directly.

In the event the AMC Preferred Equity Units are issued in certificated form, dividends generally will be paid by check mailed to the holders on the applicable record date at the address appearing on the security register.

Notices

Any notices required to be delivered to a holder of AMC Preferred Equity Units will be delivered by the Company to the Depositary, and the Depositary will, upon the Company's written instruction, transmit such notice to record holders. Notices to holders of AMC Preferred Equity Units held through DTC, or its nominee, if applicable, will be given by the Depositary to DTC for communication to its participants.

If the Preferred Stock are issued as individual Preferred Stock certificates or the depositary receipts are issued in certificated form, notices to each holder will be given, as applicable, by mail to the addresses of the respective holders as they appear on the security register.

Item 2. Exhibits.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

| Date: August 4, 2022 | AMC Entertainment Holdings, Inc. | |

| By: | /s/ Sean D. Goodman | |

| Name: | Sean D. Goodman | |

| Title: | Executive Vice President and Chief Financial Officer | |