DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on June 24, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | ||

| Filed by a Party other than the Registrant ¨ | ||

| Check the appropriate box: | ||

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material under §240.14a-12 | |

| AMC ENTERTAINMENT HOLDINGS, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

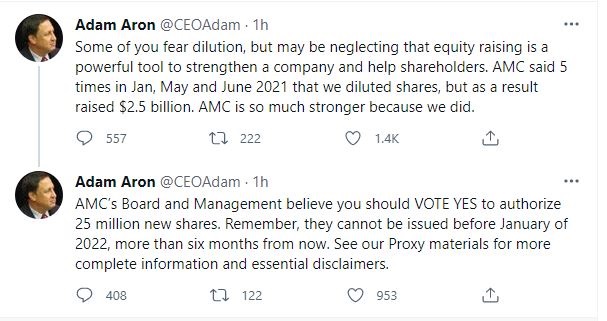

The following communication was made available by Adam Aron on his Twitter account @CEOAron, on June 23, 2021:

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the Annual Meeting of stockholders (the “Annual Meeting”) of AMC Entertainment Holdings, Inc. (“AMC” or the “Company”). This communication does not constitute a solicitation of any vote or approval. In connection with the Annual Meeting, the Company filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) on June 16, 2021 regarding the business to be conducted at the Annual Meeting. The Company may also file other documents with the SEC regarding the business to be conducted at the Annual Meeting. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS THERETO, IN THEIR ENTIRETY AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING.

Stockholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at www.investor.amctheatres.com copies of materials it files with, or furnishes to, the SEC.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the business to be conducted at the Annual Meeting. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 12, 2021 (the “2021 Form 10-K”). To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s 2021 Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Forward Looking Statements

This communication includes “forward-looking statements” within the meaning of the federal securities laws. In many cases, these forward-looking statements may be identified by the use of words such as “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “indicates,” “projects,” “goals,” “objectives,” “targets,” “predicts,” “plans,” “seeks,” and variations of these words and similar expressions. Examples of forward-looking statements include statements we make regarding the impact of COVID-19, future attendance levels and our liquidity. Any forward-looking statement speaks only as of the date on which it is made. These forward-looking statements may include, among other things, statements related to AMC’s current expectations regarding the performance of its business, financial results, liquidity and capital resources, and the impact to its business and financial condition of, and measures being taken in response to, the COVID-19 virus, and are based on information available at the time the statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks, trends, uncertainties and other facts that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks, trends, uncertainties and facts include, but are not limited to, risks related to: AMC’s ability to obtain additional liquidity, which if not realized or insufficient to generate the material amounts of additional liquidity that will be required unless it is able to achieve more normalized levels of operating revenues, likely would result in AMC seeking an in-court or out-of-court restructuring of its liabilities; the potential impact of AMC’s existing or potential lease defaults; the impact of the COVID-19 virus on AMC, the motion picture exhibition industry, and the economy in general, including AMC’s response to the COVID-19 virus related to suspension of operations at theatres, personnel reductions and other cost-cutting measures and measures to maintain necessary liquidity and increases in expenses relating to precautionary measures at AMC’s facilities to protect the health and well-being of AMC’s customers and employees; AMC’s significant indebtedness, including its borrowing capacity and its ability to meet its financial maintenance and other covenants; the manner, timing and amount of benefit AMC receives under the CARES Act or other applicable governmental benefits and support; the impact of impairment losses; motion picture production and performance; AMC’s lack of control over distributors of films; intense competition in the geographic areas in which AMC operates; increased use of alternative film delivery methods or other forms of entertainment; shrinking exclusive theatrical release window; AMC Stubs A-List not meeting anticipated revenue projections; general and international economic, political, regulatory and other risks; limitations on the availability of capital; AMC’s ability to refinance its indebtedness on favorable terms; availability of financing upon favorable terms or at all; risks relating to impairment losses, including with respect to goodwill and other intangibles, and theatre and other closure charges; and other factors discussed in the reports AMC has filed with the SEC. Should one or more of these risks, trends, uncertainties or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. For a detailed discussion of risks, trends and uncertainties facing AMC, see the section entitled “Risk Factors” in the Company’s 2021 Form 10-K filed with the SEC, and the risks, trends and uncertainties identified in its other public filings. AMC does not intend, and undertakes no duty, to update any information contained herein to reflect future events or circumstances, except as required by applicable law.