8-K: Current report filing

Published on June 30, 2020

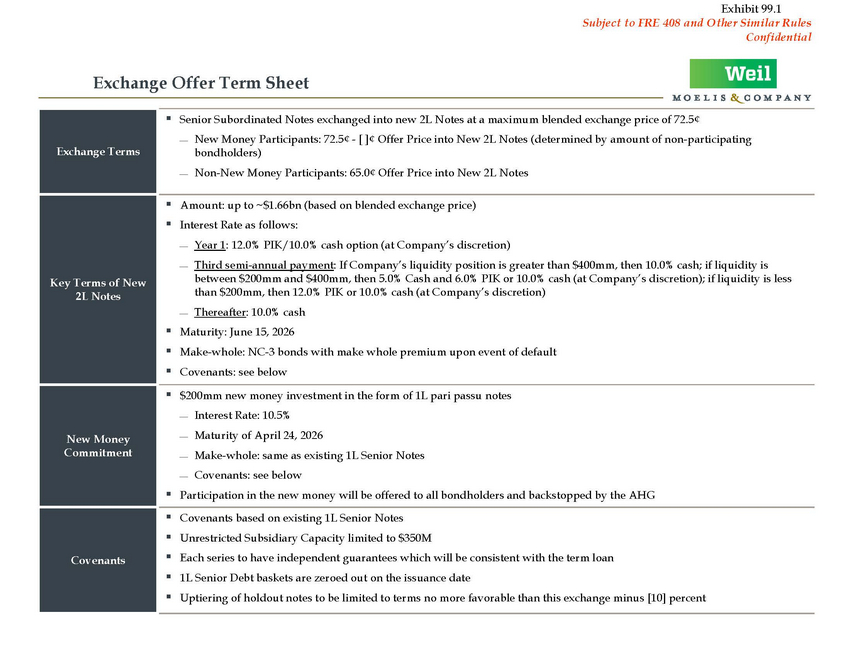

Exhibit 99.1 Subject to FRE 408 and Other Similar Rules ConfidentialExchange Offer Term SheetExchange Terms Senior Subordinated Notes exchanged into new 2L Notes at a maximum blended exchange price of 72.5¢ New Money Participants: 72.5¢ - [ ]¢ Offer Price into New 2L Notes (determined by amount of non-participating bondholders) Non-New Money Participants: 65.0¢ Offer Price into New 2L NotesKey Terms of New 2L NotesNew Money CommitmentCovenants Amount: up to ~$1.66bn (based on blended exchange price) Interest Rate as follows: Year 1: 12.0% PIK/10.0% cash option (at Company’s discretion) Third semi-annual payment: If Company’s liquidity position is greater than $400mm, then 10.0% cash; if liquidity is between $200mm and $400mm, then 5.0% Cash and 6.0% PIK or 10.0% cash (at Company’s discretion); if liquidity is less than $200mm, then 12.0% PIK or 10.0% cash (at Company’s discretion) Thereafter: 10.0% cash Maturity: June 15, 2026 Make-whole: NC-3 bonds with make whole premium upon event of default Covenants: see below $200mm new money investment in the form of 1L pari passu notes Interest Rate: 10.5% Maturity of April 24, 2026 Make-whole: same as existing 1L Senior Notes Covenants: see below Participation in the new money will be offered to all bondholders and backstopped by the AHG Covenants based on existing 1L Senior Notes Unrestricted Subsidiary Capacity limited to $350M Each series to have independent guarantees which will be consistent with the term loan 1L Senior Debt baskets are zeroed out on the issuance date Uptiering of holdout notes to be limited to terms no more favorable than this exchange minus [10] percent

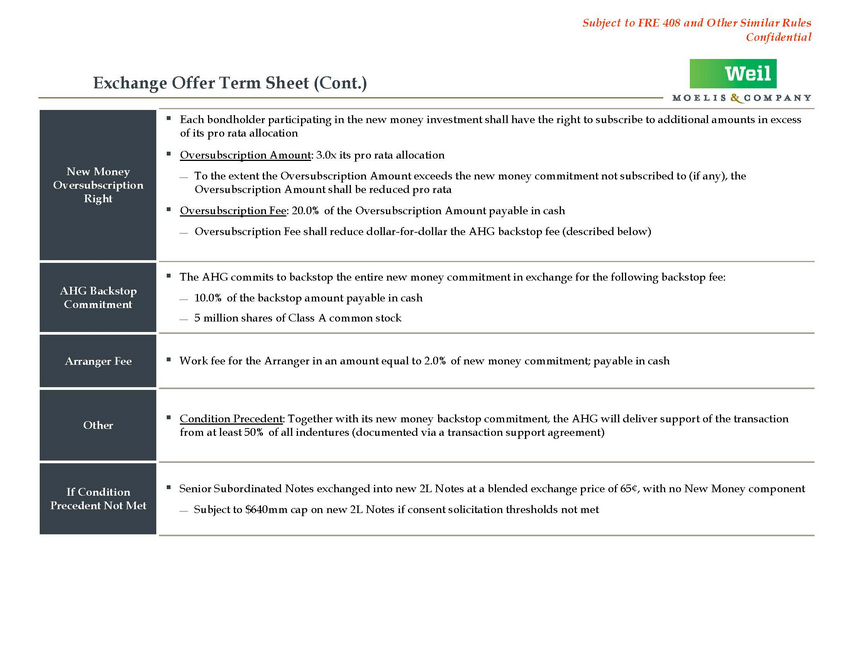

Subject to FRE 408 and Other Similar Rules ConfidentialExchange Offer Term Sheet (Cont.)New Money Oversubscription Right Each bondholder participating in the new money investment shall have the right to subscribe to additional amounts in excess of its pro rata allocation Oversubscription Amount: 3.0x its pro rata allocation To the extent the Oversubscription Amount exceeds the new money commitment not subscribed to (if any), the Oversubscription Amount shall be reduced pro rata Oversubscription Fee: 20.0% of the Oversubscription Amount payable in cash Oversubscription Fee shall reduce dollar-for-dollar the AHG backstop fee (described below)AHG Backstop Commitment The AHG commits to backstop the entire new money commitment in exchange for the following backstop fee: 10.0% of the backstop amount payable in cash 5 million shares of Class A common stockArranger Fee Work fee for the Arranger in an amount equal to 2.0% of new money commitment; payable in cashOther Condition Precedent: Together with its new money backstop commitment, the AHG will deliver support of the transaction from at least 50% of all indentures (documented via a transaction support agreement)If Condition Precedent Not Met Senior Subordinated Notes exchanged into new 2L Notes at a blended exchange price of 65¢, with no New Money component Subject to $640mm cap on new 2L Notes if consent solicitation thresholds not met