8-K: Current report filing

Published on June 22, 2020

Exhibit 99.1

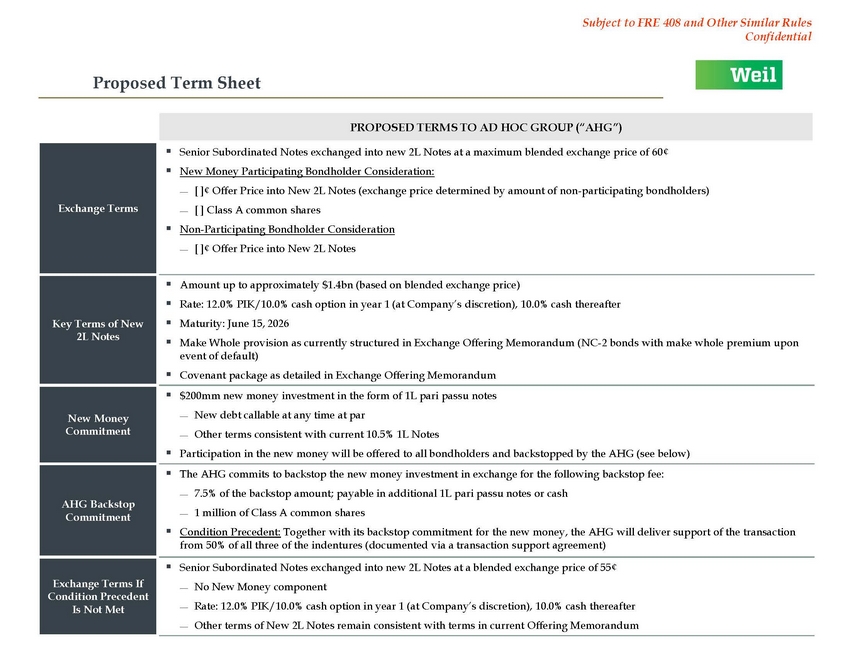

Subject to FRE 408 and Other Similar Rules Confidential Proposed Term Sheet PROPOSED TERMS TO AD HOC GROUP (“AHG”) Exchange Terms Senior Subordinated Notes exchanged into new 2L Notes at a maximum blended exchange price of 60¢ New Money Participating Bondholder Consideration: [ ]¢ Offer Price into New 2L Notes (exchange price determined by amount of non-participating bondholders) [ ] Class A common shares Non-Participating Bondholder Consideration [ ]¢ Offer Price into New 2L Notes Key Terms of New 2L Notes Amount up to approximately $1.4bn (based on blended exchange price) Rate: 12.0% PIK/10.0% cash option in year 1 (at Company’s discretion), 10.0% cash thereafter Maturity: June 15, 2026 Make Whole provision as currently structured in Exchange Offering Memorandum (NC-2 bonds with make whole premium upon event of default) Covenant package as detailed in Exchange Offering Memorandum New Money Commitment $200mm new money investment in the form of 1L pari passu notes New debt callable at any time at par Other terms consistent with current 10.5% 1L Notes Participation in the new money will be offered to all bondholders and backstopped by the AHG (see below) AHG Backstop Commitment The AHG commits to backstop the new money investment in exchange for the following backstop fee: 7.5% of the backstop amount; payable in additional 1L pari passu notes or cash 1 million of Class A common shares Condition Precedent: Together with its backstop commitment for the new money, the AHG will deliver support of the transaction from 50% of all three of the indentures (documented via a transaction support agreement) Exchange Terms If Condition Precedent Is Not Met Senior Subordinated Notes exchanged into new 2L Notes at a blended exchange price of 55¢ No New Money component Rate: 12.0% PIK/10.0% cash option in year 1 (at Company’s discretion), 10.0% cash thereafter Other terms of New 2L Notes remain consistent with terms in current Offering Memorandum