DEF 14A: Definitive proxy statements

Published on April 13, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

|

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

|

o |

Preliminary Proxy Statement |

|

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

ý |

Definitive Proxy Statement |

|

|

o |

Definitive Additional Materials |

|

|

o |

Soliciting Material under §240.14a-12 |

|

| AMC ENTERTAINMENT HOLDINGS, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

|

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

|

ý |

No fee required. |

|||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies: |

|||

| (2) |

Aggregate number of securities to which transaction applies: |

|||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) |

Proposed maximum aggregate value of transaction: |

|||

| (5) |

Total fee paid: |

|||

|

o |

Fee paid previously with preliminary materials. |

|||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

| (2) |

Form, Schedule or Registration Statement No.: |

|||

| (3) |

Filing Party: |

|||

| (4) |

Date Filed: |

|||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 10, 2018

DEAR STOCKHOLDERS:

We cordially invite you to attend the Annual Meeting of Stockholders of AMC Entertainment Holdings, Inc., which will be held on May 10, 2018 at 1:30 p.m. (Central Time) at AMC Town Center 20 Theatre, located at 11701 Nall Avenue, Leawood, Kansas 66211, for the following purposes:

- 1.

- To

elect to our Board of Directors the following three nominees for terms expiring at the 2021 Annual Meeting: Mr. Lloyd Hill, Mr. Maojun (John) Zeng,

and Mr. Howard W. "Hawk" Koch, Jr.

- 2.

- To

ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2018.

- 3.

- To conduct a non-binding advisory vote to approve the compensation of named executive officers.

These items of business are more fully described in the Proxy Statement accompanying this notice.

Our Board has fixed the close of business on March 12, 2018 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting of Stockholders or at any adjournment or postponement thereof. A list of these stockholders will be available at the time and place of the meeting and, during the ten days prior to the meeting, at the office of the Secretary of AMC Entertainment Holdings, Inc. at One AMC Way, 11500 Ash Street, Leawood, Kansas 66211.

Only stockholders and persons holding proxies from stockholders may attend the meeting. If your shares are registered in your name, you should bring your proxy card and a proper form of identification such as your driver's license to the meeting. If your shares are held in the name of a broker, trust, bank or other nominee, you will need to bring a proxy or letter from that broker, trust, bank or other nominee that confirms you are the beneficial owner of those shares.

In order that your shares may be represented at the meeting if you are not personally present, you are urged to vote your shares by telephone or Internet, or by completing, signing and dating the enclosed proxy card and returning it promptly in the accompanying postage prepaid (if mailed in the United States) return envelope.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION

TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS

| By Order of the Board of Directors, | ||

| One AMC Way | ||

| 11500 Ash Street, Leawood, KS 66211 |

|

|

| Senior Vice President, General Counsel and Secretary |

April 13, 2018

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on May 10, 2018:

The

Proxy Statement and 2017 Annual Report to Stockholders

are available at http://www.envisionreports.com/amc

AMC ENTERTAINMENT HOLDINGS, INC.

i

ii

PROXY STATEMENT

This summary highlights selected information and does not contain all of the information that you should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

2018 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | 1:30 p.m. (Central Time), Thursday, May 10, 2018 | |

|

Place: |

AMC Town Center 20 Theatre, located at 11701 Nall Avenue, Leawood, Kansas 66211 |

|

|

Record Date: |

March 12, 2018 |

|

|

Voting: |

As of the record date, holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to three votes per share. |

Agenda Item

|

Board Vote Recommendation |

|

|---|---|---|

Proposal No. 1: |

||

Election to our Board of Directors the following three nominees for terms expiring at the 2021 Annual Meeting: |

| |

Mr. Lloyd Hill, Mr. Maojun (John) Zeng, and |

FOR each Director | |

Mr. Howard W. "Hawk" Koch, Jr. |

Nominee | |

Proposal No. 2: |

||

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2018. |

FOR | |

Proposal No. 3: |

||

Non-binding advisory vote to approve the compensation of named executive officers (the "say-on-pay vote"). |

FOR |

1

This proxy statement is provided in connection with the solicitation of proxies by the Board of Directors (the "Board") of AMC Entertainment Holdings, Inc., a Delaware corporation ("we," "us," the "Company" or "AMC"), for use at the 2018 Annual Meeting of Stockholders of the Company, to be held on May 10, 2018 at 1:30 p.m. (Central Time), or any adjournment or postponement thereof, at AMC Town Center 20 Theatre located at 11701 Nall Avenue, Leawood, Kansas 66211 (the "Annual Meeting").

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting To Be Held on May 10, 2018:

Pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC"), we are providing access to our proxy materials, which include our notice of annual meeting, proxy statement and annual report to stockholders over the Internet at www.envisionreports.com/amc. These proxy materials are available without charge.

This proxy statement and the accompanying proxy are first being sent or given to stockholders beginning on or about April 13, 2018. The costs of this proxy solicitation will be borne by the Company, which maintains its principal executive offices at One AMC Way, 11500 Ash Street, Leawood, KS 66211.

2

The only voting securities of the Company are its shares of Class A and Class B common stock (collectively, the "Common Stock"). Only stockholders of record of our Common Stock at the close of business on March 12, 2018, the date selected as the record date by our Board, are entitled to vote at the Annual Meeting. On the record date, there were 52,244,412 shares of Class A common stock and 75,826,927 shares of Class B common stock outstanding. The holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to three votes per share, and such holders generally vote together as a single class on all matters. All of our Class B common stock is held by a subsidiary of the Dalian Wanda Group Co., Ltd (together with its affiliates, "Wanda"). Because of the three-to-one voting ratio between our Class B and Class A common stock, Wanda controls a majority of the combined voting power of our Common Stock at the record date and therefore will be able to control all matters submitted to our stockholders for approval at the Annual Meeting.

If your Common Stock is held through a broker, bank or other nominee (held in street name), you will receive instructions from such entity that you must follow in order to have your shares voted. If you want to vote in person, you must obtain a legal proxy from your broker, bank or other nominee and bring it to the meeting. If you hold your shares in your own name as a holder of record with our transfer agent, you may instruct the proxies how to vote following the instructions listed on the proxy card to vote over the Internet, or by signing, dating and mailing the proxy card. Of course, you can always come to the meeting and vote your shares in person.

Proxies provided by telephone or over the Internet or by mailed proxy card by stockholders of record, unless revoked, will be voted at the Annual Meeting as directed by you, or, in the absence of such direction, as the Board recommends for Proposals 1, 2 and 3 at the Annual Meeting. A stockholder submitting a proxy by telephone or over the Internet or by mailed proxy card may revoke such proxy at any time before it is used by giving written notice of revocation to the Secretary of the Company, by delivering to the Secretary of the Company a duly executed proxy bearing a later date or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, in and of itself, revoke a proxy. The Proxy Statement and 2017 Annual Report to Stockholders are available at http://www.envisionreports.com/amc or by calling 1-800-652-8683.

As of the printing of this proxy statement, we do not know of any other matter to be raised at the meeting. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxies will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned or postponed, the proxies can vote your shares at the adjournment or postponement as well.

Voting Requirement to Approve each of the Proposals

-

-

Proposal No. 1: Election of directors requires a plurality of the votes cast, which means that the three nominees for director receiving

the highest number of votes FOR election will be elected as directors. Our Board recommends a vote "for" the election of each nominee.

-

-

Proposal No. 2: Ratification of the appointment of KPMG LLP as our independent registered public accounting firm requires

approval by the holders of a majority of the shares (by voting power) present in person or represented by proxy and entitled to vote with respect to this matter. Our Board recommends a vote "for" this

proposal.

-

- Proposal No. 3: Non-binding advisory vote on compensation of named executive officers (the "say-on-pay vote") requires approval by the holders of a majority of the shares (by voting

3

power) present in person or represented by proxy and entitled to vote with respect to this matter. Our Board recommends a vote "for" this proposal. The vote on Proposal No. 3 is a non-binding advisory vote.

A quorum is required to transact business at our Annual Meeting. Stockholders of record holding shares of Common Stock constituting a majority of the shares issued and outstanding and entitled to vote at the Annual Meeting shall constitute a quorum. If you have returned valid proxy instructions or attend the meeting in person, your shares will be counted for the purpose of determining whether there is a quorum, even if you abstain from voting on some or all matters introduced at the meeting.

Abstentions will be treated as shares present and entitled to vote for purposes of any matter requiring the affirmative vote of a majority or other proportion of the shares present and entitled to vote. Accordingly, abstentions with respect to the ratification of the appointment of KPMG LLP as our independent registered public accounting firm and the say-on-pay vote will have the same effect as a vote against such proposals. Because a plurality of the votes cast is required to elect directors, abstentions and withheld votes will have no effect on the election of directors. Broker non-votes will be considered as represented for purposes of determining a quorum, but will not otherwise affect voting results.

Under rules of the New York Stock Exchange ("NYSE"), brokers may not vote on "non-routine" proposals unless they have received voting instructions from the beneficial owner, and to the extent that they have not received voting instructions, brokers report such number of shares as "non-votes." The proposals to elect directors and the say-on-pay vote are considered "non-routine," which means that brokerage firms may not vote in their discretion regarding these items on behalf of beneficial owners who have not furnished voting instructions. The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm, however, is considered a "routine" item, which means that brokerage firms may vote in their discretion on behalf of beneficial owners who have not furnished voting instructions. Although Proposal No. 3 is a non-binding advisory vote, our Board will review the results and will take them into account in making a determination concerning executive compensation.

Our business and affairs are managed by our Board, which currently consists of the following seven members: Adam M. Aron, Anthony J. Saich, Gary F. Locke, Kathleen M. Pawlus, Lloyd Hill, Maojun (John) Zeng, and Howard W. "Hawk" Koch, Jr. Mr. Lin (Lincoln) Zhang served as our non-executive Chairman until his resignation on March 12, 2018. Mr. Zeng was appointed as our non-executive Chairman effective March 14, 2018. Mr. Aron is our Chief Executive Officer ("CEO"). We currently have two vacancies on the Board. The Board intends to fill those vacancies as candidates are identified.

Pursuant to our amended and restated certificate of incorporation, our Board is divided into three classes. The members of each class serve for a staggered, three-year term. Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. The classes are composed as follows:

-

-

Dr. Saich, Mr. Locke, and Ms. Pawlus are Class I directors, whose terms will expire at the 2020 annual meeting of

stockholders;

-

-

Mr. Hill, Mr. Zeng, and Mr. Koch are Class II directors, whose terms will expire at the 2018 annual meeting of

stockholders; and

-

- Mr. Aron is a Class III director whose term will expire at the 2019 annual meeting of stockholders. Mr. Lincoln Zhang and Mr. Jack Gao (who resigned in October 2017) were previously Class III directors.

4

PROPOSAL 1:

ELECTION OF DIRECTORS

At the Annual Meeting, three individuals are to be elected as Class II directors to hold a three-year term of office from the date of their election until the Company's 2021 annual meeting and until their successors are duly elected and qualified. The three nominees for election as Class II directors are: Mr. Hill, Mr. Zeng, and Mr. Koch.

The Nominating and Corporate Governance Committee and the Board believe that the nominees have the requisite qualifications to oversee our business. Set forth below you will find certain information for each of the directors, including the nominees, which we believe evidences the directors' qualifications to serve on the Board.

The Board recommends a vote "FOR" each of the nominees.

Each of the biographies of the nominees for election as directors below contains information regarding the person's service as a director, business experience, director positions held currently or at any time during the past five years, and the experience, qualifications, attributes and skills that caused the Board to determine that the person should be nominated for election as a director at the Annual Meeting. The following information is as of February 15, 2018.

Nominees for Election as Class II Directors for a Term Ending 2021

Mr. Lloyd Hill, 74, has served as a director of the Company since December 2013. Prior to his retirement in 2006, Mr. Hill served as the Chief Executive Officer and Chairman of Applebee's International, Inc. Mr. Hill serves on the board of directors of E.E. Newcomer Enterprises, Inc. Mr. Hill also serves on the board of directors of Saint Luke's South Hospital, the audit committee for the Saint Luke's Health System and the development board for the University of Texas Medical Branch. Mr. Hill holds a master's degree in business administration from Rockhurst University in Kansas City, Missouri. Mr. Hill has extensive experience and knowledge of public company operations, as well as experience serving on the boards of other public companies.

Mr. Maojun (John) Zeng, 46, has served as a director of the Company since February 2016 and as Chairman since March 14, 2018. Mr. Zeng has been President of Wanda Film Holding Co., Ltd, a subsidiary of Wanda group, since March 27, 2014, and has served as a member of its Board of Directors since July 30, 2013. Mr. Zeng previously served as the Assistant to the President of Wanda Cultural Industries Group and Vice President of Wanda Cinema Line Corporation since February 28, 2012. Mr. Zeng holds an undergraduate degree and a master's degree in business administration from Renmin University of China. Mr. Zeng has experience serving in an executive leadership role at a major theatrical exhibition company in China and brings to the Board valuable theatrical exhibition knowledge.

Mr. Howard W. "Hawk" Koch, Jr., 72, has served as a director of the Company since October 2014. Mr. Koch is a veteran movie producer and principal at The Koch Company, the former president of the Academy of Motion Picture Arts and Sciences ("AMPAS"), and President Emeritus of the Producers Guild of America. Mr. Koch currently serves on the Board of Directors of the Motion Picture & Television Fund and the National Film Preservation Foundation. Mr. Koch previously served on the Board of Governors of AMPAS from 2004 to 2013 and the Board of Directors of the Producers Guild of America from 1999 to 2012. Mr. Koch has been intimately involved with the making of over 60 major motion pictures, among them such films as "Source Code", "Fracture", "Primal Fear", "Marathon Man," "Chinatown," "Wayne's World," "Peggy Sue Got Married," "The Idolmaker," "Heaven Can Wait," "The Way We Were" and "Rosemary's Baby." Mr. Koch continues to develop and produce movies. Mr. Koch has over 51 years of experience in the motion picture industry and provides our Board with a unique insight into the production of movies that are exhibited on our screens.

5

Directors Continuing in Office

Class I DirectorsTerm Expiring 2020

Dr. Anthony J. Saich, 64, has served as a director of the Company since August 2012. Since July 2008, Dr. Saich has served as the Director of the Ash Center for Democratic Governance and Innovation and Daewoo Professor of International Affairs at Harvard University. In his capacity as Ash Center Director, Dr. Saich also serves as the director of the Rajawali Foundation Institute for Asia and the faculty chair of the China Public Policy Program, the Asia Energy Leaders Program and the Leadership Transformation in Indonesia Program. Dr. Saich also serves as the Chair of the Board of Trustees of the China Medical Board and as a member of International Bridges to Justice and is the U.S. Secretary-General of the China United States Strategic Philanthropy Network. Dr. Saich sits on the executive committees of the John King Fairbank Center for Chinese Studies and the Asia Center, both at Harvard University, and serves as the Harvard representative of the Kennedy Memorial Trust. Dr. Saich holds a bachelor's degree in politics and geography from the University of Newcastle, United Kingdom, a master's degree in politics with special reference to China from the School of Oriental and African Studies, London University, and has a Ph.D. from the Faculty of Letters, University of Leiden, the Netherlands. Dr. Saich has over 40 years of experience in international affairs and will provide valuable international insights to the Company.

Mr. Gary F. Locke, 68, has served as a director of the Company since February 2016. Mr. Locke is currently a trade consultant and owner of Locke Global Strategies, LLC since 2014. Mr. Locke was the first Chinese American to be elected as a U.S. Governor when the voters of Washington elected him in 1996 and re-elected him in 2000. During his administration he strengthened economic ties between China and Washington State. Mr. Locke then served as U.S. Commerce Secretary from 2009-2011, where he led the effort to implement President Obama's National Export Initiative to double American exports in five years. He then became America's 10th Ambassador to China, serving from 2011-2014, and during his service he opened markets for made-in-USA goods and services and reduced wait times for visa interviews of Chinese applicants from 100 days to three days. Mr. Locke is a member of the board of directors of Fortinet, Inc. and nLight, Inc. He attended Yale University, graduating with a Bachelor degree in political science and received his law degree from Boston University. Mr. Locke brings to the Board a global and valuable business perspective due to his extensive role in politics and experience as an Ambassador to China.

Ms. Kathleen M. Pawlus, 57, has served as a director of the Company since December 2014. Ms. Pawlus, retired partner of Ernst and Young, LLP ("EY"), served as the Global Assurance Chief Financial Officer and Chief Operating Officer from 2012 to 2014. EY's Assurance practice is the largest of EY's four service lines and includes its Audit Practice, Fraud, Investigation and Dispute Services Practice, Climate Change and Sustainability Services Practice and its Financial Accounting Advisory Services Practice. Prior to this, from 2006 to 2012, Ms. Pawlus served as EY's Americas Chief Financial Officer, Global PBFA Function Leader and US Firm Chief Financial Officer responsible for finance, IT operations, treasury, purchasing and facilities. Ms. Pawlus served on EY's U.S. Executive Board from 2006 to 2012. Ms. Pawlus earned her bachelor of science degree from Indiana University and is a Certified Public Accountant. Ms. Pawlus brings to the Board extensive financial, accounting, operational and management experience in various capacities with more than 30 years of experience.

Class III DirectorTerm Expiring 2019

Mr. Adam Aron, 63, has served as Chief Executive Officer, President and a director of the Company since January 2016. From February 2015 to December 2015, Mr. Aron was appointed Chief Executive Officer of Starwood Hotels and Resorts Worldwide, Inc. Since 2006, Mr. Aron has served as Chairman and Chief Executive Officer of World Leisure Partners, Inc., a personal consultancy for matters related to travel and tourism, high-end real estate development, and professional sports, that he

6

founded. Mr. Aron served as Chief Executive Officer and Co-Owner of the Philadelphia 76ers from 2011 to 2013, and remains a co-owner. From 2006 to 2015, Mr. Aron served as Senior Operating Partner of Apollo Management L.P., compensation for which ran through March of 2017. Mr. Aron currently serves on the board of directors of Norwegian Cruise Line Holdings, Ltd. and the Philadelphia 76ers. Mr. Aron served on the board of directors of Prestige Cruise Holdings, Inc. from 2007 to 2014. Mr. Aron received a Master's of Business Administration degree with distinction from the Harvard Business School and a bachelor of arts degree cum laude from Harvard College. Mr. Aron brings to the Board significant business and executive leadership experience, including valuable insight into consumer services. He has more than 25 years of experience as a Chief Executive Officer, more than 25 years of experience as a corporate director, and more than 35 years of consumer-engagement experience.

Corporate Governance Guidelines

Our Corporate Governance Guidelines and Principles reflect the principles by which the Board operates and sets forth director qualification standards, responsibilities, compensation, evaluation, orientation and continuing education, board committee structure, chief executive officer performance review, management succession planning and other policies for the governance of the Company. A copy of the Corporate Governance Guidelines and Principles is available on our website at www.amctheatres.com under "Investor Relations""Governance""Governance Documents".

The Board executes its oversight responsibility for risk management directly and through its committees, as follows:

The Audit Committee has primary oversight responsibility with respect to financial and accounting risks. The Audit Committee discusses with management the Company's major financial risk exposures and the Company's risk assessment and risk management policies. Management provides to the Audit Committee periodic assessments of the Company's risk management processes and systems of internal control. The Chairman of the Audit Committee reports to the full Board regarding material risks as deemed appropriate.

The Board's other committees oversee risks associated with their respective areas of responsibility. For example, the Compensation Committee considers the risks associated with our compensation policies and practices, with respect to both executive compensation and compensation generally. The Board is kept abreast of its committees' risk oversight and other activities via reports of the committee chairmen to the full Board. These reports are presented at every regular Board meeting and include discussions of committee agenda topics, including matters involving risk oversight.

The Board considers specific risk topics, including risks associated with our annual operating plan, our capital structure, and cyber security. In addition, the Board receives reports from the members of our senior leadership team that include discussions of the risks and exposures involved in their respective areas of responsibility. Further, the Board is informed of developments that could affect our risk profile or other aspects of our business.

Compensation Policies and Practices as They Relate to Risk Management

The Compensation Committee has reviewed and discussed the concept of risk as it relates to the Company's compensation policies and it does not believe the Company's compensation policies or practices create or encourage the taking of excessive risks that are reasonably likely to have a material

7

adverse effect on the Company. Below are some of the highlights of the Company's compensation programs that mitigate risks associated with compensation:

-

-

Compensation is comprised of a combination of base salary, annual cash incentive, and long-term equity incentive awards;

-

-

Equity compensation vesting is multi-year service based and performance based with overlapping performance periods; and

-

- Maximum payout for cash and equity incentives is 200% of the value at target.

The Compensation Committee has identified no material risks in the compensation programs for 2017.

We have a Code of Business Conduct and Ethics that applies to all of our associates, including our principal executive officer, principal financial officer and principal accounting officer, or persons performing similar functions. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. The Code of Business Conduct and Ethics, which address the subject areas covered by the SEC's rules, may be obtained free of charge through our website: www.amctheatres.com under "Investor Relations""Governance""Governance Documents". Any amendment to, or waiver from, any provision of the Code of Business Conduct and Ethics required to be disclosed with respect to any senior executive or financial officer shall be posted on this website.

Board and Committee Information

The Board held five meetings during the year ended December 31, 2017. Each director attended at least 75% of the total combined meetings held by the Board plus the meetings held by the committees of the Board on which such director served, except for Mr. Zeng.

Our stockholders and other interested parties may communicate to our Board, its committees or our non-management directors as a group, by writing to the Secretary of AMC Entertainment Holdings, Inc. at One AMC Way, 11500 Ash Street, Leawood, KS 66211. Stockholders and other interested parties should indicate that their correspondence is intended to be communicated to the Board.

We avail ourselves of the "controlled company" exception under the rules of the NYSE, which permits a listed company of which more than 50% of the voting power for election of directors is held by an individual, a group or another company to not comply with certain of the NYSE's governance requirements. Because more than 50% of our voting power is held by Wanda, we are not required to have a majority of independent directors on our Board. We currently have three independent directors, Mr. Hill, Dr. Saich, and Ms. Pawlus. In addition, while we are not required to have a Compensation Committee or a Nominating and Corporate Governance Committee, we have established such committees, each of which is composed of three directors, one of whom from each committee is independent.

Our Board has determined that Mr. Hill, Dr. Saich, and Ms. Pawlus are independent in accordance with NYSE rules and within the meaning of the Securities Exchange Act of 1934 (the "Exchange Act") for purposes of serving on our Audit Committee. The remaining members of the Board, Mr. Locke, Mr. Zeng, Mr. Aron, and Mr. Koch, are not independent under the NYSE rules or within the meaning of the Exchange Act.

8

Under our current leadership structure, the roles of Chairman of the Board and Chief Executive Officer are held by different individuals. Mr. Zhang served as our non-executive Chairman of the Board, until his resignation on March 12, 2018. Mr. Zeng was appointed as our non-executive Chairman of the Board on March 14, 2018, and Mr. Aron serves as our Chief Executive Officer. At this time, our Board believes that this structure is best for the Company as it allows our Chairman to oversee board matters and assist the Chief Executive Officer with strategic initiatives, while enabling our Chief Executive Officer to develop and implement the strategic direction of the Company. Our Chairman is not considered independent under the NYSE rules.

Our non-management directors meet in an executive session, without members of management present, no less than once per year in accordance with the NYSE rules. Our Board Chairman or his designee presides over these executive sessions.

We encourage our directors to attend our Annual Meeting of Stockholders, absent unusual circumstances. Seven directors attended the 2017 Annual Meeting of Stockholders. Except for Mr. Zeng, all directors attended the 2017 Annual Meeting of Stockholders.

Our Board has established three standing committees. The standing committees consist of an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The standing committees are comprised of directors as provided in the table below:

Board Member

|

Audit(1) | Compensation | Nominating and Corporate Governance |

|||

|---|---|---|---|---|---|---|

Adam M. Aron |

||||||

Anthony J. Saich |

Member | | Chair | |||

Gary F. Locke |

Member | |||||

Kathleen M. Pawlus |

Chair | | | |||

Lloyd Hill |

Member | Chair | ||||

John Zeng |

| Member | | |||

Howard W. "Hawk" Koch, Jr. |

Member | Member | ||||

Meetings Held in 2017 |

4 | 4 | 4 |

- (1)

- Our Audit Committee is comprised of three independent members, all of whom are financially literate as defined in the NYSE rules.

Each of our standing committees, the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, operates under a charter, which is available on our website at www.amctheatres.com under "Investor Relations""Governance""Governance Documents". The functions performed by each of the standing committees of the Board are briefly described below.

Our Audit Committee consists of Mr. Hill, Dr. Saich and Ms. Pawlus. The Board has determined that Mr. Hill and Ms. Pawlus qualify as Audit Committee financial experts as defined in Item 407(d)(5) of Regulation S-K and that each member of our Audit Committee is financially literate as defined in

9

the NYSE rules and each member is independent within the meaning of Rule 10A-3 of the Exchange Act and the NYSE rules.

The principal duties and responsibilities of our Audit Committee are as follows:

-

-

to oversee our financial reporting process and internal control system;

-

-

to appoint and replace our independent registered public accounting firm from time to time, determine their compensation and other terms of

engagement, oversee their work and perform an annual evaluation;

-

-

to oversee the performance of our internal audit function; and

-

- to oversee our compliance with legal, ethical and regulatory matters.

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Our Compensation Committee consists of Mr. Hill, Mr. Koch, and Mr. Zeng. Mr. Jack Gao was a member until his resignation on October 27, 2017. Despite the exception as a "controlled company" under the NYSE rules, our Compensation Committee charter provides that one member of the Compensation Committee will be independent in accordance with NYSE rules, and Mr. Hill is that member. The principal duties and responsibilities of our Compensation Committee are as follows:

-

-

to provide oversight on the development and implementation of the compensation policies, strategies, plans and programs for our key employees

and non-employee directors and disclosure relating to these matters;

-

-

to review and approve the compensation of our CEO and our other executive officers; and

-

- to provide oversight concerning the compensation of our CEO, succession planning, performance of our CEO and compensation related matters.

The Committee may delegate to management administration of incentive compensation plans for non-executive officers. The Compensation Committee engaged and retained Aon Hewitt ("Aon"), as an independent executive compensation consultant, to provide advice on 2017 compensation matters. During 2017, Aon provided advice on executive and director compensation programs, executive and director market pay analysis, compensation peer group, CEO pay recommendations and drafting of the Compensation, Discussion and Analysis disclosures contained in the Company's Proxy Statement. The Compensation Committee reviewed the nature of its relationship with Aon and determined that there were no conflicts of interest with respect to Aon's independence.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Dr. Saich, Mr. Locke, and Mr. Koch. Despite the exception as a "controlled company" under the NYSE rules, our Nominating and Corporate Governance Committee charter provides that one member of the Nominating and Corporate Governance Committee will be independent in accordance with NYSE rules, and Dr. Saich is that member. The principal duties and responsibilities of the Nominating and Corporate Governance Committee are as follows:

-

-

to establish criteria for board and committee membership and recommend to our Board proposed nominees for election to the Board and for

membership on committees of the Board; and

-

- to make recommendations to our Board regarding board governance matters and practices.

10

The Nominating and Corporate Governance Committee is responsible for reviewing with the Board, on an annual basis, the appropriate criteria that directors are required to fulfill (including experience, qualifications, attributes, skills and other characteristics) in the context of the current make-up of the Board and the needs of the Board given the circumstances of the Company. In identifying and screening director candidates, the Nominating and Corporate Governance Committee considers whether the candidates fulfill the criteria for directors approved by the Board, including integrity, objectivity, independence, sound judgment, leadership, courage and diversity of experience (for example, in relation to finance and accounting, strategy, risk, technical expertise, policy-making, etc.).

The Board has not adopted a formal diversity policy but pursuant to the Company's Corporate Governance Guidelines, the Board broadly construes diversity to mean diverse background, education, skills, age, expertise with a proven record of accomplishment and the ability to work well with others. The Nominating and Corporate Governance Committee does not assign specific weight to any particular factor but in selecting members for open Board positions, the Board takes into account such factors as it deems appropriate, which may include the current composition of the Board, the range of talents, experiences and skills that would best complement those already represented on the Board and the need for financial or other specialized expertise. The Board seeks to achieve a mix of members whose experience and backgrounds are relevant to the Company's strategic priorities and the scope and complexity of the Company's business. Overall, each of our Board members is committed to the growth of the Company for the benefit of the stockholders, contributes new ideas in a productive and congenial manner and regularly attends board meetings.

The Nominating and Corporate Governance Committee considers recommendations for Board candidates submitted by stockholders using substantially the same criteria it applies to recommendations from the Nominating and Corporate Governance Committee, directors and members of management. Stockholders may submit recommendations by providing the person's name and appropriate background and biographical information in writing to the Nominating and Corporate Governance Committee at: Company Secretary, One AMC Way, 11500 Ash Street, Leawood, Kansas 66211 or by emailing: KConnor@amctheatres.com. Invitations to serve as a nominee are extended by the Board itself via the Chairman and the Chairman of the Nominating and Corporate Governance Committee.

Compensation Committee Interlocks and Insider Participation

Mr. Hill and Mr. Koch were members of the Compensation Committee for all actions taken during the year ended December 31, 2017. Mr. Jack Q. Gao was chairman of the Compensation Committee until his resignation on October 27, 2017. Mr. Zeng became a member of the Compensation Committee in February 2018. During the period January 1, 2017 through December 31, 2017, no member of the Compensation Committee had a relationship required to be described under the SEC rules relating to disclosure of related person transactions (other than as described below in "Related Person Transactions" with respect to agreements with Wanda) and none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee of the Company.

The following section presents information regarding the compensation paid during the year ended December 31, 2017 to members of our Board who were not employees of Wanda or the Company ("non-employee directors"). The other members of our Board do not receive any compensation from the Company. We reimburse all directors for any out-of-pocket expenses incurred by them in connection with their services provided in such capacity.

11

Non-Employee Director Compensation

In order to attract and retain qualified non-employee directors, the Company has adopted a Non-Employee Director Compensation Plan, amended effective January 1, 2017, pursuant to which non-employee directors are compensated for their service to the Company. Each non-employee director receives the following annual compensation for services as a Board member:

- a)

- an

annual cash retainer of $150,000;

- b)

- annual

stock award with a value of $65,000. Stock awards are made pursuant to the Company's 2013 Equity Incentive Plan, are fully vested at the date of grant, and are

issued on the same date annual grants are made to senior management. Directors may elect to receive all or a portion of their cash retainer in stock. Stock awards must be retained until the earlier to

occur of the third anniversary of the grant date or the director's departure from the Board. The number of shares awarded to each non-employee director is determined by dividing the value of the award

by the average closing price of the stock for the five trading days prior to the date of the stock award; and

- c)

- an annual cash retainer for non-employee directors who serve on a committee as follows:

Committee

|

Chairperson | Member | |||||

|---|---|---|---|---|---|---|---|

Audit |

$ | 20,000 | $ | 5,000 | |||

Compensation |

10,000 | 5,000 | |||||

Nominating and Corporate Governance |

| 10,000 | | 5,000 | |||

The following table presents information regarding the compensation of our non-employee directors during the year ended December 31, 2017.

Name

|

Fees Earned or Paid in Cash(1) |

Stock Awards(2) |

Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Anthony J. Saich |

$ | 165,000 | $ | 66,265 | $ | 231,265 | ||||

Lloyd Hill(3) |

150,000 | 76,455 | 226,455 | |||||||

Howard W. "Hawk" Koch, Jr. |

| 160,000 | | 66,265 | | 226,265 | ||||

Gary F. Locke(3) |

68,813 | 155,111 | 223,924 | |||||||

Kathleen M. Pawlus |

| 170,000 | | 66,265 | | 236,265 | ||||

- (1)

- Includes

the annual cash retainer for services as a board member, the annual cash retainer for services as a member of a committee, and the annual cash retainer for

services as a chairman of a committee.

- (2)

- Represents

the aggregate grant date fair values, as computed in accordance with Financial Accounting Standards Board's Accounting Standard Codification Topic 718,

CompensationStock Compensation, calculated based upon the closing price of the Company's Class A common stock on March 31, 2017 of $31.45 per share for Dr. Saich,

Mr. Hill, Mr. Koch, Mr. Locke and Ms. Pawlus.

- (3)

- Each of Mr. Hill and Mr. Locke elected to receive a portion of his annual cash retainer in the form of stock.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of our Class A and Class B common stock as of March 12, 2018, with respect to:

-

-

each person or group of affiliated persons known by us to own beneficially more than 5% of any class of the outstanding shares of

Class A and Class B common stock, together with their addresses;

-

-

each of our directors, director nominees and our Named Executive Officers; and

-

- all directors and executive officers as a group.

The address for each of our directors, director nominees and Named Executive Officers is c/o AMC Entertainment Holdings, Inc., One AMC Way, 11500 Ash Street, Leawood, Kansas 66211. Each person has sole voting and dispositive power over shares held by them, except as described below.

NAME

|

Class A Common Stock Number |

% | Class B Common Stock Number |

% | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5% Beneficial Owners: |

|||||||||||||

Wanda America Investment Holding Co. Ltd., a wholly-owned indirect subsidiary of Dalian Wanda Group Co., Ltd.(1) |

| | | | | 75,826,927 | | 100 | % | ||||

The Baupost Group, LLC(2) |

5,000,000 | 9.6 | % | | | ||||||||

Janus Henderson Group plc(3) |

| 4,507,676 | | 8.6 | % | | | | | ||||

The Vanguard Group Inc.(4) |

3,878,954 | 7.4 | % | | | ||||||||

BlackRock, Inc.(5) |

| 3,435,807 | | 6.6 | % | | | | | ||||

Mittleman Brothers, LLC(6) |

3,124,651 | 5.9 | % | ||||||||||

Directors, Director Nominees and Named Executive Officers: |

| | |||||||||||

Adam M. Aron |

| 183,809 | | * | | | | | |||||

Craig R. Ramsey |

108,529 | * | | | |||||||||

John D. McDonald |

| 74,461 | | * | | | | | |||||

Elizabeth Frank |

77,615 | * | | | |||||||||

Mark A. McDonald |

| 71,951 | | * | | | | | |||||

Anthony J. Saich |

10,330 | * | | | |||||||||

Lloyd Hill |

| 19,654 | | * | | | | | |||||

Gary F. Locke |

20,757 | * | | | |||||||||

John Zeng(7) |

| | | * | | | | | |||||

Howard W. "Hawk" Koch., Jr. |

13,192 | * | | | |||||||||

Kathleen M. Pawlus |

| 14,495 | | * | | | | | |||||

All directors and executive officers as a group (16 persons)(8) |

749,872 | 1.4 | % | | | ||||||||

- *

- Less

than 1%

- (1)

- Based

on a schedule 13G filed March 5, 2014 by Wanda America Investment Holding Co. Ltd. In such filing, Wanda America Investment

Holding Co. Ltd. lists its address as One AMC Way, 11500 Ash Street, Leawood, Kansas 66211. The rights of the holders of Class A common stock and Class B common

stock are identical, except with respect to voting and conversion applicable to the Class B common stock. Each share of Class A common stock is entitled to one vote. Each share of

Class B common stock is entitled to three votes and is convertible at any time into one share of Class A common stock.

- (2)

- Based on a Schedule 13G filed February 13, 2018 by The Baupost Group, LLC, Baupost Group GP LLC and Seth A. Klarman (collectively, "Baupost"). In such filing, Baupost lists its

13

address as 10 St. James Avenue, Suite 1700, Boston, MA 02116 and indicates shared voting and dispositive power over all shares.

- (3)

- Based

on a Schedule 13G filed February 13, 2018 by Janus Henderson Group plc ("Janus"). In such filing, Janus lists its address as 201

Bishopsgate EC 2M 3AE, United Kingdom and indicates sole voting and dispositive power over 4,077,277 shares.

- (4)

- Based

on a Schedule 13G/A #3 filed February 8, 2018 by The Vanguard Group Inc. In such filing, The Vanguard Group Inc. lists its address

as 100 Vanguard Blvd., Malvern, PA 19355. The Schedule 13G/A indicates sole voting power on 57,548 shares and sole dispositive power on 3,820,168 shares and shared voting power over 4,620

shares and shared and dispositive power over 58,786 shares.

- (5)

- Based

on a Schedule 13G/A #4 filed January 29, 2018 by BlackRock, Inc. In such filing, BlackRock, Inc. lists its address as 55 East

52nd Street, New York, NY 10055. The Schedule 13G/A indicates sole voting power on 3,327,296 shares and sole dispositive power on 3,435,807 shares and shared voting power

over 0 shares and shared and dispositive power over 0 shares.

- (6)

- Based

on Schedule 13G filed January 31, 2018 by Mittleman Brothers, LLC. In such filing, Mittleman Brothers, LLC lists its address as 105

Maxess Road, Suite 207, Melville, NY 11747. The Schedule 13G indicates sole voting power on 0 shares and sole dispositive power on 0 shares and shared voting power over 3,124,651 shares

and shared and dispositive power over 3,124,651 shares. Excludes 32,268 shares for which Mittleman Brothers disclaims beneficial ownership.

- (7)

- Does

not include shares of Class B common stock held by Wanda. Mr. Zeng is an employee of Dalian Wanda Group Co., Ltd., an affiliate of

Wanda American Investment Holding Co. Ltd. He does not have the power to dispose or vote any of our capital stock held by Wanda American Investment Holding Co. Ltd. Wanda

American Investment Holding Co. Ltd's ownership of our Class B common stock is set forth in the table.

- (8)

- Includes 155,079 shares of Class A common stock beneficially held by executive officers not named in the table.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock and other equity securities. Officers, directors and holders of greater than 10% of our Common Stock are required by regulations of the SEC to furnish us with copies of all Section 16(a) reports they file.

To our knowledge, based solely upon a review of the copies of such reports furnished to us and/or written representations that no other reports were required to be filed during 2017, all filing requirements under Section 16(a) applicable to our officers, directors and 10% stockholders were satisfied timely, except for one late Form 4 for Mr. Jack Gao, a former director, with respect to one transaction.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures with Respect to Related Transactions

The Board has adopted the AMC Entertainment Holdings, Inc. Policy on Transactions with Related Persons as our policy for the review, approval or ratification of any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is, or will be a participant, and one of the Company's executive officers, directors, director nominees, 5% stockholders (or the immediate family or household members

14

of any of the foregoing) or any firm, corporation or other entity in which any of the foregoing persons controls, is employed by, or has a material ownership interest (each, a "Related Person") has a direct or indirect material interest.

This policy is administered by the Audit Committee. As appropriate for the circumstances, the Audit Committee will review and consider relevant facts and circumstances in determining whether or not to approve or ratify such transaction. Our policy includes certain factors that the Audit Committee takes into consideration when determining whether to approve a related person transaction as follows:

-

-

the position within or relationship of the related person with the Company;

-

-

the materiality of the transaction to the related person and the Company, including the dollar value of the transaction, without regard to

profit or loss;

-

-

the business purpose for and reasonableness of the transaction (including the anticipated profit or loss from the transaction), taken in the

context of the alternatives available to the Company for attaining the purposes of the transaction;

-

-

whether the transaction is comparable to a transaction that could be available on an arms-length basis or is on terms that the Company offers

generally to persons who are not related persons;

-

-

whether the transaction is in the ordinary course of the Company's business and was proposed and considered in the ordinary course of business;

and

-

- the effect of the transaction on the Company's business and operations, including on the Company's internal control over financial reporting and system of disclosure controls and procedures, and any additional conditions or controls (including reporting and review requirements) that should be applied to such transaction.

Management Stockholders Agreement

On the closing of the merger with Wanda on August 30, 2012 ("Merger"), the Company and Wanda entered into a management stockholders agreement (the "Management Stockholders Agreement") with members of management, including certain of our Named Executive Officers. The Management Stockholders Agreement was amended in connection with our initial public offering (the "IPO"), and it continued in effect following the completion of the IPO, although the occurrence of the IPO caused certain provisions of the agreement to cease to be in effect.

Put Rights. Beginning on January 1, 2016 (or upon the termination of a management member's employment by the Company without cause, by the management member for good reason, or due to the management member's death or disability) the management members will have the right to require the Company to purchase shares of the Company acquired in connection with the Merger if and only if such shares are not fully and freely tradeable. The put right price is equal to the price per share paid by such management member with appropriate adjustments for any subsequent events such as dividends, splits, combinations and the like. Such put rights expire on January 1, 2019.

Piggyback Registration Rights. Subject to specified limitations, all management members have unlimited piggyback registration rights. The Company has agreed to pay all registration expenses relating to these registrations.

15

Registration Rights Agreements

Wanda

In connection with the IPO, we entered into a registration rights agreement with Wanda (the "Registration Rights Agreement"). Pursuant to the Registration Rights Agreement, the Company has agreed to use its best efforts to effect registered offerings upon request from Wanda and to grant incidental or "piggyback" registration rights with respect to any Class A common stock held by Wanda. The Class B common stock converts to Class A common stock in certain circumstances.

The obligation to effect any demand for registration by Wanda is subject to certain conditions, including limitations on the number of demand registrations and limitations on the minimum value of securities to be registered. In connection with any registration effected pursuant to the terms of the Registration Rights Agreement, we will be required to pay for all of the fees and expenses incurred in connection with such registration, including registration fees, filing fees and printing fees. However, the underwriting discounts and selling commissions payable in respect of registrable securities included in any registration are to be paid by Wanda. We have also agreed to indemnify the holders of registrable securities against all claims, losses, damages and liabilities with respect to each registration effected pursuant to the Registration Rights Agreement.

Tax Sharing Agreement

In connection with the IPO, we entered into a tax agreement with a U.S. subsidiary of Wanda. Pursuant to the tax agreement, for any period that we were members of any consolidated or other tax group of which the Wanda subsidiary was the common parent, we will pay the group's tax liabilities attributable to our activities up to the amount that would be payable by us if the Company was the common parent of the consolidated or other tax group and, in addition, we will have the right to control the filing of tax returns, audits and other tax matters of any such consolidated or other tax group.

Wanda Receivables

As of December 31, 2017, the Company recorded a receivable due from Wanda of $575,834 for reimbursement of general administrative and other expense incurred on behalf of Wanda.

16

PROPOSAL 2:

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected KPMG LLP ("KPMG") as the independent registered public accounting firm to perform the audit of our consolidated financial statements and our internal control over financial reporting for 2018. KPMG served as our independent registered public accounting firm for 2017. KPMG representatives are expected to attend the 2018 Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions. We are asking our stockholders to ratify the selection of KPMG as our independent registered public accounting firm for 2018. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time during the year if it determines that a change would be in the best interests of the Company and its stockholders.

The Audit Committee oversees the selection of a new lead audit engagement partner every five years. The Audit Committee requires key KPMG partners assigned to our audit to be rotated at least every five years. The Audit Committee and its chair oversee the selection process for each new lead engagement partner. Throughout this process, the Audit Committee and management provide input to KPMG about AMC priorities, discuss candidate qualifications and interview potential candidates put forth by the firm. To help ensure continuing auditor independence, the Audit Committee also periodically considers whether there should be a regular rotation of the independent auditor.

If the stockholders fail to ratify the selection of this firm, the Audit Committee may appoint another independent registered public accounting firm or may decide to maintain its appointment of KPMG.

The Board recommends a vote "FOR" ratification of the selection of KPMG as our independent registered public accounting firm for 2018.

17

Our Audit Committee reviews our financial reporting process on behalf of our Board. In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited financial statements contained in the 2017 Annual Report on Form 10-K with our management and our independent registered public accounting firm, KPMG. Our management is responsible for the financial statements and the reporting process, including the system of internal controls. KPMG is responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles and expressing an opinion on the effectiveness of the Company's internal control over financial reporting.

The Audit Committee has discussed with KPMG the matters requiring discussion by Statement on Auditing Standard No. 1301, Communication with Audit Committees (as amended), and all other matters required to be discussed with the auditors. In addition, the Audit Committee has received the written disclosures and the letter from KPMG required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor's communications with the Audit Committee concerning independence, and has discussed with the independent auditors their independence. The Audit Committee has concluded that the independent auditors currently meet applicable independence standards.

Based on the reviews and discussions to which we refer above, the Audit Committee recommended to our Board (and our Board has approved) that the audited financial statements be included in our 2017 Annual Report on Form 10-K, for filing with the SEC.

Audit Committee of the Board of Directors

Kathleen

M. Pawlus (Chairperson)

Lloyd Hill

Anthony J. Saich

18

PRINCIPAL ACCOUNTING FEES AND SERVICES

The following table shows the fees that the Company was billed for the audit and other services provided by KPMG for the years ended December 31, 2017 and December 31, 2016. The Audit Committee has considered whether the provision of such services is compatible with maintaining the independence of KPMG and determined they were compatible. The Audit Committee has the sole right to engage and terminate the Company's independent registered public accounting firm, to pre-approve their performance of audit services and permitted non-audit services, and to approve all audit and non-audit fees.

Type of Fee

|

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

|||||

|---|---|---|---|---|---|---|---|

Audit Fees(1) |

$ | 8,762,478 | $ | 3,452,222 | |||

Audit-Related Fees(2) |

886,754 | 998,902 | |||||

| | | | | | | | |

Tax Fees(3) |

| 488,855 | | 45,244 | |||

Total |

$ | 10,138,087 | $ | 4,496,368 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- (1)

- Audit

Fees include the audit of our annual financial statements and our internal control over financial reporting, review of financial statements included in our

Quarterly Reports on Form 10-Q and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements

for the years ended December 31, 2017 and December 31, 2016.

- (2)

- Audit-Related

Fees includes assurance and related services by KPMG that are reasonably related to the performance of the audit or review of our financial statements

and are not reported under "Audit Fees." The services for the fees disclosed under this category include other accounting related work and work related to acquisitions.

- (3)

- Tax Fees include professional services rendered by KPMG for U.S. and international tax return preparation and tax compliance.

Audit Committee Pre-Approval Policy

The Audit Committee has adopted policies and procedures for the pre-approval of audit services and permitted non-audit services to be performed by our independent registered public accounting firm in order to assure that the provision of such services does not impair the independent registered public accounting firm's independence. The policies provide general pre-approval for certain types of services, as well as approved costs for those services. The term of any general pre-approval is twelve months from the date of pre-approval unless the Audit Committee specifies otherwise. Any costs or services that are not given general pre-approval require specific pre-approval by the Audit Committee. The policy directs that, if management must make a judgment as to whether a proposed service is a pre-approved service, management should seek approval of the Audit Committee before such service is performed.

Requests to provide services that require specific approval by the Audit Committee must be submitted to the Audit Committee by both the independent auditor and management, and must include a joint statement as to whether, in their view, the request or application is consistent with the SEC's rules on auditor independence. Under the Audit Committee's pre-approval policy, the chairman of the Audit Committee has the authority to address any requests made for pre-approval of services between Audit Committee meetings, and the chairman must report any pre-approval decisions made between Audit Committee meetings to the Audit Committee at its next scheduled meeting. The policy prohibits the Audit Committee from delegating its responsibility to pre-approve any permitted services to management.

19

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee has reviewed and discussed with management the disclosures contained in the following section entitled "Compensation Discussion and Analysis." Based on this review and discussion, the Compensation Committee recommended to the Board that the section entitled "Compensation Discussion and Analysis" be included in this Proxy Statement for the 2018 Annual Meeting.

Members

of the Compensation Committee:

Lloyd Hill, Chairperson

Howard W. "Hawk" Koch, Jr.

John Zeng

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion & Analysis ("CD&A") describes the philosophy, objectives and structure of our fiscal year 2017 executive compensation program. This CD&A is intended to be read in conjunction with the tables beginning on page 31, which provide further historical compensation information for our named executive officers ("NEOs") as identified below.

Name

|

Position | |

|---|---|---|

| Adam M. Aron | Chief Executive Officer, President and Director | |

| Craig R. Ramsey | Executive Vice President and Chief Financial Officer | |

| John D. McDonald | Executive Vice President U.S. Operations | |

| Elizabeth Frank | Executive Vice President, Worldwide Programming and Chief Content Officer | |

| Mark A. McDonald | Executive Vice President, Global Development |

The Company successfully closed its acquisition of Nordic Cinema Group Holding AB ("NCG") on March 28, 2017, which further strengthens our global entertainment brand and follows on the heels of other successful acquisitions undertaken in recent years, including the Odeon and UCI Cinemas Holdings Limited acquisition on November 30, 2016 and Carmike Cinemas on December 21, 2016. While the past year was a challenging one for the industry as a whole, we believe we are well positioned with our expansive theater brand presence for future profitability and growth.

Despite the successful execution of our business strategy in fiscal year 2017, we were negatively impacted by various external factors, including a weak industry box office, negative public perceptions regarding the quality and content of films being produced, and the rise of in-home on-demand entertainment alternatives.

However, while the short-term performance of AMC and our industry as a whole may be disappointing, we remain very optimistic about our future, long-term prospects. We have sought to balance our capital allocation, with the aim of deleveraging over the next two years. We refocused our capital allocation toward the highest returns, importantly including high-return projects featuring the full renovation of key Odeon and former Carmike theatres, as well as buying back more than $47.5 million of AMC Class A common shares.

Our compensation program is grounded in a pay-for-performance philosophy. Performance goals in both our short- and long-term incentive plans are set at challenging levels, with the ultimate goal that the achievement of meaningful metrics will drive long-term, sustainable shareholder value growth. As

20

such, our failure to meet certain financial and stock performance metrics during 2017 is reflected in the pay outcomes for our executives and our Compensation Committee's decisions. For example:

-

-

Annual incentives paid out at only 41% of target, on average, for our NEOs, considerably below levels in prior years. This was primarily driven

by a corporate performance component, based on Adjusted EBITDA for AIP, which was only $729.1 million as compared to a target of approximately $875.2 million. (See Appendix A for

this calculation.) In determining Adjusted EBITDA for purposes of annual incentives, the Compensation Committee also excluded the results from NCG because no contribution from NCG was included in

setting the target for 2017.

-

-

As we have transitioned from our previous one-year to our new three-year performance periods for regular annual PSUs grants, we utilized

Performance Stock Unit Transition Awards ("PSUTs") to bridge the gap in pay opportunity for certain executives in 2016 and 2017. As was also the case with our 2016 PSUT grants, our 2017 PSUT grants

did not meet threshold performance (fiscal year 2017 net earnings), and as a result these awards were forfeited and executives received zero payout.

-

- The Compensation Committee decided to freeze base salaries without increase for our Named Executive Officers for 2018.

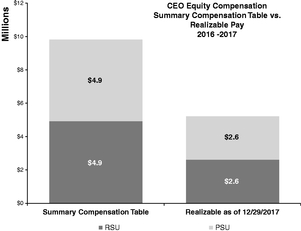

|

The realizable pay of our executives is much lower than the figures in the Summary Compensation Table. For example, our CEO's equity grants over the past two years had an aggregate value, as reported on the Summary Compensation Table, of approximately $9.8 million; due to the decline in share price over that time period, his realizable value of those grants is nearly half of this amount, approximately $5.2 million. This simple illustration shows how our CEO's pay is aligned with our stock price performance, and therefore aligned with the interests of stockholders. |

|

21

How Our Compensation Program Works

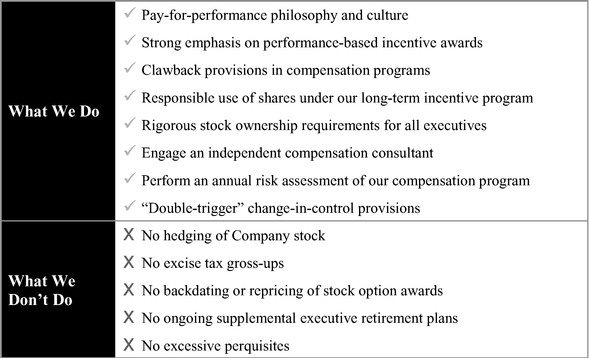

The Compensation Committee regularly reviews best practices in executive compensation and uses the following guidelines to design our compensation programs:

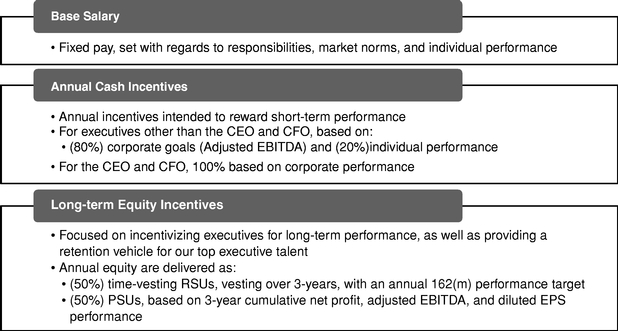

Our Compensation Committee oversees our executive compensation program, which includes three primary compensation elements: base salary, annual cash incentives, and long-term equity awards. The Compensation Committee has tailored our program to incentivize and reward specific aspects of Company performance that it believes are central to delivering long-term stockholder value.

22

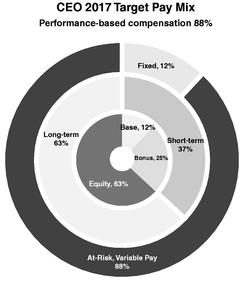

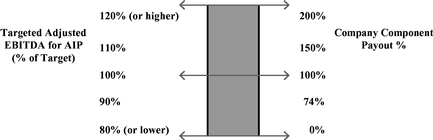

The Compensation Committee utilizes the above mentioned compensation elements to promote a performance-based culture that aligns the interests of management and stockholders. To do this, the committee chooses an appropriate balance of fixed and variable pay as well as long-term versus short-term incentives and opportunities. In 2017, our target pay mix was as follows:

|

|

Consideration of Say on Pay Results

The Board and the Compensation Committee continually evaluate our compensation policies and practices. As part of that process, the Board and the Compensation Committee consider the results of our annual advisory vote on executive compensation, commonly known as the "say-on-pay" vote. At our 2017 Annual Meeting, approximately 97.5% of the votes were cast in support of the say-on-pay proposal. The Company has considered this voting result, and in light of this strong support, our compensation policies and decisions continue to be focused on financial performance and aligning the interests of executives with the interests of stockholders.

Executive Compensation Philosophy and Program Objectives

The goals of the Compensation Committee with respect to executive compensation are:

-

-

to attract, retain, motivate and reward talented executives;

-

-

to tie annual compensation incentives to the achievement of specified performance objectives; and

-

- to achieve long-term creation of value for our stockholders by aligning the interests of these executives with those of our stockholders.

To achieve these goals, we endeavor to maintain compensation plans that tie a substantial portion of executives' overall compensation to key strategic, operational and financial goals and other non-financial goals that the Compensation Committee deems important. The Compensation Committee evaluates our compensation programs to ensure they are supportive of these goals and our business strategy and align the interests of our executives with those of our stockholders.

Executive Compensation Program Elements

Our executive compensation program primarily consists of a combination of base salary, annual cash incentives, and long-term equity incentives. Our Compensation Committee believes that a combination of these elements offers the best approach to achieving our compensation goals, including

23

attracting and retaining talented and capable executives and motivating our executives and other officers to expend maximum effort to improve the business results, earnings and create long-term, sustainable growth of shareholder value.

Base salaries for our Named Executive Officers are reviewed from time to time by the Compensation Committee and may be increased pursuant to such review and in accordance with guidelines contained in the various employment agreements in order to realign salaries with market levels after taking into account individual responsibilities, performance and experience. Base salaries for our Named Executive Officers are established based on several considerations, including:

-

-

the scope of their responsibilities

-

-

current competitive practices of peer group companies

-

-

individual performance and achievements

-

-

current compensation

-

- recommendations from the CEO for executives (other than the CEO)

The table below shows the annual base salaries for our Named Executive Officers for 2017, compared to 2016:

Executive

|

2016 Base Salary |

2017 Base Salary |

% Increase | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Adam M. Aron |

$ | 995,000 | $ | 1,100,000 | | 10.6 | % | |||

Craig R. Ramasey |

$ | 563,750 | $ | 650,000 | 15.3 | % | ||||

John D. McDonald |

$ | 517,650 | $ | 534,500 | | 3.3 | % | |||

Elizabeth Frank |

$ | 511,500 | $ | 534,500 | 4.5 | % | ||||

Mark A. McDonald |

$ | 453,500 | $ | 506,560 | | 11.7 | % | |||

The Compensation Committee has the authority to award annual incentive bonuses to our Named Executive Officers pursuant to our annual incentive compensation program ("AIP"), which historically have been paid in cash and traditionally have been paid in a single installment in the first quarter of the subsequent year upon certification of performance by the Compensation Committee.

Under employment agreements with our Named Executive Officers, each Named Executive Officer is eligible for an annual bonus, as it may be determined by the Compensation Committee from time to time. We believe that annual bonuses based on performance serve to align the interests of management and stockholders. Individual bonuses are performance based and, as such, can be highly variable from year to year. The annual incentive bonus opportunities for our Named Executive Officers are determined by our Compensation Committee, taking into account the recommendation of our CEO (except with respect to his own bonus).

The aggregate bonus for each Named Executive Officer, except for Mr. Aron and Mr. Ramsey, was apportioned to a Company component (80%) and an individual component (20%). However, in the case of Mr. Aron and Mr. Ramsey, their aggregate bonus is entirely based on Company performance with no individual component.

24

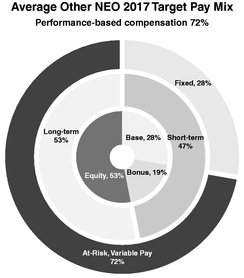

-

- Company Performance: For 2017, this component was based on attainment of Adjusted EBITDA for AIP goals, with payouts ranging from 0% to 200% of target. Adjusted EBITDA for AIP ranged from a threshold of $700,128,000 to a maximum of $1,050,192,000. The following table presents the AIP payout scale for the Company component:

-

- Individual Performance: The individual component of the bonus is based on achievement of individual key performance objectives and overall individual performance and contribution to our strategic and financial goals. Our Compensation Committee and, except with respect to his own bonus, our CEO, retain certain discretion to decrease or increase individual component bonuses relative to the targets based on qualitative or other subjective factors deemed relevant by the Compensation Committee.

Note: Adjusted EBITDA for AIP is calculated as set forth on Appendix A.

For Mr. Aron and Mr. Ramsey, the Compensation Committee reserved discretion to reduce the Company component payout or cancel in its entirely in the event the Company failed to achieve 2017 net earnings (exclusive of certain items) of at least $40.8 million.

The following table summarizes the AIP bonus for our Named Executive Officers for 2017:

Opportunity |

Allocation | Achievement | Actual |

||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Executive |

2017 Base Salary |

Target (as % of base salary) |

Target ($) |

|

Company |

Individual |

|

Company |

Individual |

|

2017 Earned AIP |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adam M. Aron |

$ | 1,100,000 | | 200 | % | $ | 2,200,000 | | | 100 | % | | | | | 33 | % | | | | $ | 726,000 | |||||||||

Craig R. Ramsey |

$ | 650,000 | 70 | % | $ | 455,000 | 100 | % | | 33 | % | | $ | 150,150 | |||||||||||||||||

John D. McDonald |

$ | 534,500 | | 70 | % | $ | 374,150 | | | 80 | % | | 20 | % | | | 33 | % | | 100 | % | | $ | 173,619 | |||||||

Elizabeth Frank |

$ | 534,500 | 65 | % | $ | 347,425 | 80 | % | 20 | % | 33 | % | 100 | % | $ | 161,224 | |||||||||||||||

Mark A. McDonald |

$ | 506,560 | | 65 | % | $ | 329,264 | | | 80 | % | | 20 | % | | | 33 | % | | 100 | % | | $ | 152,772 | |||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |